AUD/USD Bounces on Jobs Surge, but $0.6390 Breakdown Threatens Reversal

AUD/USD gains on strong jobs data and trade optimism, but technicals warn of a breakdown below $0.6390 amid US dollar weakness and China ris

Quick overview

- The Australian dollar rebounded above $0.6430 after easing US/China trade tensions and a strong domestic jobs report showing 89,000 new jobs in April.

- Despite the positive momentum, gains for the AUD are fragile due to potential renewed trade tensions from US actions against Chinese chipmakers.

- The US dollar remains under pressure from soft inflation data, leading to expectations of multiple Fed rate cuts before year-end.

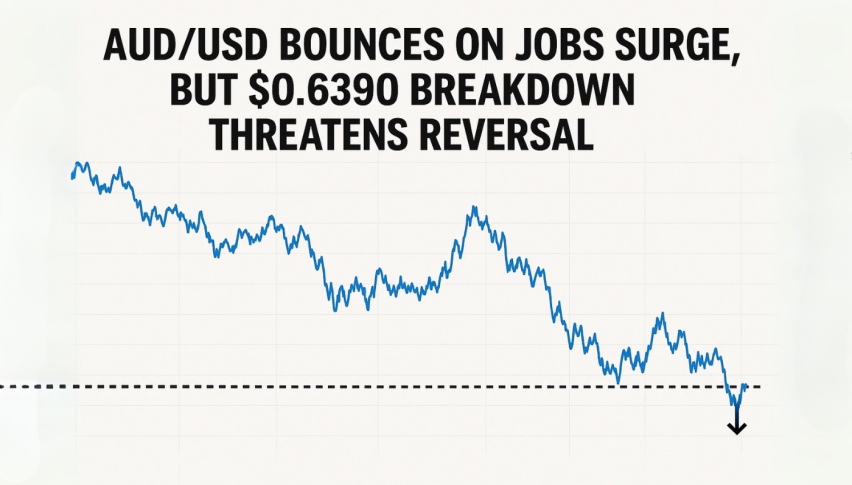

- Technically, the AUD/USD is at a critical point, with a bearish pennant pattern suggesting potential downside if it breaks below $0.6390.

The Aussie bounced back during Friday’s European session, rising above $0.6430 after two days of losses. This came as US/China trade tensions eased with both countries agreeing to slash tariffs to 30% for the US and 10% for China. This restored some global risk appetite and is good for the risk sensitive AUD.

More momentum came from a strong domestic jobs report. The Australian Bureau of Statistics said employment rose 89,000 in April, four times the expected 20,000. The unemployment rate was steady at 4.1% and wages grew 3.4% year over year, beating expectations. This surprised markets and took the heat off the RBA to cut rates and lifted year end rate forecasts from 2.85% to 3.1%.

But gains are fragile. Reports the US may blacklist Chinese chipmakers could re-ignite trade tensions. Given Australia’s economic ties to China this could hurt Aussie demand.

Fed Rate Cut Bets Hit the Greenback

While the Aussie showed some strength the US dollar remained under pressure. Soft inflation data added to dovish Fed expectations. The April PPI rose 2.4% year over year, down from 2.7% in March and below the 2.5% forecast. Core PPI followed with 3.1% year over year, and the monthly figure showed a 0.5% decline.

The CPI also slowed to 2.3% year over year. With jobless claims steady (229,000) and continuing claims up marginally (1.881 million) this data supports a narrative of a slowing economy. Swap traders are now pricing in multiple rate cuts before year end.

With inflation cooling and consumer sentiment near two year lows the US dollar has limited upside. This creates room for AUD/USD to stabilise if geopolitical risks don’t get in the way.

AUD/USD Support Breakdown Below $0.6390

Technically the AUD/USD is at a critical point. The pair is testing the bottom of a converging wedge at $0.6410 and failed to break above the 50 period EMA at $0.6422. This is a classic bearish pennant, a continuation pattern that favours the downside.

-

MACD histogram is negative and signal lines are fading

-

Price is respecting the descending trendline from May 14

-

Rejection at resistance is repeated

If the price breaks below $0.6390 with conviction the bears could target $0.6362 and then $0.6340. A close back above the EMA and trendline would invalidate the setup.

Traders: Look for a bearish candle below support before getting in. This confirms sellers are in control. Use a stop loss above $0.6425 to protect against fakeouts. Be patient—don’t anticipate, confirm.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account