323,816 Traders lose $1 Billion amid Bitcoin, XRP, Solana Crash

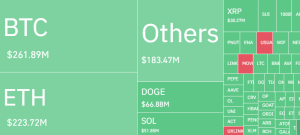

Coinglass data showed 323,816 traders were liquidated for the day the total liquidations come in at $1.07 billion.

BTC dropped below the $95K market on Friday, continuing the negative price developments that began following the contentious remarks made by the US Federal Reserve Chair. The altcoins have been even more severely affected, with notable double-digit losses from major altcoins like Ethereum, XRP Doge, and Solana

The altcoins followed suit as Bitcoin fell from over $105,000 on Wednesday to just under $95K on Friday The pioneer asset is currently in a state of freefall, though, as its price dropped by several thousand dollars just a short while ago, plunging to a weekly low of $94.9K on Biannce.

A less dovish monetary policy in 2025 is bad news for the cryptocurrency market. The prolonged rise in the US dollar value also poses a macro risk to digital assets which is generally bad for Bitcoin and other cryptocurrency assets. The biggest threat to Bitcoin is a strong dollar and declining liquidity.

Arthur Hayes, the co-founder and former CEO of the cryptocurrency exchange BitMEX, thinks that the current bullish trends in the cryptocurrency market might not last for long in light of Donald Trump’s recent victory in the presidential election,.

According to the co-founder of BitMEX, many politicians will start campaigning by the end of 2025 because of the midterm elections in November 2026. This implies that Trump may not be able to push his policies through at least for for some time.

Trump has more than doubled the price of Bitcoin this year due to his promises to protect cryptocurrency mining interests, establish a Bitcoin reserve, and establish America as the world’s “crypto capital.”.

Policymakers expect the Fed funds rate to fall to 3 percent by the end of 2025 or by an additional 50 basis points in rate cuts the following year, according to the Fed’s quarterly economic projections, which include a “dot plot” illustrating the central bank’s expectations for the rate’s trajectory.

However, the fact that on-chain factors for the cryptocurrency are still very positive, particularly the ongoing decline in exchange balances, supports the hypothesis that the BTC supply deficit is elevated.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account