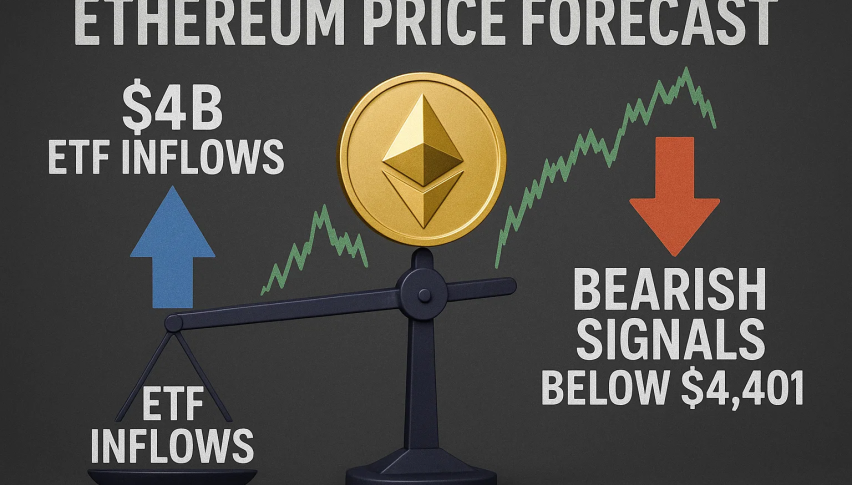

Ethereum Drops 20%: ETH Finds Roadblock at $3,500, Will Spot ETFs Rescue Bulls?

Ethereum is down 20% from recent swing high. Despite confidence, ETH risks breaking $3,000 amid rising outflows from spot ETFs

Ethereum followed Bitcoin, looking at the formation in the daily chart. After the consolidation above $3,300 for the better part of this week, the drop of August 1 crashed bulls. As it is, the bar is a confirmation of the July 24 and 25 bears, signaling weakness. A follow-through of yesterday’s losses means that Ethereum’s trends are below $3,000, opening up the second most valuable coin to $2,800. This is a retest of recent swing lows of May and July 2024. Even so, optimism remains high, with most analysts viewing this drop as an opportunity for bulls to accumulate.

The sell-off across the crypto scene means Ethereum is in red. After the swing high to around $3,900 in May, the coin is now down 20%. In the past day, ETH shrunk by 1%, pushing losses to over 3% in the previous week. The dump was with rising trading volume which now stands at over $17 billion. If the coin crashes over the weekend, the reaction at $2,800 will be vital in shaping the short to medium-term trajectory.

Traders are closely monitoring the following Ethereum news developments:

- Spot Ethereum ETFs are live, but after days of outflows, July ended strongly. According to trackers, BlackRock bought $118 million of ETH as the product saw inflows for the first time.

- Despite free-falling prices, ETH is once more retesting a critical resistance trend line. If there is a recovery over the weekend, bulls will likely stretch gains in the coming sessions.

Ethereum Price Analysis

ETH/USD is under immense selling pressure after the breakout of August 1.

Technically, ETH is bullish, but in the short term, sellers have the upper hand.

The zone between $2,800 and $3,000 is crucial, and buyers must absorb selling pressure to maintain the uptrend.

If bears fail to flow in today, losses of August 1 might become climactic. In that case, aggressive buyers might consider buying the dips.

However, a conservative trader might wait for a clean break above $3,500 or below $2,800.

Losses below $2,800 might push Ethereum to $2,500.

Conversely, a bounce above the local resistance at $3,500 might fan demand, lifting prices to over $4,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account