Gold Price Forecast: XAU/USD Awaits Fed Moves Amid China’s Buying Pause

During the early European trading hours on Monday, the Gold price (XAU/USD) faced downward pressure. Recent data revealed

•

Last updated: Monday, July 8, 2024

During the early European trading hours on Monday, the Gold price (XAU/USD) faced downward pressure. Recent data revealed that for the second consecutive month, the People’s Bank of China (PBoC) abstained from purchasing gold in June.

As the foremost consumer of bullion globally, China’s purchasing pause could exert a downward force on gold prices. This development highlights China’s significant influence over global gold markets, potentially setting a bearish tone unless offset by other factors.

Speculation of US Fed Rate Cuts and Political Factors

In contrast to the bearish signals from China, anticipatory sentiments regarding potential US Federal Reserve interest rate cuts in the third quarter are providing a bullish undertone for gold, traditionally seen as a non-yielding asset.

The political landscape in France is also contributing to market volatility; following the parliamentary elections, the emergence of a hung parliament has escalated political uncertainty. This situation tends to push investors towards safe-haven assets like gold.

The market is poised for further cues from US Federal Reserve Chair Jerome Powell’s upcoming testimony and the June Consumer Price Index (CPI) data, which are both crucial indicators that could influence the Fed’s monetary policy decisions.

Impact of Recent US Employment Data on Gold Prices

The latest US employment figures also play a critical role in shaping gold market sentiments. The Nonfarm Payrolls for June showed an addition of 206K jobs, surpassing the anticipated 190K but noting a downward revision from May’s 218K.

This was coupled with a slight increase in the Unemployment Rate to 4.1% from 4.0% the previous month, and a slowdown in Average Hourly Earnings growth to 3.9% year-over-year from 4.1% in May.

These statistics suggest a softening labour market, increasing the probability of a Fed rate cut in September, now priced in at 77% by the markets, up from 70% prior to the report.

“Market expectations for a rate cut have been significantly influenced by the latest labour market data, which may lead to more bullish conditions for gold if the Fed acts to cut rates,” noted Nitesh Shah, a commodity strategist at WisdomTree.

Technical Outlook and Short-term Projections

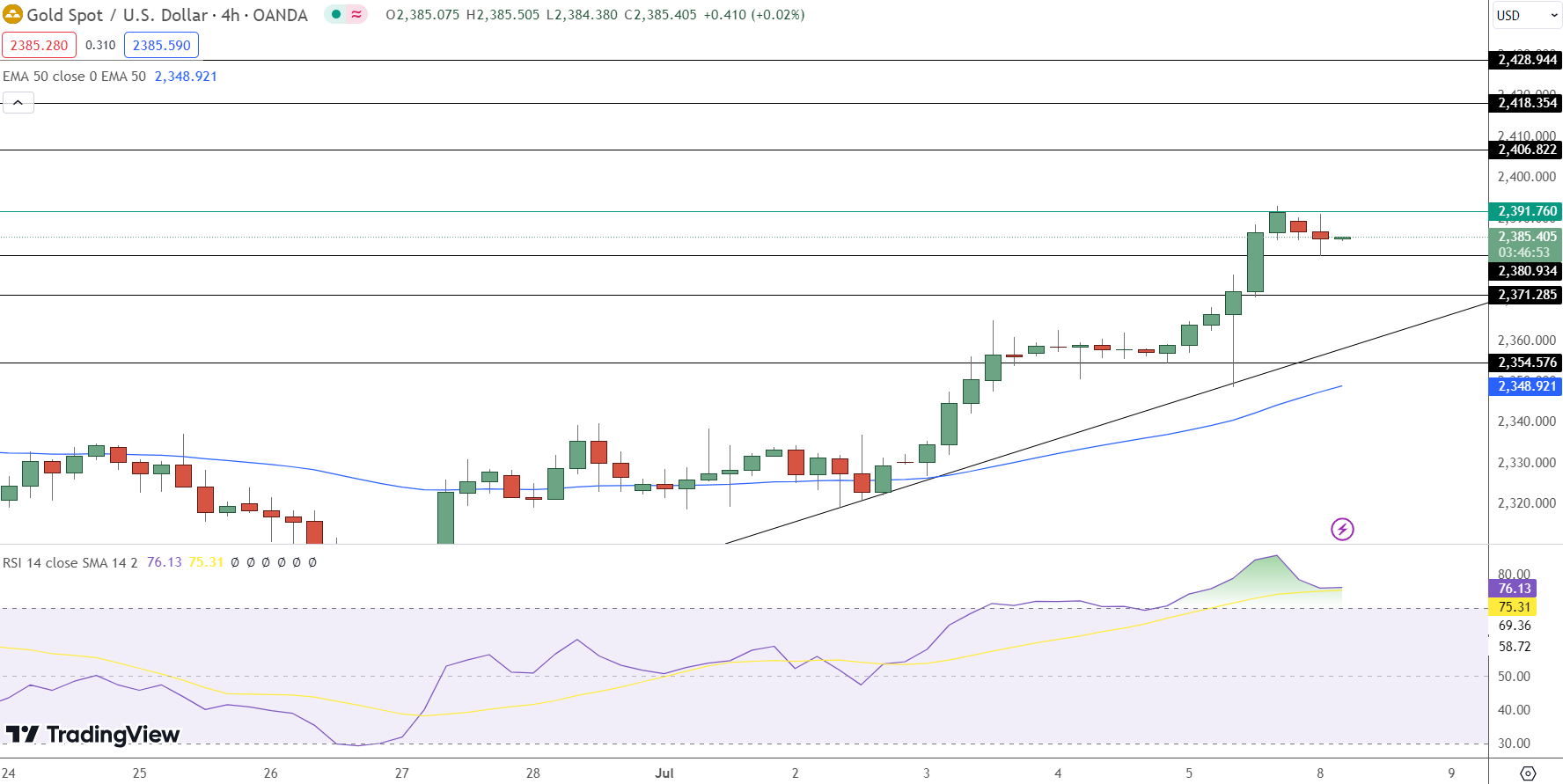

As of now, gold is trading at $2,384.72, contending with a resistance level of $2,393.17. A decisive movement below the pivotal point of $2,381.09 might trigger further selling, with critical support established at $2,371.91.

The technical indicators reveal a bullish scenario as long as gold prices stay above the $2,381.09 pivot, supported by the 50-day and 200-day EMAs positioned at $2,359.76 and $2,339.76, respectively.

However, a drop below this pivot could lead to accelerated sell-offs, indicating the fragile balance of current market dynamics.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.