Bitcoin Whales Accumulate as Price Dips, ETFs See Mixed Signals

Bitcoin whales (large investors) took advantage of the recent price drop, accumulating a massive 20,600 BTC (worth $1.38 billion) on June 11th. This marks the highest daily inflow for whales since late February, according to CryptoQuant.

Bitcoin Whales Accumulate, Exchange Reserves Dwindle

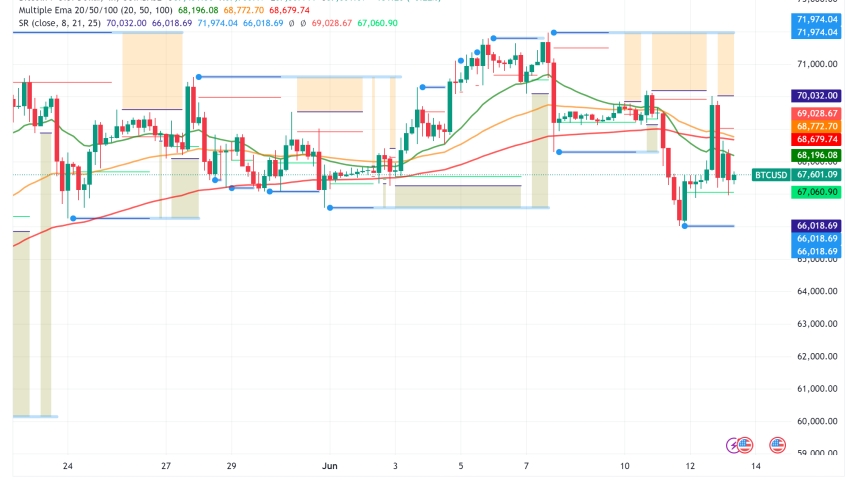

Bitcoin whales consistently bought Bitcoin as the price fell from $71,650 to around $69,000, accumulating between 1,300 and 2,200 BTC daily. This buying spree culminated in a massive 20,600 BTC inflow on June 11th, showcasing whale confidence in Bitcoin’s long-term potential.

Supporting this bullish sentiment, Bitcoin reserves on cryptocurrency exchanges have hit a new low since December 2021, indicating investors are holding onto their coins and anticipating future price increases.

Bitcoin ETF Flows: A Mixed Bag

While whale accumulation suggests optimism, Bitcoin ETF flows present a mixed picture. A recent outflow of $200 million from Bitcoin ETFs initially caused concern, but it may have also signaled a “buy the dip” opportunity, leading to a slight price rebound.

This highlights a potential competition between holding actual Bitcoin and acquiring it through ETFs. Some ETF providers are offering low introductory fees to attract investors, with Fidelity’s ETF boasting zero fees until August.

Analysts Remain Bullish

Despite the short-term volatility, analysts like CryptoCon maintain a bullish long-term outlook for Bitcoin. They point to historical charts suggesting a potential price target of $91,500, potentially followed by a further surge above $100,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account