CAC: French Stocks in a Range Awaiting ECB – PMI & Industrial Production Data Have no Impact

The market is trading sideways this morning as traders sit on the sidelines awaiting tomorrow’s ECB meeting and press conference.

The market is trading sideways this morning as traders sit on the sidelines awaiting tomorrow’s ECB meeting and press conference.

Most traders and analysts see a 95% chance of a rate cut tomorrow, which has already been priced in for weeks. What is really on the market’s mind is the forward guidance which is expected to be hawkish.

Today’s economic data from France had no impact on the market as the ECB’s meeting weighs more on traders’ minds. Industrial Production MoM increased as forecast, which you might have expected to push the market higher.

While PNI data declined more than forecast and had little impact all the same as the market continued within its day range.

Industrial Production 0.50% Expected 0.50% Previous -0.20%

Services PMI 49.3 Expected 49.4 Previous 51.30

Composite PMI 48.9 Expected 49.1 Previous 50.5

I expect the day’s trading range to remain flat with spikes and troughs within the day’s range as the market gears up for what is likely to be a volatile afternoon for Eurozone stocks.

Technical View

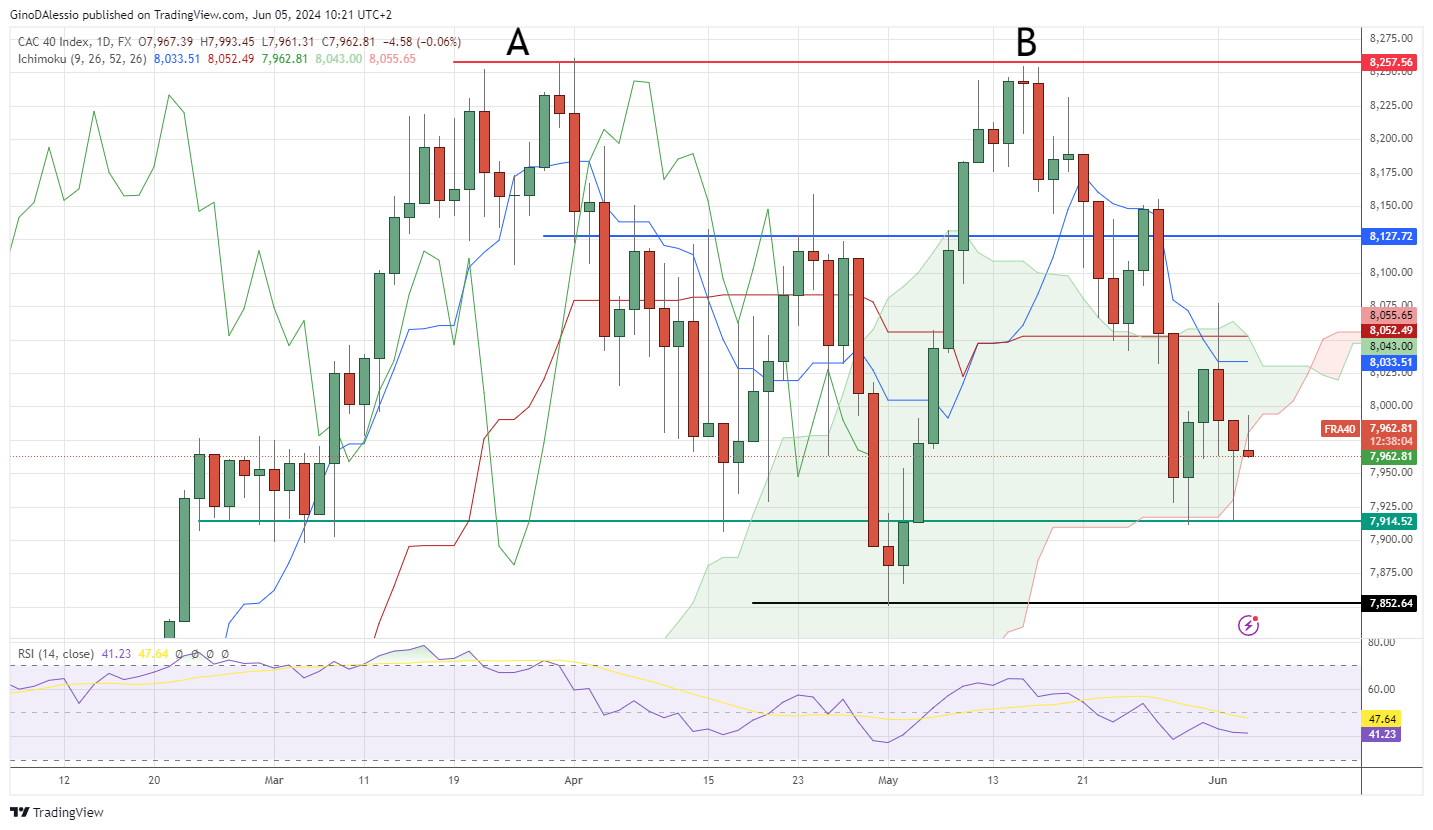

The day chart below for the CAC shows a market that has been trading within a wide range February. The top of the range was tested twice (points A and B) while the low of the range was set in May at 7,852.

The past 4 candles remained within the range set by the cloud, the top coincides with Kijun Sen (crimson line) and the low with the base of the range set in February of 7,914 (green line). Tomorrow’s candle should give an indication of the next move.

A breakout of the low would find support on the recent low of 7,852 (black line) set on May 2. While a breakout to upside would find resistance at around 8,127 (blue line), a level set by 2 previous attempts to rally higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account