Solid Earnings, Buybacks, Global Drive Fuel Naspers Share Price NPN to New Records

Naspers Ltd. has re-entered the spotlight with a powerful rally in stock price, record highs, and strong financial results—all underpinned..

Quick overview

- Naspers Ltd. has experienced a significant stock price rally, reaching record highs and strong financial results driven by strategic buybacks.

- The company's recent earnings report showed a 12.46% increase in revenue and a 19.84% rise in net income year-over-year.

- Naspers' global investment arm, Prosus, also reported impressive growth, further boosting investor confidence in the company's strategy.

- Analysts believe Naspers has potential for continued growth, supported by its digital business foundation and favorable market conditions.

Naspers Ltd. has re-entered the spotlight with a powerful rally in stock price, record highs, and strong financial results—all underpinned by bold buybacks and a global strategy shift.

Naspers Rebounds Sharply, Hits Record Highs

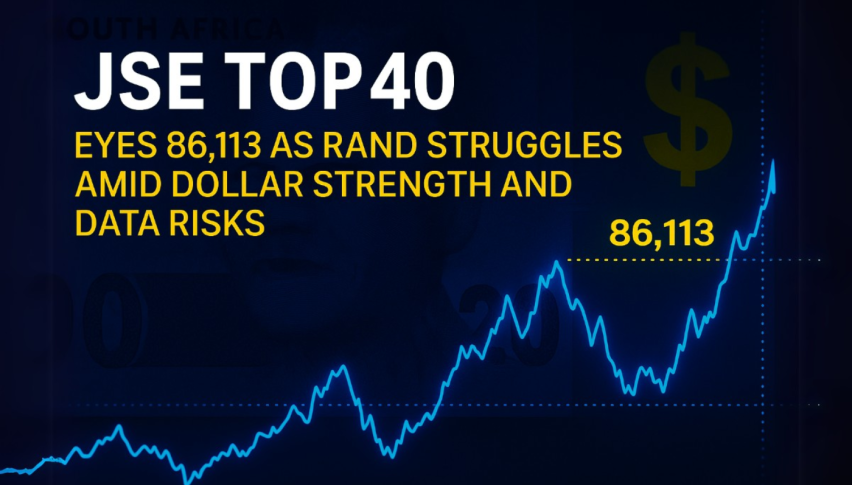

After a bearish start to Monday’s JSE session, Naspers Ltd. (JSE: NPNJn) rebounded powerfully, climbing as high as ZAR 5,347.00 intraday before closing slightly lower at ZAR 5,337.22, up +0.84% on the day. This capped off a strong week that saw shares gain nearly 5%, following a close of R5,088.64 the previous week.

The latest rally marks a remarkable 35% surge over the past month, reversing April’s steep decline when the stock briefly dipped below R4,000 amid global trade tensions and broader market uncertainty.

Naspers Chart Weekly – MAs Continue to Support NPNJn on Pullbacks

Technical support at the 50-week simple moving average (SMA) helped stabilize the downtrend, launching a six-week winning streak that’s pushed Naspers to historic highs.

Earnings Impress Across Core and Global Operations

Fueling the optimism was a robust full-year earnings report released yesterday. Naspers posted:

- Revenue: USD 7.23 billion, up 12.46% YoY

- Net Income: USD 3.42 billion, up 19.84% YoY

Driven by digital platforms, e-commerce, and emerging markets, the company also delivered annual sales growth of 10.8% and profitability growth nearing 20%. Under the leadership of newly appointed CEO Fabricio Bloisi, Naspers has added ZAR 550 billion to its market capitalization in 2025 alone.

Prosus Boosts the Bullish Case

Adding to the bullish sentiment, Naspers’ global investment arm, Prosus, also outperformed expectations. Last week, it reported:

- Adjusted Earnings: USD 435 million (exceeding the USD 400 million target)

- Revenue Growth: +20%

- Profit Growth: +50% to USD 270 million

These results bolster Naspers’ strategy of spinning out Prosus to focus more sharply on global ventures. Standout segments included its OLX classifieds and food delivery business iFood, which now handles 120 million+ monthly orders and generated over USD 200 million in profitability.

Aggressive Share Buybacks Fuel Technical Momentum

Investor enthusiasm has been further amplified by continued share repurchases, which have created upward pressure on the stock. Between January 10 and April 9, Naspers repurchased 5.19 million shares, roughly 3.16% of its issued capital, at prices between R3,576.95 and R4,955.59.

That momentum continued into May. Between April 28 and May 2, the Group purchased an additional 177,844 shares at an average price of R4,922.54, totaling ZAR 875 million (approximately USD 47.3 million). These repurchases have not only reduced share float but also signaled strong internal confidence, helping propel the stock to new heights.

NPNJn Chart Daily – Q1 Highs Turned Right Away Into Support Signaling Further Upside

Additionally, for the period between 5 May 2025 and 9 May 2025, Naspers bought 276,340 shares at an average price of ZAR5,014.8732 per share for a total consideration of ZAR1,385,810,050 (US$75,982,563).

Global Market Tailwinds Add Further Lift

Beyond internal performance, external factors have helped improve sentiment. Recent U.S.-China trade agreements, especially the weekend truce, provided a risk-on tone to global equities—lifting major stocks like NPNJn on Monday morning.

Though some traders may have hoped for a pullback to re-enter, Naspers has consistently used pullbacks to the weekly moving averages as a platform for new rallies. This behavior, combined with solid earnings and macro tailwinds, makes the current uptrend both technically and fundamentally justified.

Conclusion: Still Room to Run

Despite a historic rally and new all-time highs, many analysts and investors believe Naspers still has more room to grow. With a strong foundation in digital businesses, accelerating global expansion through Prosus, and shareholder-friendly buyback strategies, the stock appears well-positioned for continued momentum—especially as market sentiment continues to improve.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account