Texas Investor Hit: Crypto Keys Seized in $1.1M Tax Fraud

In a first for cryptocurrency regA Texas court orders Bitcoin investor to hand over crypto keys in a $1.1M tax fraud case...

In a first for cryptocurrency regulation, a Texas federal court has ordered Frank Richard Ahlgren III to turn over all crypto wallet private keys, access codes and storage devices.

This follows Ahlgren’s conviction for tax fraud where he was found guilty of underreporting over $3.7 million in Bitcoin sales from 2017-2019.

Judge Robert Pitman issued the order on January 6, enforcing a restraining order that includes Ahlgren’s family and representatives. He can’t transfer any of his digital assets, including Bitcoin, Ethereum and Litecoin, without court approval so that the value is preserved to pay off $1.1 million in restitution to the US government.

How Ahlgren’s Fraud Unfolded

Ahlgren’s tax fraud was based on falsified returns and hidden cryptocurrency transactions. Here are the details:

- 2017 Sale: Sold 683 Bitcoin for $3.7 million when Bitcoin was at $5,800.

- Fraudulent Reporting: Inflated the cost basis of his Bitcoin to reduce reported capital gains.

- 2018-2019 Sales: Sold another $650,000 in Bitcoin but didn’t report these transactions on his tax returns.

Prosecutors said Ahlgren used multiple wallets, in-person transfers and mixing services to hide the transactions. He owed over $1 million in taxes.

Legal and Financial Consequences

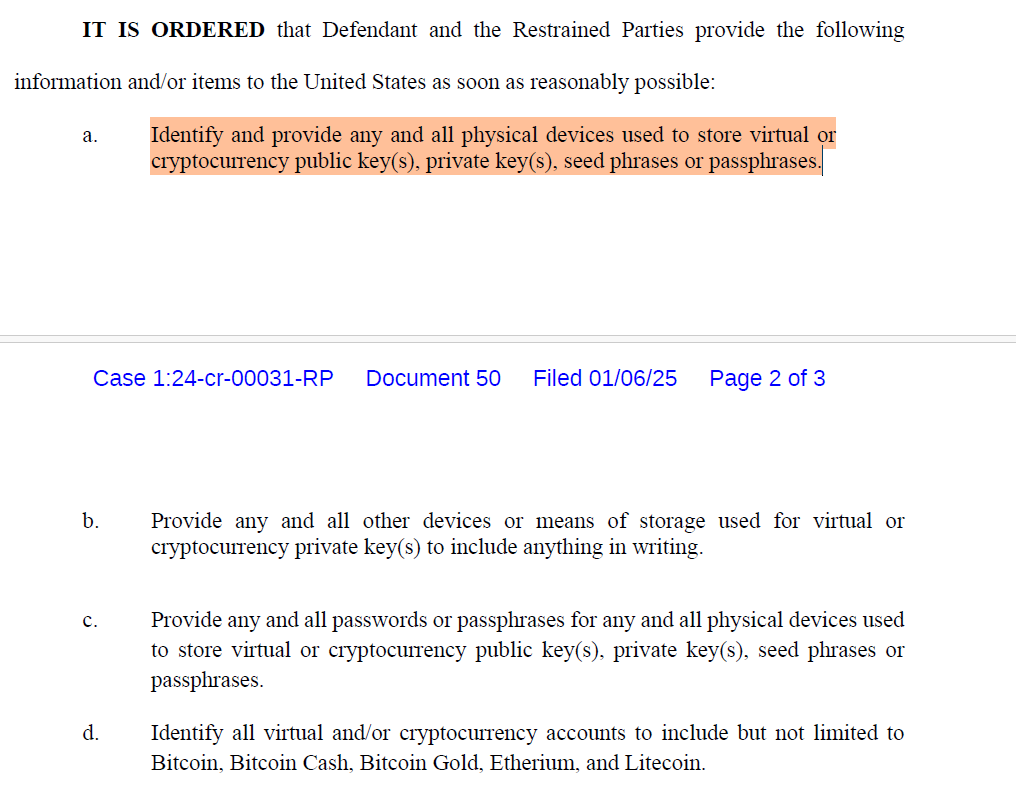

Ahlgren pleaded guilty in September 2024 to filing a false tax return and was sentenced to 2 years in prison, 1 year of supervised release. The January 6 order requires:

- Restitution Compliance: Ahlgren must turn over all public and private crypto keys and storage devices.

- Restricted Transfers: No transfers of digital assets except for court approved living expenses.

- Crypto Assets: The restraining order includes Bitcoin, Bitcoin Cash, Ethereum and Litecoin.

The order will remain in effect until the restitution is paid or further order of the court.

A Landmark Case for Crypto Tax Evasion

Ahlgren’s case is the first criminal tax evasion case involving only cryptocurrency, according to IRS-Criminal Investigation acting special agent Lucy Tan. It’s a warning to the digital asset community of the increasing regulatory attention and the risks of non-compliance.

As cryptocurrency grows, cases like Ahlgren’s remind us that accurate reporting and transparency are key in digital asset transactions. For investors, the message is clear: crypto is taxable and evasion has severe consequences.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account