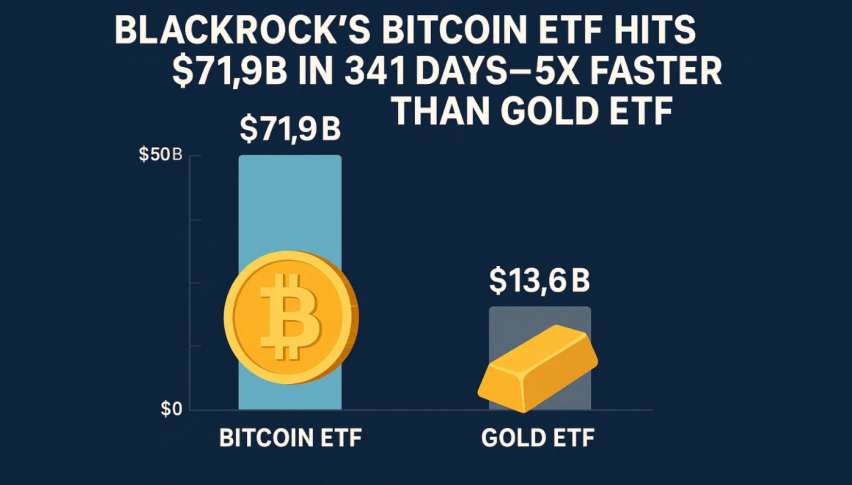

BlackRock’s Bitcoin ETF Hits $71.9B in 341 Days—5x Faster Than Gold ETF

BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest ETF in history to reach $71.9 billion...

Quick overview

- BlackRock's iShares Bitcoin Trust (IBIT) reached $71.9 billion in assets under management in just 341 days, setting a new record for ETFs.

- The fund, launched on January 11, 2024, has attracted significant institutional and retail investment, holding 661,457 Bitcoin.

- IBIT's rapid growth is attributed to strong institutional demand and its role as an inflation hedge, with $6.96 billion in net inflows since its inception.

- The launch of IBIT futures in Russia indicates a growing international interest in crypto ETFs and the potential for further global expansion.

BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest ETF in history to reach $71.9 billion in assets under management (AUM) in just 341 days. That’s faster than the previous record held by SPDR Gold Shares (GLD) which took 1,691 days to reach $70 billion.

The fund launched on January 11, 2024 and trades on the Nasdaq and has attracted institutional and retail investors. IBIT holds 661,457 Bitcoin and BlackRock is now the largest institutional holder of Bitcoin surpassing Binance and MicroStrategy.

At $61.77 per share the ETF is already changing how investors get exposure to Bitcoin through traditional markets. As of early June it had $201 million in monthly inflows after a record $5.9 billion in May.

Why Investors Are Choosing IBIT

In a recent interview with Yahoo Finance, Robert Mitchnick, BlackRock’s head of digital assets said IBIT’s rapid growth is driven by Bitcoin’s increasing use as an inflation hedge and alternative store of value.

Key reasons for the fund’s success:

- Strong Institutional Demand: Over $1 billion in trading volume on the first day.

- Diversified Access: Regulated exposure to Bitcoin without direct ownership.

- Superior Inflows: $6.96 billion net inflows since January 2024, 6th among all ETFs.

Mitchnick said Bitcoin’s role in global finance is evolving and it’s becoming a key component of diversified investment strategies.

Future Outlook and Global Expansion

June 4th Russia’s Moscow Exchange (MOEX) launched IBIT futures but they are only available to accredited investors. This is a sign of growing international interest in crypto ETFs and IBIT’s global expansion.

Bloomberg ETF analyst Eric Balchunas even thinks BlackRock could surpass Satoshi Nakamoto (Bitcoin’s creator who holds an estimated 1.1 million BTC) by next summer if the growth continues.

As the ETF landscape evolves IBIT’s momentum shows the trend: traditional finance is embracing Bitcoin faster than ever.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account