CAC Drops 1% – Weaker Manufacturing PMI & LVMH Earnings

French stocks followed a broader Eurozone selloff today, the CAC was particularly hit by a slowdown in sales from Europe’s second largest co

French stocks followed a broader Eurozone selloff today, the CAC was particularly hit by a slowdown in sales from Europe’s second largest company, LVMH.

To add to the bearish sentiment, today’s Manufacturing PMI data showed a reduction in activity compared to forecasts. The Manufacturing PMI released showed activity fell to 44.1, while analysts had expected a small increase to 48.9 from 48.8 last month.

A decline in LVMH sales growth from China, the world’s second largest economy, gave way to weaker than expected earnings. Last night’s report showed an EPS of 14.57 compared to forecasts of 15.128, a miss of 4.63%.

To complete the negative picture, the company reported revenue for the last quarter at €41.7 billion compared to a forecast of €42.3 billion, or a miss of €601.5 million. MC stocks opened down 4.3% on the day, while the CAC is down 0.92%.

Yesterday’s earnings reports misses from Alphabet and Tesla also added to a bearish sentiment carryover. The main U.S. stock indices dropped overnight, with the NAS100 down 1% and the S&P500 down 0.75% on the day.

French stocks are still beleaguered by a stalled political situation, with what looks like splintered National Assembly lacking an outright winner from the general election.

Technical View

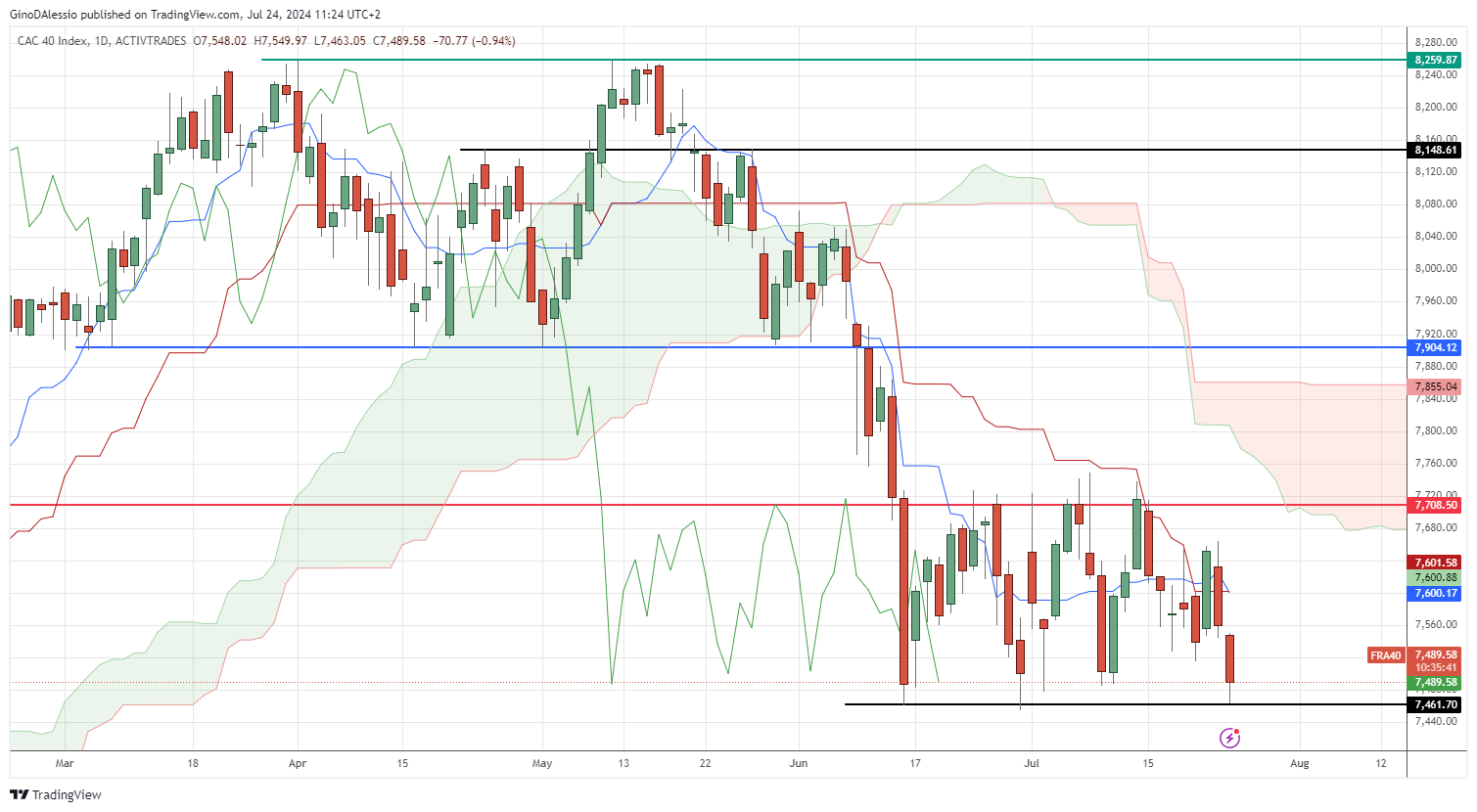

The day chart below for the CAC shows a market still trading within a wide range (blue area). The sideways trend’s range is well established by multiple touches to the upper and lower boundaries.

Today’s candle has tested the low boundary of the sideways range, having opened with a gap on yesterday’s close. It’s likely to stall on this level, or even rebound towards the higher boundary of the range.

However, a close below the sideways range should lead to lower prices. The next support if the range breaks, would be at 7,317, which corresponds to the low of a previous retracement that gave way to the rally of the all-time high at 8,259.87 (green line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account