crypto-armageddon: leveraged traders lose $1 billion

$900 million was liquidated in the last 24 hours, with $764 million coming from long positions and $124 million from short positions

The huge liquidation in the crypto market also shows the wider effects of today’s downturn. About $900 million was liquidated in the last 24 hours, with $764 million coming from long positions and $124 million from short positions, according to Coinglass.

Traders exposure to additional risks, including liquidation risks, is constant when they trade on unregulated bitcoin derivative exchanges. The exchange’s risk engine aggressively closes a trader’s position when the trader’s position reaches the liquidation price.

A tiny number of positions being liquidated has little effect on the market. However, the market price may be significantly impacted if thousands of positions with comparable liquidation values are liquidated.

Furthermore, market buy and sell orders brought on by liquidations may result in abrupt price changes, which may have the “cascading effect” of liquidating additional surrounding positions.

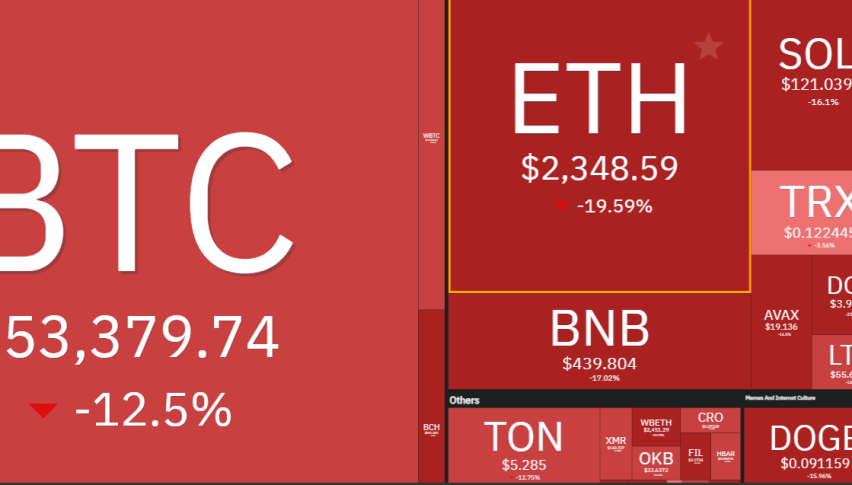

After a further dip in price on Monday morning, Bitcoin dropped to $53,000 on Binance, its lowest level since late February of this year.

Uncertainty in the US economy, investors withdrawing money, increased market turbulence by the Bank of Japan’s unexpectedly aggressive posture last week, and the US Federal Reserve’s cautious approach kept crypto traders nervy.

Weak US economic statistics and the Fed’s reluctance to lower rates in September have increased the rush for safe investments, contrary to market projections.

Such action increased concerns that the Fed is running behind schedule in raising interest rates and that dramatic ease in monetary policy would be needed to avert a recession.

Nonetheless, some cryptocurrency traders think the current state of affairs would force the Fed to decrease interest rates in 2024. In the past day, there has been an 11% increase in the likelihood of a Fed emergency rate cut, according to data from the prediction market Polymarket.

Bitcoin lost more than $15K since last Monday, ranking among the worst weekly performances in its 15-year history

On the last day, 229,879 traders were liquidated, for a total liquidation value of $881.76 million. A $27 million Bitcoin liquidation order was issued on Huobi, making it the largest order in history.

The fear and greed index for the cryptocurrency market has dropped below 25, which is seen as a “fear” state. This indicator reflects the overall market attitude, which has turned negative.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account