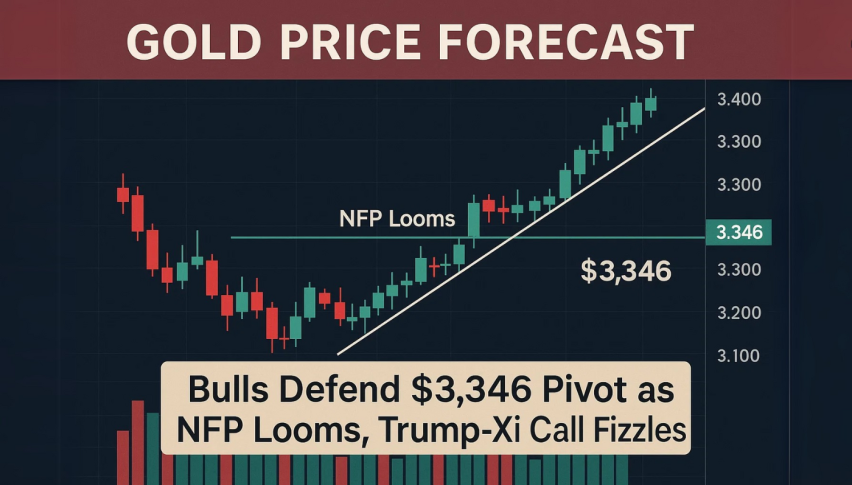

Gold Price Forecast: Bulls Defend $3,346 Pivot as NFP Looms, Trump-Xi Call Fizzles

Gold is inching higher this Friday, looking set for a weekly win as disappointing U.S. job numbers took center stage

Quick overview

- Gold is rising this Friday, buoyed by disappointing U.S. job numbers despite a brief positive reaction to a Trump-Xi phone call.

- Jobless claims have reached a seven-month high, indicating a cooling job market ahead of today's nonfarm payrolls report.

- Gold is showing resilience around the $3,346 mark, with traders defending the uptrend line and maintaining a bullish outlook.

- The key resistance levels to watch are $3,364 and $3,393, while a drop below $3,332 could signal a deeper pullback.

Gold is inching higher this Friday, looking set for a weekly win as disappointing U.S. job numbers took center stage, despite an unusual phone conversation between Presidents Trump and Xi. While the two leaders talked about their ongoing trade disputes and critical mineral issues, nothing substantial came from their chat. The market’s initial positive reaction didn’t last long.

“Sure, the Trump-Xi call might have calmed nerves for a minute,” says Tim Waterer from KCM Trade, “but investors quickly got back to worrying about the economy. Let’s face it – it’s the weak job numbers pushing gold right now, not political theater.”

And those numbers aren’t looking great – jobless claims just hit their highest point in seven months, reinforcing what many already suspected: the job market is cooling down. The big question now? Today’s nonfarm payrolls report dropping at 12:30 GMT. Economists are expecting about 130,000 new jobs in May, well below April’s 177,000, while unemployment should hold steady at 4.2%.

If these numbers come in significantly different than expected, gold could finally break out of its recent sideways pattern.

Gold Buyers Holding Strong at $3,346

Gold continues to show resilience, bouncing nicely off that important $3,346 mark – which happens to line up with the 0.382 Fibonacci level from May 31’s high of $3,393. Traders are also defending the uptrend line from the May 29 low of $3,271, and by doing so, they are keeping the upside (bullish) picture intact.

Where to Watch:

Looking at support? Keep an eye on $3,346, with backup at $3,332 and $3,317 if things get shaky.

For resistance, we’re watching $3,364, then $3,393, and $3,414 if momentum really builds.

Right now, gold’s trading above its 50-period moving average ($3,339) – a positive short-term sign. Those quick dips below $3,346 that keep bouncing back? That’s telling us buyers are still interested at these levels.

If we can push decisively above $3,364, the path looks clear for another run at $3,393, with potential to reach $3,414 or even $3,437 if momentum builds.

Mixed Signals, But Bulls Have the Edge

The momentum indicators are sitting on the fence right now. The MACD is flat as a pancake, suggesting we’re in consolidation mode rather than seeing a trend change. That said, watch for a crossover above the signal line – that would confirm the bulls are back in control. Until then, expect choppy trading driven by today’s news cycle.

What’s the Play?

For the optimists: A close above $3,364 could send gold climbing toward $3,393 and potentially $3,414.

For the cautious: Watch out if we drop below $3,332 – that could open the door to a deeper pullback to $3,297.

Bottom Line

With economic uncertainty growing and all eyes on today’s job report, gold remains a popular safe haven. The real battleground is that $3,346–$3,364 zone – just make sure you see some solid volume confirmation before jumping in.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account