SHIB Burn Rate Skyrockets 1000%, Holder Metrics Signal Bullish Momentum Despite Dip

The Shiba Inu coin has once again piqued investor interest in a roaring Q4 bull market, owing to a increase in the SHIB burn rate.

The Shiba Inu coin has once again piqued investor interest in a roaring Q4 bull market, owing to a increase in the SHIB burn rate.

On Tuesday, burn data showed a whopping 1000% increase, indicating that the cryptocurrency’s supply was severely depleted. As a result, market participants anticipate big gains in the dog-themed meme token. besides, additional optimistic metrics showed that the asset’s price may soon double.

SHIB Burn Rate Soars with 1000% Increase, Fueling Optimism as Supply Decreases

According to Shibburn’s most recent data, the SHIB burn rate increased by 1068% intraday, which showed that the token’s supply was significantly reduced. According to the statistics, 51.76 million coins were transferred to a null address, meaning that they were permanently removed from circulation. As a result of the law of supply and demand, the broader market mood towards the digital asset became more positive.

Simultaneously, the weekly burn statistics indicated that 2.44 billion tokens were withdrawn from the circulating supply. With the enormous burns, the Shiba Inu coin’s entire market supply has dwindled to 589.25 trillion SHIB to date.

Meanwhile, another positive ecosystem development has boosted investors’ confidence in crypto. Shibarium’s layer-2 network was launched 16 months ago, and the platform already has 2 million registered on-chain wallet addresses. Shibarium’s soaring burn rate and more activity have fuelled hope for the cryptocurrency during the Q4 bull market.

ShibaSwap, a decentralised exchange within the ecosystem, has almost $28 million in total value locked up. The network’s transaction volume has surged, and annualised fees have risen to more than $3.2 million.

Despite the above-mentioned SHIB burn rate rise, Shiba Inu prices fell 15% intraday and are now at $0.00002695. This is due to the price correction in overall crypto market as coins are getting stabilized after roaring bull run.

SHIB Large Holder Concentration Expands

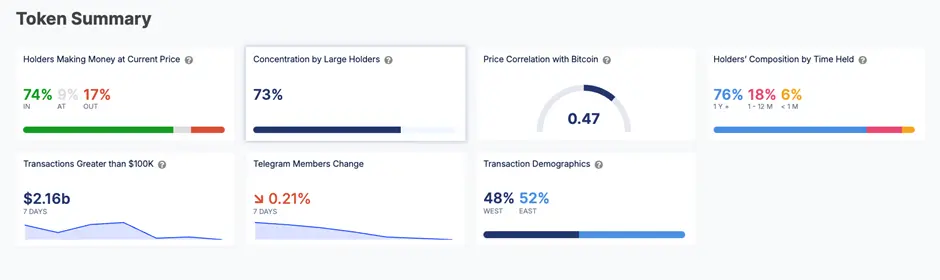

The findings from SHIB demonstrate substantial trends in largeholder concentration and investor activity. Based on the data, whale wallets own over 1 percent of the circulating supply, while investors with 0.1% to 1% control a significant 73% of SHIB’s circulating supply. Whales dominate this section, accounting for 59.03%, or 580.98 trillion SHIB. On the other hand, investors account for 14.19% of the total, or 139.63 trillion SHIB.

SHIB Holder Metrics: Majority in Profit and Long-Term Commitment

Metrics that show profitability among holders are also useful. Currently, 74% of SHIB holders are “in the money,” which means they are gaining at current prices. Meanwhile, 17% are “out of the money,” meaning they will lose money based on the present price, while the remaining 9% will break even.

A review of holders’ commitments suggests that the majority are long-term investors. Approximately 76% of SHIB holders have held their shares for more than a year. Additionally, 18% of holders have held their positions for 1-12 months. A smaller 6% had owned SHIB for less than a month which show fresh arrivals into the ecosystem.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account