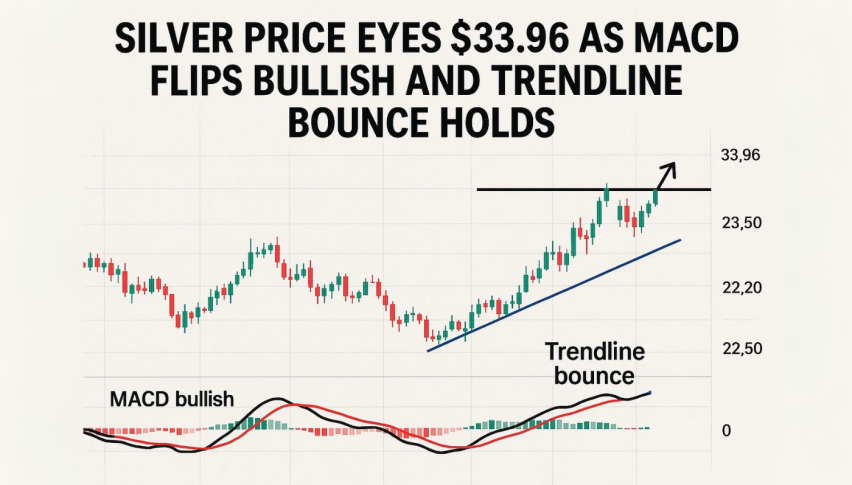

Silver Price Eyes $33.96 as MACD Flips Bullish and Trendline Bounce Holds

Silver (XAG/USD) is back on buyers’ radar after defending key support near $32.74. The metal found footing at the ascending...

Quick overview

- Silver (XAG/USD) has shown resilience by defending key support at $32.74 and reclaiming the 50-hour EMA at $33.11.

- The MACD crossover indicates early bullish momentum, strengthening the near-term outlook for silver.

- Traders should watch for a bullish engulfing candle or a close above $33.41 to confirm potential upside.

- A failure to hold above $33.00 could shift sentiment towards bearish targets around $32.73.

Silver (XAG/USD) is back on buyers’ radar after defending key support near $32.74. The metal found footing at the ascending trendline that’s held since mid-May, forming a long-tailed wick—an early sign of buyer defense. The price has since reclaimed the 50-hour exponential moving average (EMA), currently at $33.11, restoring short-term bullish structure.

The bounce follows a steep rejection from $33.99, which triggered a sharp pullback. But now, with higher lows forming and a move above the EMA, silver appears to be regaining technical strength. The recent recovery toward $33.20 sets the stage for a potential breakout if momentum persists.

MACD Crossover Signals Fresh Upside

A notable shift on the MACD adds weight to the bullish case. The MACD line has crossed above the signal line below zero, while histogram bars have flipped green—both pointing to early momentum favoring the bulls.

This convergence of indicators strengthens the near-term outlook:

-

Support held at: $32.74

-

MACD crossover: Below zero, turning positive

-

50-hour EMA reclaimed: $33.11

-

Next resistance: $33.41, then $33.69

Traders watching for confirmation may focus on a bullish engulfing candle or a decisive hourly close above $33.41. That level has capped upside moves in recent sessions and serves as a key trigger for fresh bids.

Trade Setup and Risk Zones

For new and seasoned traders alike, the structure offers a clean, textbook bounce scenario. The trendline from May, the 50-EMA, and the MACD alignment all build a strong case for upside follow-through—provided resistance levels give way.

Bullish Setup:

-

Entry: Break and close above $33.41

-

Stop-loss: Below $33.00 (trendline and EMA protection)

-

Targets: $33.69 (initial), $33.96 (extended)

On the flip side, a failure to hold $33.00 could flip sentiment quickly, with bears likely aiming for a retest of $32.73. For now, the technical bounce remains in play—it’s about whether bulls can push through the ceiling.

As always, in volatile metals like silver, confirmation is everything. Wait for your signal, manage your risk, and let the trend do the work.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account