FTSE MIB: Leonardo Rally not Enough to Keep the MIB Index in the Green

Leonardo (LDO) is today’s biggest mover, gaining 2.8% on the day. Fineco Banca is second with a gain of 1.6%. However, despite some strong performance from a select few the MIB index is down 0.4% on the day.

Leonardo (LDO) is today’s biggest mover, gaining 2.8% on the day. Fineco Banca is second with a gain of 1.6%. However, despite some strong performance from a select few the MIB index is down 0.4% on the day.

Italy released Retail Sales today, with YoY increase of 2% compared to last month’s 2.4%, and the MoM data came in flat with an expected increase of 0.2%. Today’s selloff started before the data release, but the sluggish numbers are not helping.

Yesterday’s earnings for Unicredit and MPS were well received, but that sentiment has faded already, Unicredit is down 0.7% on the day. The recent rally had been fueled by the perception that interest rates would be coming down sooner rather than later.

The forecast for the ECB is for a cut already in June. However, comments for the Fed’s Kashkari have blunted those hopes somewhat. Kashkari stated that it may be the case that interest rates stay higher for longer. In other words, we may not even see a rate cut within this year.

Technical View

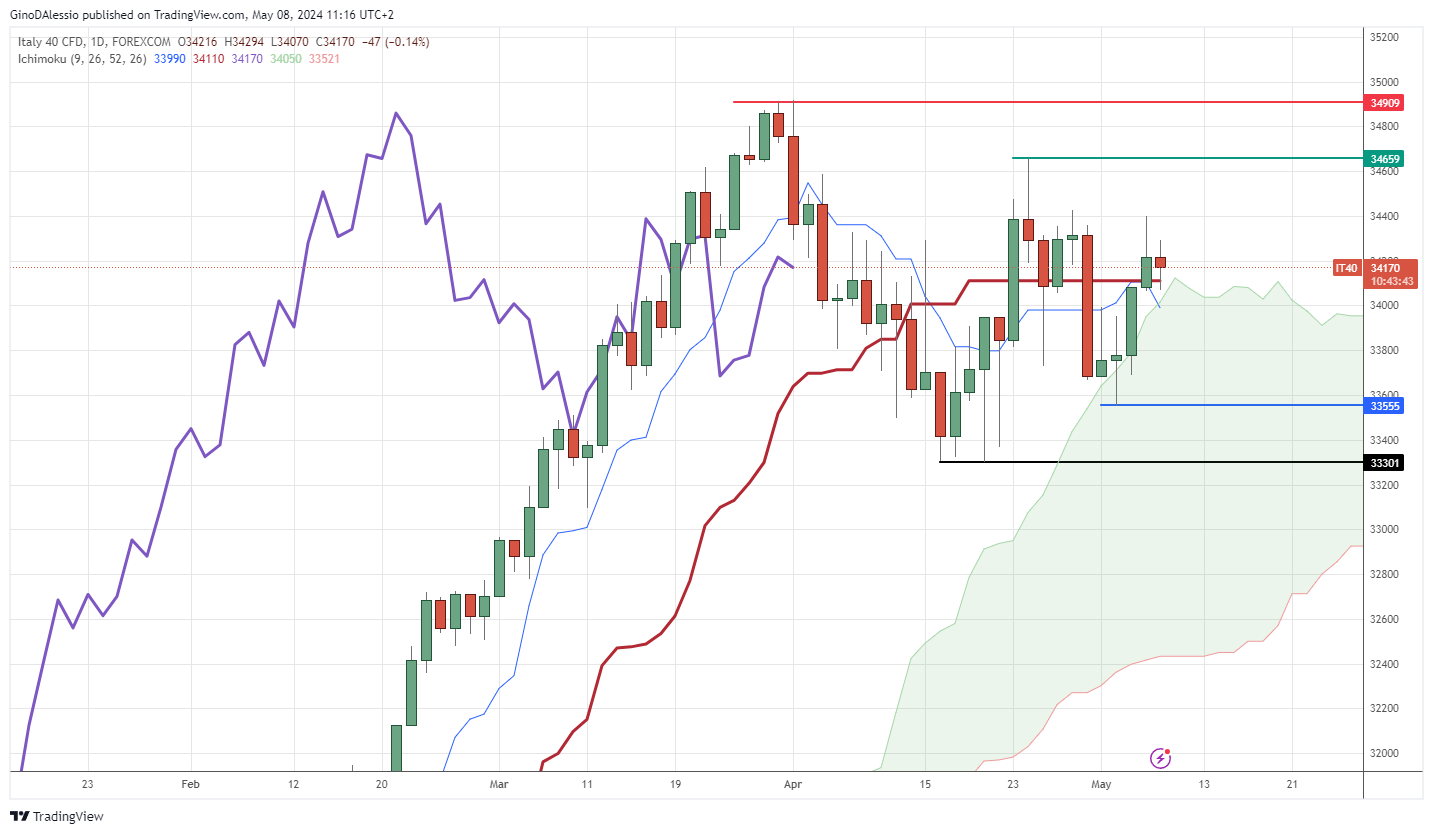

The day chart below for the FTSE MIB shows a bullish trend that is still intact. The correction that started in March reached the support of the Ichimoku cloud. The market has since bounced off the cloud in the last two sessions.

Today’s candle looks like it may hold above the cloud, which would signal higher prices. A close inside the cloud would signal possible lower prices. The cloud is considered no mans land, so we can expect high levels of volatility while the market stays within this area.

Should the support of the cloud not hold the next support level is at 3355 (blue line). While on the upside, the market will find resistance at the previous high of 34659 (green line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account