Asian Markets Mixed as Investors Brace for Potential Federal Rate Cuts

Asian stock markets presented mixed outcomes in recent trading, as investors remain vigilant amidst signals from the Federal Reserve

In today’s trading, Asian stock markets presented mixed outcomes in recent trading, as investors remain vigilant amidst signals from the Federal Reserve regarding potential interest rate adjustments.

Markets in Japan, China, and South Korea displayed a blend of cautious optimism and apprehension, echoing Wall Street’s slow climb toward its record highs.

The US stock market’s recent performance has emboldened some Asian traders, buoyed by expectations of stabilizing US inflation and a potential rate cut from the Fed. A lower rate would alleviate borrowing costs, providing relief for investors seeking to finance expansion. However, economic challenges, including China’s uneven recovery and global supply chain issues, continue to create uncertainty.

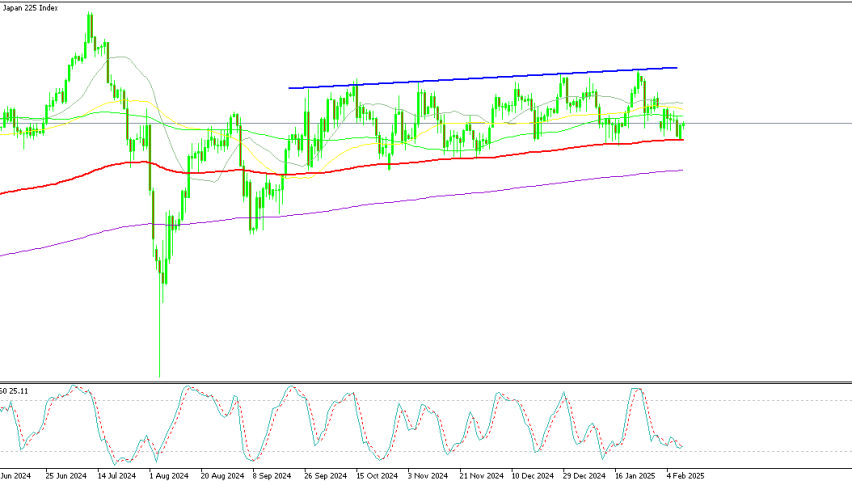

Japan’s Nikkei index saw moderate gains but slipped by 0.9% to 36,507.10. The Japanese yen appreciated against the U.S. dollar, with the USD/JPY pair dropping to 141.05 from 141.79 during Friday’s early trading session, exerting pressure on Japan’s export sector.

According to IG market analyst Yeap Jun Rong, although the Bank of Japan is unlikely to implement any rate changes at its upcoming meeting, there are signals of potential hawkish policies on the horizon, with a possible rate hike in December. Additionally, Japan’s industrial production data, set to be released later in the day, may further impact the yen’s value by influencing market sentiment regarding the manufacturing sector.

Meanwhile, China’s Shanghai Composite faced headwinds, down by 0.5% at 2,704.09 hindered by slower-than-expected industrial output and challenges in the property sector.

Hang Seng index, on the other hand, went up 0.8% to 17,384.40 while South Korea’s Kospi increased 0.1% to 2,575.41. Investors in Hong Kong and South Korea remain particularly cautious, awaiting further developments in monetary policy.

As the global economy faces this delicate balance, Asian investors will continue closely monitoring macroeconomic data and central bank policy to guide their investment decisions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account