U.S. Housing Starts Rebound In April But Building Permits Extend Slump

New residential construction in the U.S. rebounded in the month of April, according to a report released by the Commerce Department on Thursday, although the report also unexpectedly showed a continue...

New residential construction in the U.S. rebounded in the month of April, according to a report released by the Commerce Department on Thursday, although the report also unexpectedly showed a continued decrease in building permits.

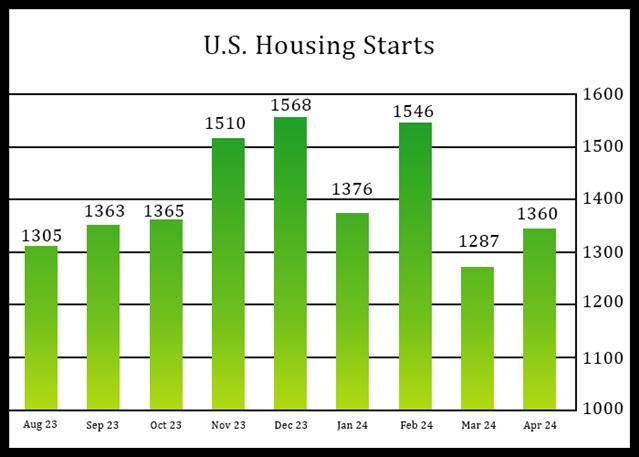

The Commerce Department said housing starts surged by 5.7 percent to an annual rate of 1.360 million in April after plunging by 16.8 percent to a revised rate of 1.287 million in March.

Economists had expected housing starts to spike by 7.5 percent to an annual rate of 1.420 million from the 1.321 million originally reported for the previous month.

Multi-family starts led the rebound, skyrocketing by 30.6 percent to an annual rate of 329,000 after plummeting by 38.8 percent to a revised rate of 252,000 in March.

Meanwhile, the report said single-family starts fell by 0.4 percent to an annual rate of 1.031 million in April after tumbling by 8.7 percent to a revised rate of 1.035 million in March.

“The data are consistent with a weaker pace of starts in Q2 compared to Q1,” said Nancy Vanden Houten, U.S. Lead Economist at Oxford Economics. “We expect starts to rise slightly in the second half of the year when we expect interest rates to move lower as the Fed begins to cut interest rates.”

She added, “We expect single-family starts, where there continues to be a shortage of supply, to drive any gains in housing starts in 2024.”

The Commerce Department also said building permits slumped by 3.0 percent to an annual rate of 1.440 million in April after plunging by 5.0 percent to a revised rate of 1.485 million in March.

Building permits, an indicator of future housing demand, were expected to jump by 1.5 percent to an annual rate of 1.480 million from the 1.458 million originally reported for the previous month.

Multi-family permits dove by 7.4 percent to an annual rate of 464,000 in April after tumbling by 6.5 percent to a revised rate of 501,000 in March.

The report said single-family permits also slid by 0.8 percent to an annual rate of 976,000 in April after plunging by 4.2 percent to a revised rate of 984,000 in March.

On Wednesday, the National Association of Home Builders released a separate report showing an unexpected deterioration in U.S. homebuilder confidence in the month of May, with higher mortgage rates weighing on sentiment.

The report said the NAHB/Wells Fargo Housing Market Index tumbled to 45 in May from 51 in April. Economists had expected the index to come in unchanged.

Homebuilder confidence decreased for the first time since November 2023, as mortgage rates averaged above 7 percent for the past four weeks per data from Freddie Mac.

Gain the edge with RTTNews Economic Calendar. Updated in real-time, explore RTTNews Economic Calendar today

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account