Daily Crypto Signals: XRP Soars, Investors Turn Their Attention to Ethereum

November 2025 emerged as a transformative month for the cryptocurrency ecosystem, marked by substantial venture capital investments and

November 2024 emerged as a transformative month for the cryptocurrency ecosystem, marked by substantial venture capital investments and renewed market dynamism.

The month witnessed an impressive 99 blockchain startup deals totaling over $350 million, underscoring the continued vitality of digital asset markets.

Bitcoin Sees 38% Monthly Gain in November

With a 38% monthly gain and hanging close to the $100,000 psychological barrier, Bitcoin BTC/USD showed amazing tenacity all over the month. This momentum was driven mostly by institutional investors, MicroStrategy leading the way by purchasing 15,400 BTC between November 25 and December 1. Investing $1.5 billion at an average price of $95,976, the company’s whole Bitcoin holdings come to 402,101 tokens valued at $38.4 billion. Derivatives markets showed consistent confidence; a 17% annualized futures premium indicated trader optimism even with price consolidation.

Ethereum ETFs See Strong Inflows of $2.2B

Ethereum ETH/USD told an equally gripping story of institutional adoption and possible legislative revolution. With unprecedented net inflows of $2.2 billion in 2024, the bitcoin exceeded its prior 2021 investment benchmark. With present staking returns averaging around 3.1% annually and projections showing they might rise to 4-5% during times of increased network activity, analysts at Bernstein Research highlighted the potential for ETH staking payouts in US exchange-traded funds. Driven by expected yearly free cash flow of up to $66 billion, Matthew Sigel of VanEck offers the most optimistic projection: Ethereum may perhaps reach $22,000 per token by 2030.

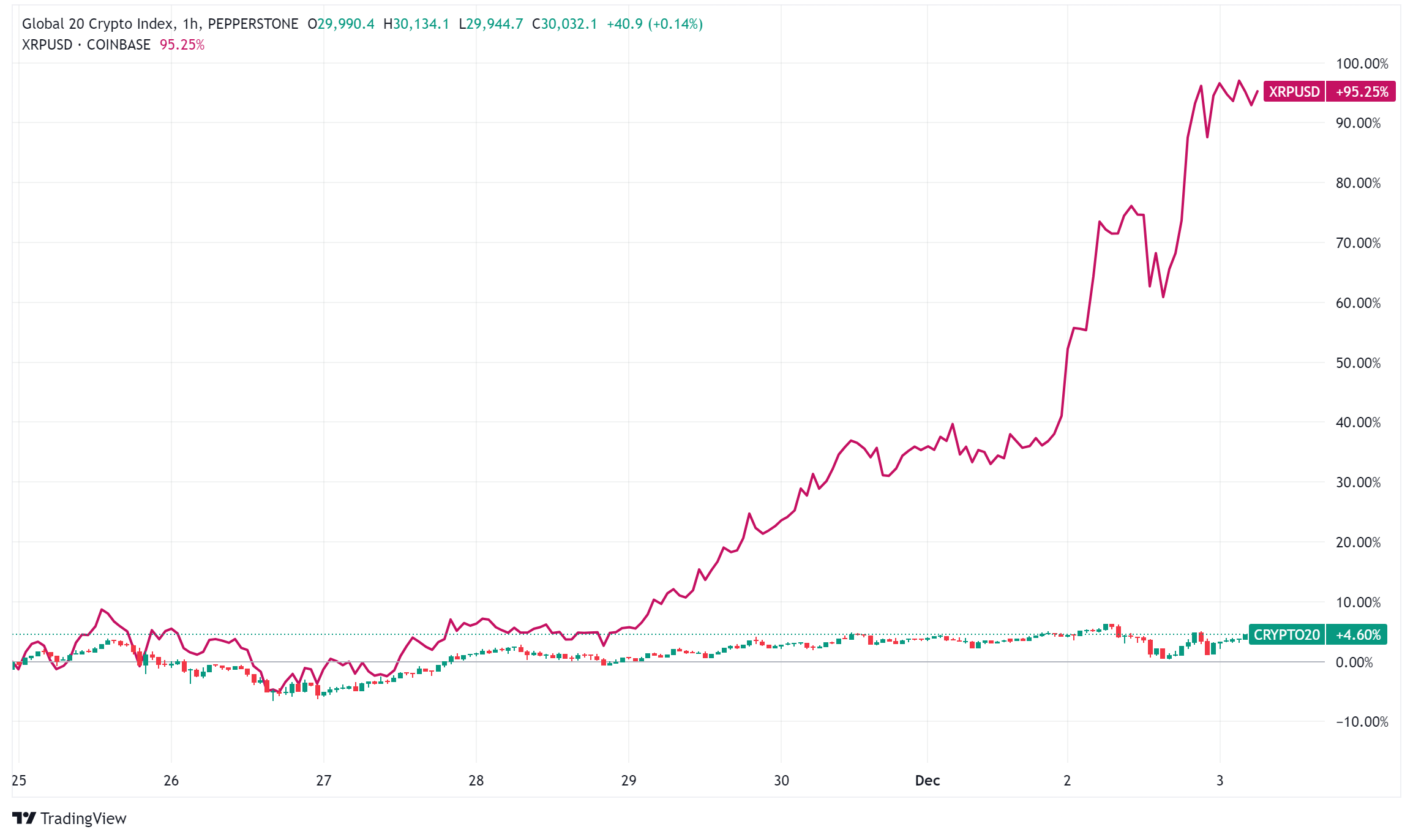

XRP Rallies Nearly 300% in November

With a stunning 297% monthly return and a seven-year high at $1.95, XRP XRP/USD turned out as the most unexpected performance of the month. Significant wallet accumulations drove the momentum of the cryptocurrency; holders between 1-10 million XRP added 679.1 million tokens valued $1.6 billion in just three weeks. XRP turned Tether to become the third-largest crypto asset by effectively outperforming Solana in market value. Driven by increased market interest and hope of a more crypto-friendly legislative climate, analysts like Jacob Canfield are estimating possible price objectives between $5 and $6.60.

Venture Capital and Startup Ecosystem in Crypto

The venture capital landscape painted an equally promising picture. While Barter raised $3 million in startup money to maximize trade systems, Talus Network locked $6 million for creating distributed artificial intelligence agent infrastructure. For creative zero-knowledge identity verification technology, Rarimo drew $2.5 million. Binance Labs kept making targeted investments to help startups pushing the envelope of blockchain technology like Kernel and Astherus.

Underlying these developments is a broader narrative of technological innovation and institutional maturation. The cryptocurrency market is demonstrating increased sophistication, with startups focusing on complex infrastructure solutions spanning artificial intelligence, trading optimization, and decentralized identity verification. Viewed by institutional investors as strategic technological platforms with transforming potential rather than only speculative assets, cryptocurrencies are becoming more and more important. The junction of institutional investment, technical innovation, and possible legislative changes points to a more ordered and mainstream future for the bitcoin market transcending its turbulent past.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account