Bitcoin and Ethereum Options Expire Today, Market Anticipates Volatility

Today's crypto market is buzzing with anticipation as nearly $2 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts are set

Today’s crypto market is buzzing with anticipation as nearly $2 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire. This significant event often leads to price volatility, and traders are closely monitoring the situation.

Looking Back: Expirations Often Lead to Rebound

Historical trends suggest a possible rebound for crypto prices following today’s options expiry. Bitcoin options expiring today hold a notional value of $1.27 billion, with a put-to-call ratio of 0.46 and a maximum pain point of $66,500.

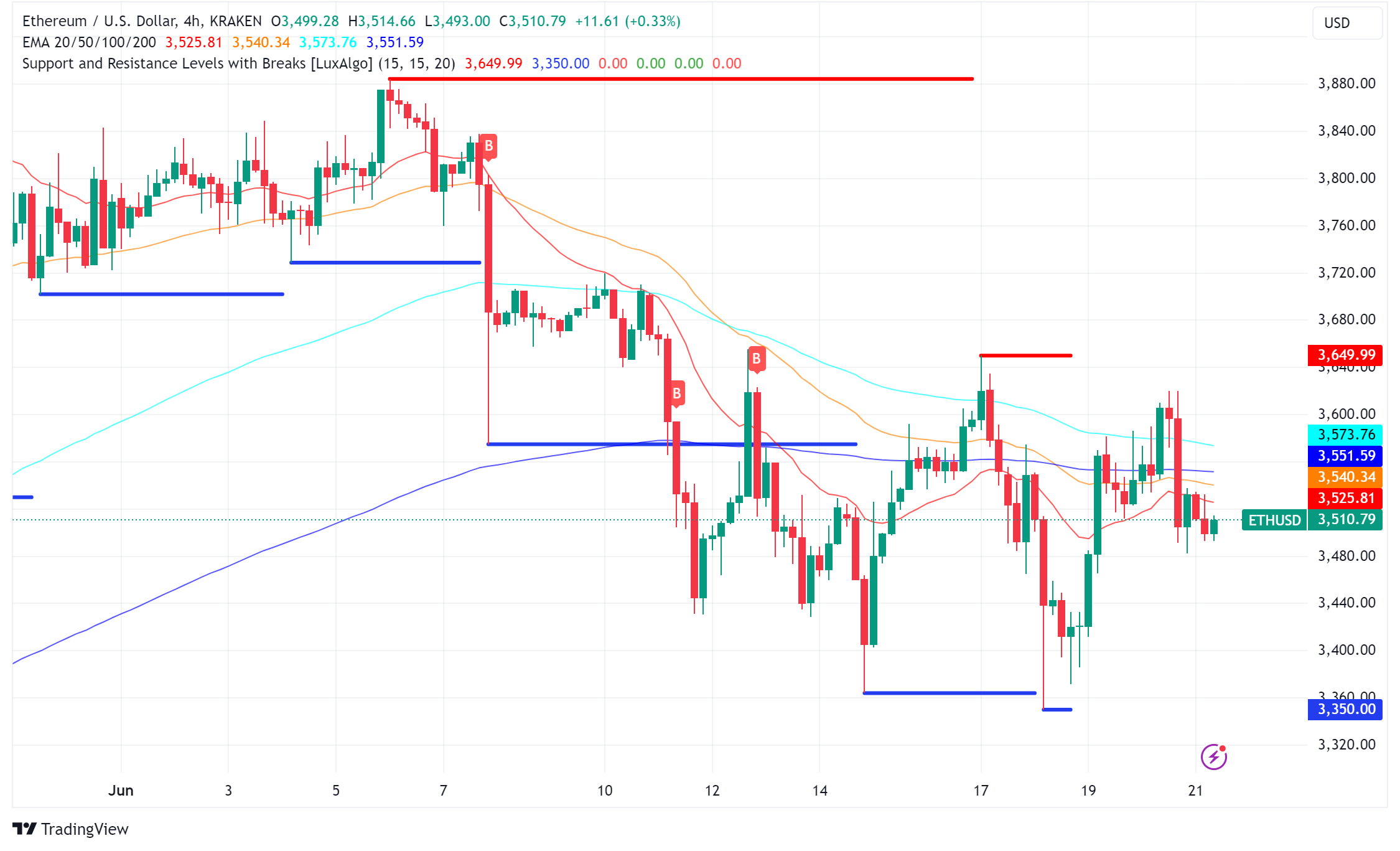

Ethereum options expiring today have a notional value of $693.37 million, with a put-to-call ratio of 0.30 and a maximum pain point of $3,500. (For options newbies, the maximum pain point indicates the price level that inflicts the most financial loss on option holders.)

Analysts: Options Activity Hints at Stability, Not Major Shifts

Analysts at Greeks.Live point to a rise in forward options volume, particularly block calls. They also note that despite high realized volatility (RV), implied volatility (IV) has remained stable. This suggests the market may not experience any drastic movements before the expiry.

Historically, the third quarter tends to be a challenging one for crypto, often followed by a rebound towards the quarter’s end. Analysts believe this pattern may repeat itself.

Bitcoin Trades Flat, Ethereum Up Slightly

This week, Bitcoin fluctuated between $64,258 and $66,782, while Ethereum ranged between $3,387 and $3,632. At the time of writing, Bitcoin sits at $64,924, down 2.7% in the last week. Ethereum trades at $3,526, reflecting a 1.5% increase.

Volatility Expected, But Temporary Disruptions Likely

Options expirations can cause temporary market disruptions, but they typically lead to a period of stabilization afterward. Analysts’ insights offer valuable context for traders to consider when navigating the anticipated volatility. By staying vigilant and analyzing technical indicators alongside market sentiment, traders can make informed decisions during this dynamic period.

Bitwise Debuts Spot Ether ETF Commercial as NFT

In other Ethereum news, digital asset manager Bitwise unveiled its first commercial for a spot Ether (ETH) exchange-traded fund (ETF) on Thursday. The ad takes a unique approach, allowing non-fungible token (NFT) enthusiasts to mint the 39-second clip on the Ethereum blockchain.

Themed around Ethereum’s 24/7 operation compared to traditional finance’s downtime, the commercial has been minted over 1,100 times so far. Bitwise will donate half of the proceeds from the NFT sales to Protocol Guild, a group that funds Ethereum core contributors.

Ethereum Price Faces Resistance, Potential Downturn Signals

Ethereum’s attempt to climb above $3,650 resistance proved unsuccessful, and the price is currently indicating a possible decline below $3,450. A break below a short-term rising channel and a dip beneath the $3,485 and $3,450 support levels could fuel a bearish momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account