DAX Struggles to Gain Higher Ground After Yesterday’s 1.05% Rise

The DAX failed to rally higher today as did its European peers such as FTSE MIB or CAC. The German index remained in the green, up by just 0.11% on the day.

The DAX failed to rally higher today as did its European peers such as FTSE MIB or CAC. The German index remained in the green, up by just 0.11% on the day.

The Trade Balance for Germany released today showed a higher-than-expected positive balance. Exports rose by 0.9% compared to last month, while the consensus had been for an increase of 0.4%.

The extra exports came mostly from trade with China and the US. The gain leads to a positive trade balance of €22.3 billion from €21.4 billion last month. Despite the good news the broader market has struggled today to keep up with the FTSE MIB +0.6% or the CAC +0.4%.

Another negative note came from the Construction PMI, which was expected at 40 and came in at 37.5, while the EU average for this metric was 41.9.

Technical View

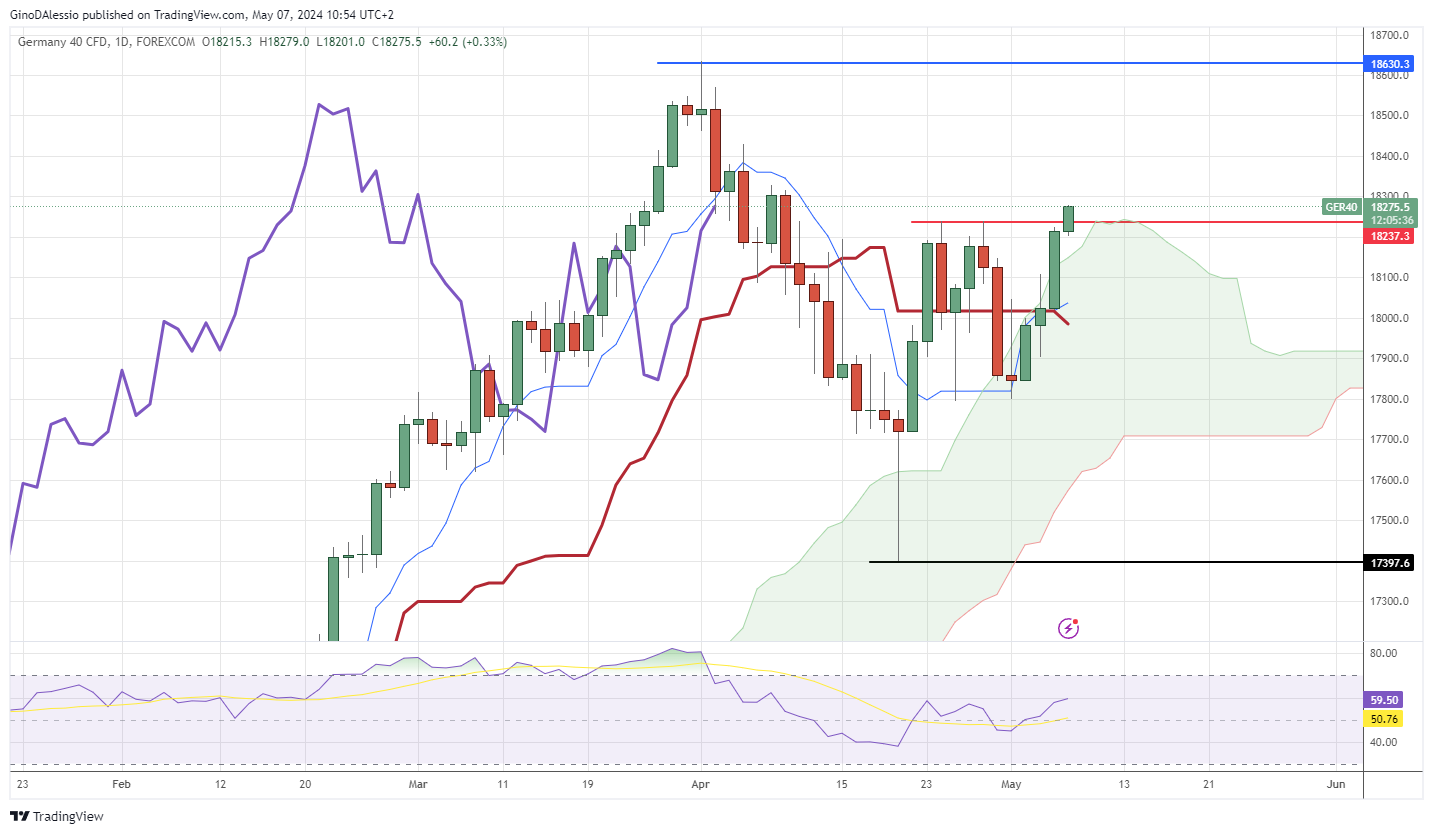

The day chart below for the DAX 40 shows a market still in a bullish trend. Price is still above the Ichimoku cloud and has recently bounced off the cloud twice. Today’s candle is fighting with the resistance level (red line) at 18237, which was set by 2 tops in late April.

Should the market close above this resistance level, we should get further bullish momentum to the next resistance level (blue line) at 18630. To the downside the market has a lot of support from the Ichimoku cloud. If that breaks, we have the next support at 17397, a low inside the cloud from April 19 (black line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account