Forex Signals Brief June 26: Fed Holds Steady, Dollar Dips, Eyes Now on Durable Goods

Yesterday the Dollar Weakened as Powell Testified for the second day; Today Markets Shift Focus to Durable Goods and Commodities.

Quick overview

- The US dollar fell sharply against the yen and franc, reflecting a cautious tone from the Federal Reserve amid inflation risks.

- Federal Reserve Chair Jerome Powell emphasized data dependence and indicated that a rate cut could be possible if inflation softens.

- Equity markets rallied despite rate uncertainty, with significant gains in major indices, while commodities like crude oil and gold saw declines.

- Attention now shifts to Durable Goods Orders, with expectations for a rebound driven by aircraft demand, although underlying demand may remain weak.

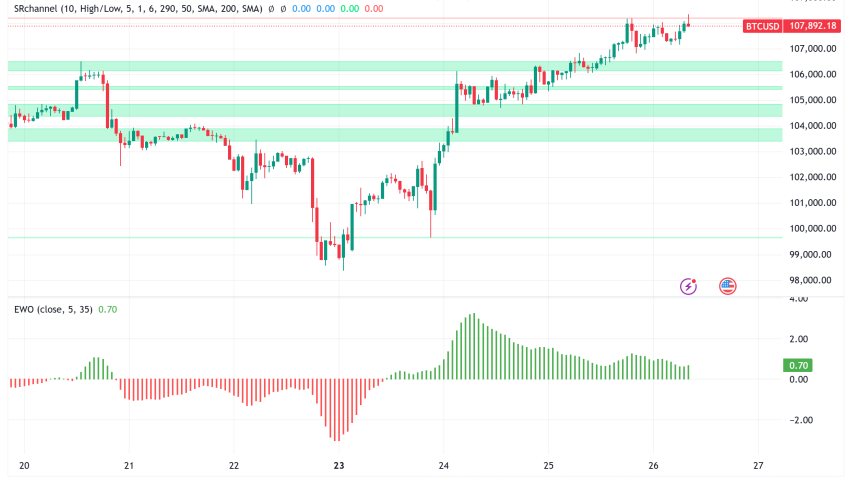

Live BTC/USD Chart

Yesterday the Dollar Weakened as Powell Testified for the second day; Today Markets Shift Focus to Durable Goods and Commodities.

Dollar Falls Sharply Against Yen and Franc

The US dollar declined broadly in today’s trading, led by a sharp drop of -0.92% against both the Japanese yen (JPY) and the Swiss franc (CHF). This marked the biggest daily loss for the greenback among key currency pairs. The softness came as traders responded to a cautious tone from the Federal Reserve amid lingering inflation risks and geopolitical uncertainty.

Powell Emphasizes Data Dependence and Inflation Risks

Federal Reserve Chair Jerome Powell’s testimony before Congress was the primary market-moving event. Speaking before the House and set to appear in the Senate tomorrow, Powell maintained that the US economy is not in recession and that the labor market shows no signs of weakening. This strength gives the Fed room to hold off on immediate rate adjustments.

However, Powell did note that a rate cut could be justified if inflation proves softer than expected. At the same time, he acknowledged that recent tariff forecasts could add inflationary pressure, especially during the June–August period. The Fed remains open to multiple policy paths, including a potential rate cut as early as July, but there is no fixed timeline. Policymakers are firmly in “wait-and-see” mode.

Equity Markets Rally Despite Rate Uncertainty

Equities reacted positively:

- S&P 500 rose by +67.01 points to close at 6,092.18 (+1.11%)

- Dow Jones Industrial Average jumped +507.24 points to 43,089.02 (+1.19%)

- NASDAQ Composite advanced +281.56 points to 19,912.53 (+1.43%)

On the commodity front, crude oil dropped $3.50 to $65.01, while gold lost $44 or -1.31%, closing at $3,323.06.

Today’s Forex Market Events: Durable Goods Data Now in Spotlight

Today the US Final Q1 GDP is expected to remain unchanged at -0.2%, as are the Unemployment Claims at 244K. So attention shifts to Durable Good Orders.

Markets now turn to incoming economic data, particularly Durable Goods Orders:

- The consensus for headline durable goods m/m is +6.8%, reversing April’s -6.3% drop

- Core durable goods m/m are expected at +0.1%, slightly lower than the prior +0.2%

The expected spike in orders is driven largely by aircraft demand—Boeing reportedly received over 300 new orders in May. However, underlying demand outside transportation may remain weak.

Wells Fargo analysts suggest that the improvement excluding transportation may only be about 0.2%, reflecting tepid demand. Orders for core capital goods (excluding defense and aircraft) appear to be softening, potentially due to pre-tariff stockpiling and slowing corporate investment.

Looking ahead, capital expenditure is forecast to cool in Q2 as companies grapple with tight financial conditions, trade-related uncertainty, and a subdued business outlook. Investors will be watching nondefense capital goods shipments for confirmation.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD jumping above 1.16 but returned back below 1.15, while stock markets retreated on Friday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Price Struggles Despite Global Tensions

Despite escalating geopolitical tensions, gold prices fell nearly 3% last week. After peaking at $3,500/oz in April, gold has pulled back and is now testing short-term support. Several doji candlesticks on the daily chart reflect market indecision. The 20- and 50-day moving averages are offering near-term stabilization.

A retest of $3,430–$3,450 is possible if geopolitical risks escalate. On the downside, a breach below $3,300 might signal markets are beginning to price in a long-term easing of global tensions.

USD/JPY Dips Amid Capital Flows, Not Fundamentals

The USD/JPY pair bucked the usual interest rate spread narrative. It fell from 143.40 to 144.31, largely due to capital outflows from Japan amid growing geopolitical risks and global yield-hunting behavior. Analysts suggest this movement was more flow-driven than fundamentally justified.

Immediate support is at 142.70, with key resistance at 145.00. Unless risk sentiment shifts significantly, larger moves may stall.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Slips Below $100K as Sentiment Sours

Bitcoin (BTC) has been under pressure, dropping below its 50-day moving average near $104,000 and then breaking below $100,000, a level not seen since early May. While long-term investors may see this as a buying opportunity, short-term traders are eyeing potential support levels at $90,000 or even April lows near $74,000.

BTC/USD – Weekly chart

Ethereum Outpaces Bitcoin Amid Technical Tailwinds

Ethereum (ETH) has outshone Bitcoin in recent weeks, rallying over 20% since April on institutional buying and excitement over the Pectra upgrade. The technical focus is now the 200-day moving average. A breakout above this level could open the path toward $4,000—potentially allowing ETH to outperform BTC through the summer.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account