New York Manufacturing Index Indicates Significant Turnaround In September

The Federal Reserve Bank of New York released a report on Monday showing regional manufacturing grew for the first time in nearly a year in the month of September. The New York Fed said its general b...

The Federal Reserve Bank of New York released a report on Monday showing regional manufacturing grew for the first time in nearly a year in the month of September.

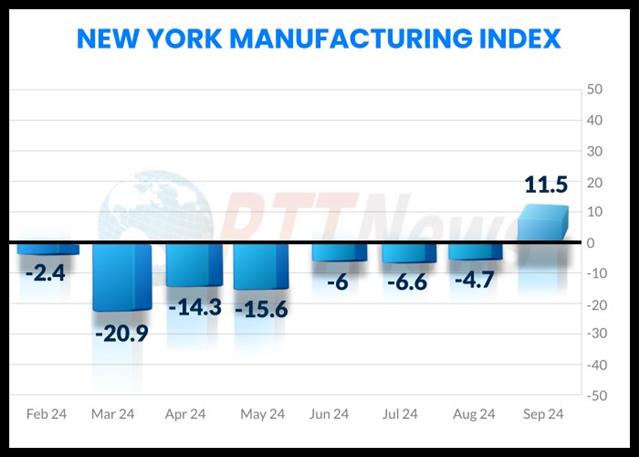

The New York Fed said its general business conditions index surged to a positive 11.5 in September from a negative 4.7 in August, with a positive reading indicating growth. Economists had expected the index to inch up to a negative 3.9.

With the sharp increase, the index returned to positive territory for the first time since hitting a positive 9.1 last November.

The much bigger than expected increase by the headline index partly reflected a significant turnaround by new orders, as the new orders index spiked to a positive 9.4 in September from a negative 7.9 in August.

The shipments index also shot up to 17.9 in September from 0.3 in August, while the number of employees index crept up to a negative 5.7 in September from a negative 6.7 in August but continued to indicate a modest contraction.

On the inflation front, the prices received index dipped to 7.4 in September from 8.5 in August and the prices paid index edged down to 23.2 in September from 23.4 in August.

The report also said firms grew more optimistic that conditions would improve in the months ahead, as the index for future business activity climbed to 30.6 in September from 22.9 in August.

The Federal Reserve Bank of Philadelphia is scheduled to release its report on regional manufacturing activity in the month of September on Thursday.

The Philly Fed’s diffusion index for current general activity is expected to jump to a positive 2.4 in September from a negative 7.0 in August, with a positive reading indicating growth.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account