USDCAD 200 Pips Down From the Highs Despite the Soft Ivey PMI

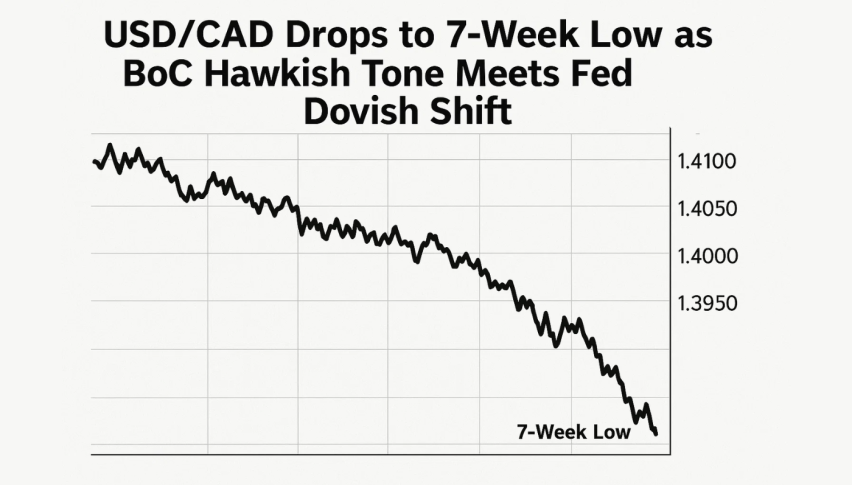

USDCAD began a bullish trend in July, rising by 3.5 cents. However, since Monday, the USDCAD has reversed, losing 2 cents.

USDCAD began a bullish trend in July, rising by 3.5 cents. However, since Monday, the USDCAD has reversed, losing 2 cents. The Bank of Canada’s dovish decision to cut its policy interest rate by 25 basis points from 4.75% to 4.5% added further to the upside momentum in this pair.

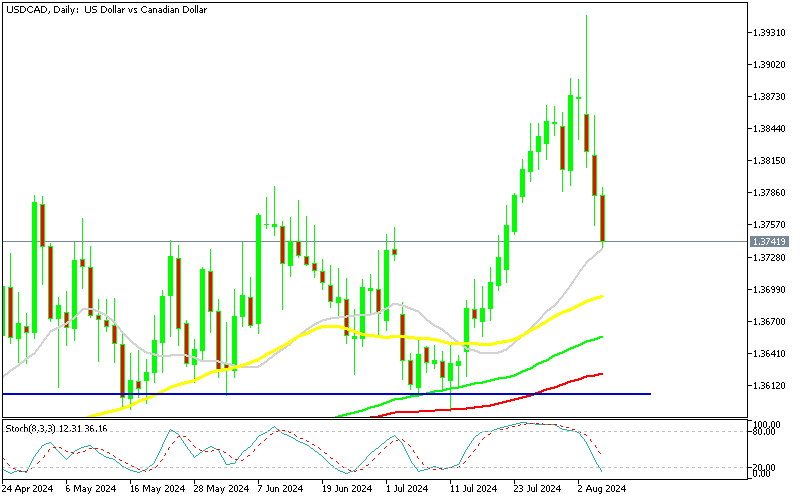

USD/CAD Chart Daily – Sellers Facing the 20 SMA

Besides that, the Canadian dollar has also been weakened by a recent shift toward negative risk sentiment as multinational corporations reported lower Q2 earnings and the Chinese recovery slowed. This week, sentiment has improved, fueling an upward movement in USD/CAD over the past three days, despite the US dollar losing value against most major currencies.

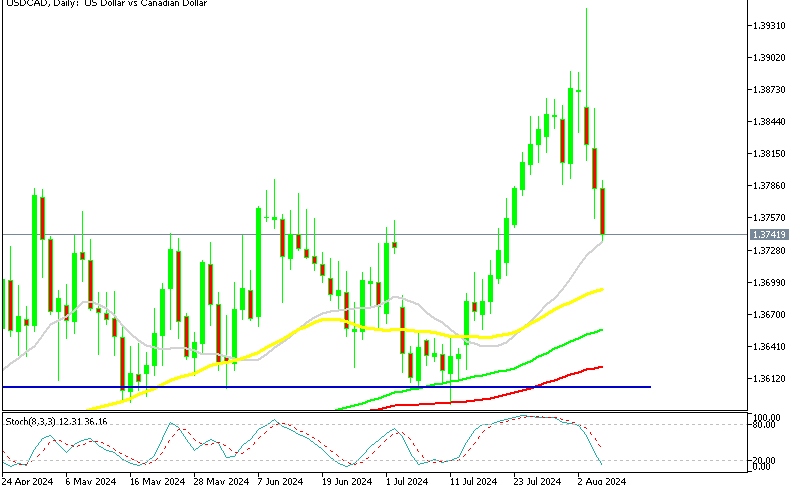

During risk-off flows, the USD appreciated against commodity currencies like the CAD. However, as market sentiment stabilized, the greenback relinquished all of its gains. The odds were higher with the softer July data for the BoC, as the market was pricing in a 95% probability of a 25 bps drop in September and a total of 65 bps of easing by year-end before the Ivey PMI. Additionally, buyers are currently contending with the 20 Daily SMA (gray).

Canada July Ivey PMI Report

- Adjusted Ivey PMI: 57.6 points (vs. 60 points expected)

- June Non-seasonally Adjusted Ivey PMI: 62.5 points

- Unadjusted July PMI: 55.3 points

- June Ivey PMI: 62.4 points

- Employment Index:

- July: 56.1 points (up from 52.9 points in June)

- Prices Index:

- July: 59.2 points (down from 62.3 points in June, lowest since March)

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account