Forex Signals Brief May 22: Bitcoin, Bond Yields and Gold Soar Again

Global markets were whipsawed by rising yields, weak housing data, central bank cues, and crypto optimism, as investors processed a mixed se

Quick overview

- Global markets experienced volatility due to rising yields, weak housing data, and mixed signals from central banks and cryptocurrencies.

- U.S. mortgage applications declined as interest rates rose, while Canada's housing market showed continued weakness with a drop in new home prices.

- Crude oil inventories unexpectedly increased, contributing to a cautious sentiment in energy markets amid rising Treasury yields.

- Bitcoin surged over 6% to surpass $100K, driven by optimism in the cryptocurrency market, while Ethereum gained over 20% following its recent upgrade.

Live BTC/USD Chart

Global markets were whipsawed by rising yields, weak housing data, central bank cues, and crypto optimism, as investors processed a mixed set of signals across asset classes.

The economic calendar was light in the U.S., with the only notable update being a decline in weekly mortgage applications due to rising interest rates. In Canada, the housing slowdown continued, with April’s New Home Price Index falling by 0.4%, further pointing to sustained weakness in the real estate sector.

Crude Oil: Unexpected Supply Bump

The latest EIA report revealed a surprise build in U.S. crude inventories, which rose by 1.33 million barrels, defying expectations of a drawdown. This unexpected stock increase added to the cautious tone across energy markets.

Bond Yields Soar to Multi-Month Highs

- Treasury yields climbed sharply amid deficit concerns and strong technical momentum.

- The 10-year yield surged 10.3 basis points to 4.584%, its highest level since February.

- The 30-year yield jumped 11.1 bps to 5.079%, a level last seen in November 2024.

Support from the 200-hour moving average kept the trend intact, as traders weighed the fiscal implications of new policy proposals.

Deficit Worries Resurface

Concerns over rising U.S. debt levels re-emerged after the unveiling of the administration’s proposed “Big Beautiful Tax Deal.” The plan leans heavily on sustained 3% GDP growth rather than spending cuts to balance the budget—a strategy drawing renewed attention following Moody’s recent downgrade of U.S. credit outlook.

Market Turbulence as Yields Climb

U.S. equity markets struggled for direction. The S&P 500 and NASDAQ briefly recovered early losses, only to reverse course and close sharply lower. Treasury yield pressure and deficit anxieties contributed to the late-session drop. Meanwhile, the U.S. dollar ended weaker against all major currencies despite some midday strength.

Today’s Economic Highlights: May 20–24, 2025

ECB Minutes: One Cut, No Commitment

The European Central Bank’s April minutes confirmed a 25 basis point rate cut, with policymakers removing language around policy restrictiveness. The move puts the policy rate at the upper edge of the ECB’s neutral range (1.75%–2.25%).

While the decision was unanimous, officials stressed increased economic uncertainty and noted that the cut may still tighten financial conditions via confidence channels. Markets are now watching for any dovish signals to follow in future meetings.

Eurozone and UK PMI Preview

Markets are bracing for Thursday’s Flash PMI data:

Eurozone (May Estimates):

- Manufacturing: 49.5 (prev. 49.0)

- Services: 50.3 (prev. 50.1)

- Composite: 50.8 (prev. 50.4)

UK (May Flash):

- Manufacturing: 45.9 (prev. 45.4)

- Services: 49.5 (prev. 49.0)

- Composite: 48.2 (prev. 51.5)

April marked a sharp pullback for the UK, with manufacturing hitting its weakest level in over three years and services slipping into contraction, reflecting fading demand both domestically and abroad.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD falling below 1.11, and stock markets continuing upward. The moves weren’t too big, but we opened 37 trading signals in total, finishing the week with 25 winning signals and 12 losing ones.

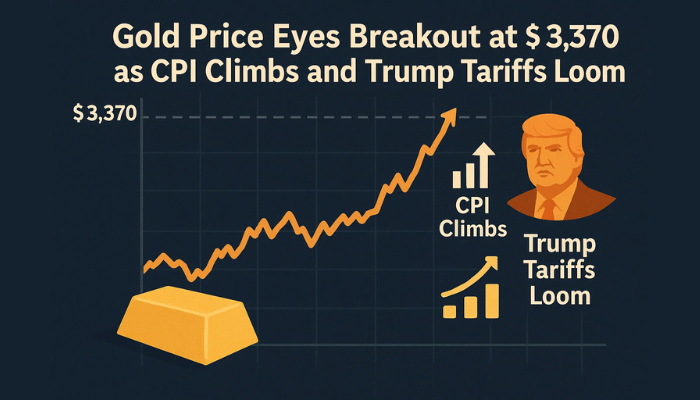

Gold Rebounds, But Traders Stay Cautious

Gold endured a volatile session, falling below $3,120 during European trading before surging nearly $120 back toward $3,200. The metal rebounded strongly from its 50-day moving average, but traders remained hesitant to push it back to April’s peak near $3,500. A mix of risk appetite and technical retracement kept the momentum in check.

USD/JPY Volatility & Dollar Sentiment

The USD/JPY pair staged a strong intraday reversal after slipping below the key 140.00 level, eventually rising above 146.00 and testing resistance near the 200-day moving average around 148.50. Profit-taking capped further gains, but bullish sentiment remains intact, especially as traders look to buy dips amid dollar strength.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Returns Above $105K

Cryptocurrencies saw a broad rally, led by Bitcoin, which climbed over 6% to climb above $100K and print a new record high yesterday above $110K, marking its highest level since February. Optimism over improving trade ties between the U.S. and both China and the UK added fuel to the risk-on mood, drawing capital back into digital assets.

BTC/USD – Weekly chart

Ethereum Tests MAs after Rebound Following Pectra Upgrade

Ethereum also rallied strongly, gaining over 20% from its April low of $1,475 to nearly $2,200. The launch of Ethereum’s “Pectra” upgrade, which enhanced wallet integration and staking features, further boosted confidence in the digital asset space. The update marks a significant step forward for Ethereum’s ecosystem, drawing renewed attention from both retail and institutional investors.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account