NIKKEI225 Rallies in European Session Awaiting Inflation Data

Japanese stocks get a boost from a weaker yen as BoJ refrains from forex market intervention, up 0.6%.

Japanese stocks get a boost from a weaker yen as BoJ refrains from forex market intervention, up 0.6%.

The stock market has seen the BoJ intervene directly in the forex market and through the JGB purchases to prop up the yen. The market sees the lack of forex market intervention as an indicator that the central bank will also hold back on bond market intervention.

Decreasing the BoJ’s JGB purchase would push up bond yields making stocks less attractive. At the last central bank meeting there was no mention of how the BoJ would decrease purchases. This stance now adds to the lack of intervention in the forex market, increasing hopes that the central bank will not hike rates soon.

The market consensus for tonight’s Core Inflation data is an increase from 2.2% last month to 2.6% YoY. While the general Inflation YoY last month came in at 2.5% with no forecast at the moment for tonight’s data.

Rising inflation will likely provoke the BoJ into taking action. While they may not act directly on the central bank rate, they may intervene in the JGB market to push yields higher. This action would tame inflationary pressure and prop up the yen.

However, it would also put pressure on the stock market as investors weigh the pros and cons of a higher fixed income compared to the risk of holding shares.

Technical View

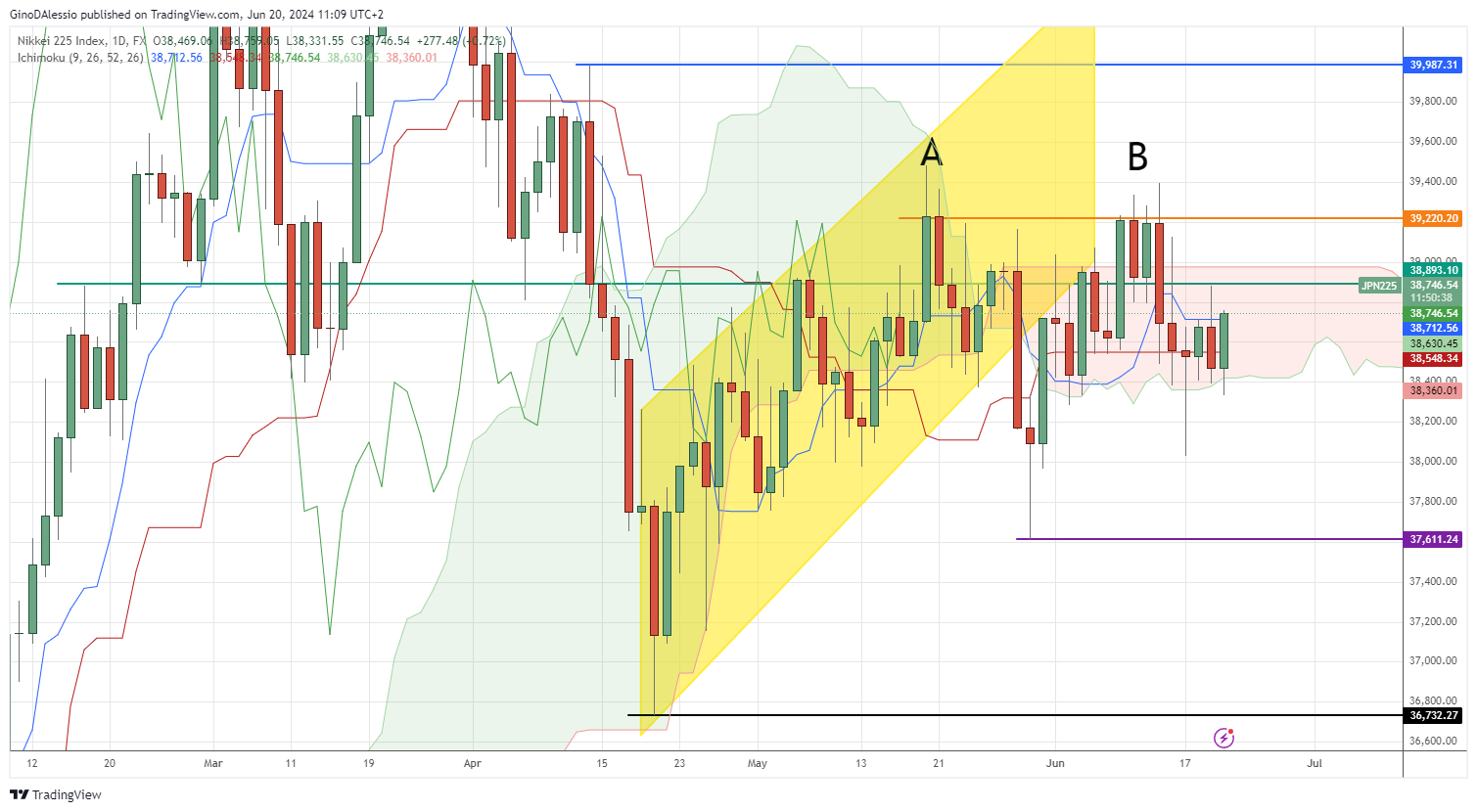

The day chart for the NIKKEI225 shows a market still trading within the Ichimoku cloud. The cloud, referred to as no-man’s land, is an area of uncertainty. And the market has been trading within a wide range over the past 14 sessions.

The last attempt to trend higher, point B, failed at the same level as the attempt at point A. This gave rise to a double top, but the market entered the cloud and has been unable to find its next trend.

The next break above or below the cloud should give clues as to which direction will be the next one. The level of 39,000 coincides with the topside of the cloud creating a strong resistance area.

The downside is supported by the bottom of the clous at 38,400 area. Further support will be found at the low of the June 17 candle at 38,040 and further down at a previous low of 37,611.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account