Silver Hits $33.22 as Dollar Falls—Is $33.70 the Next Big Bull Target?

Silver (XAG/USD) hit $33.15 yesterday as the US Dollar weakened and political uncertainty in Washington continued.

Quick overview

- Silver (XAG/USD) reached $33.15 as the US Dollar weakened due to political uncertainty and a downgrade of the US credit outlook.

- Analysts remain optimistic about silver and gold, predicting further upside if macroeconomic risks continue.

- Silver has broken above $32.93 and is testing resistance at $33.22, with bullish momentum indicated by the MACD.

- Traders are advised to enter above $33.22, with support levels at $32.93 and $32.68.

Silver (XAG/USD) hit $33.15 yesterday as the US Dollar weakened and political uncertainty in Washington continued. The Dollar Index (DXY) fell to its lowest since May 7, making dollar-denominated metals like silver and gold more attractive to international buyers.

The dollar dropped after Moody’s downgraded the US credit outlook and doubts grew around President Trump’s tax-cut plan. “The dollar lost more than a point in the last 24 hours,” said Marex analyst Edward Meir, as Trump’s effort to unify Republicans behind the bill hit a snag with a few holdouts.

With uncertainty rising and inflation expectations still in play precious metals are back in favor, especially when the Fed is cautious. While gold gets all the attention during macro turmoil, silver has been quietly moving higher, riding the wave of market anxiety and a weaker dollar.

Analysts Still Like Precious Metals

Despite the recent rally, analysts think there’s more to come for silver and gold if macro risks persist. KCM Trade’s Chief Market Analyst, Tim Waterer, sees more upside for gold and silver “over the medium- to longer-term” but any trade deal breakthrough could cool demand.

St. Louis Fed President Alberto Musalem said improved trade conditions would support employment and help inflation stabilize at the Fed’s 2% target. That would reduce the need for future rate hikes—an outcome that’s good for metals like silver.

So while the macro story is still fluid, the current environment is still bullish for silver in the short-term.

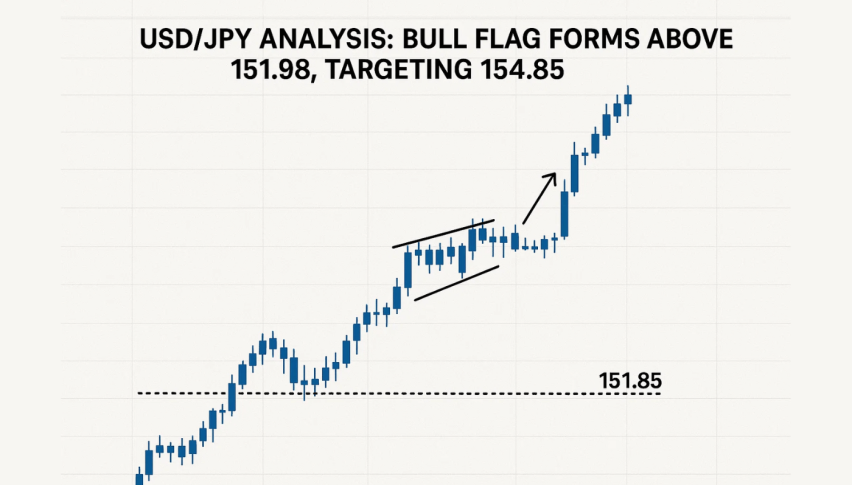

Silver Charts Show Bullish Breakout

On the charts, silver has broken out above $32.93 and is now testing $33.22, the top of the 1-hour channel. The move followed a bullish engulfing candle and price is above the 50-EMA at $32.68, which is strong support.

The MACD is confirming momentum with a fresh buy signal and expanding histogram bars. But $33.22 is resistance so bulls need to clear that level.

Support: $32.93, $32.68, $32.41

Trade Setup (Bullish):

-

Entry: Above $33.22

-

Stop: Below $32.68

-

Targets: $33.45, $33.70

If silver can break and hold $33.22, it could run to multi-month highs. But without a clean break, wait for dips to support before getting in.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account