Platinum Boom Powers Valterra Share Price Higher After Anglo Split

Valterra Platinum is riding a wave of renewed investor enthusiasm following its high-profile demerger, with platinum prices hitting levels..

Quick overview

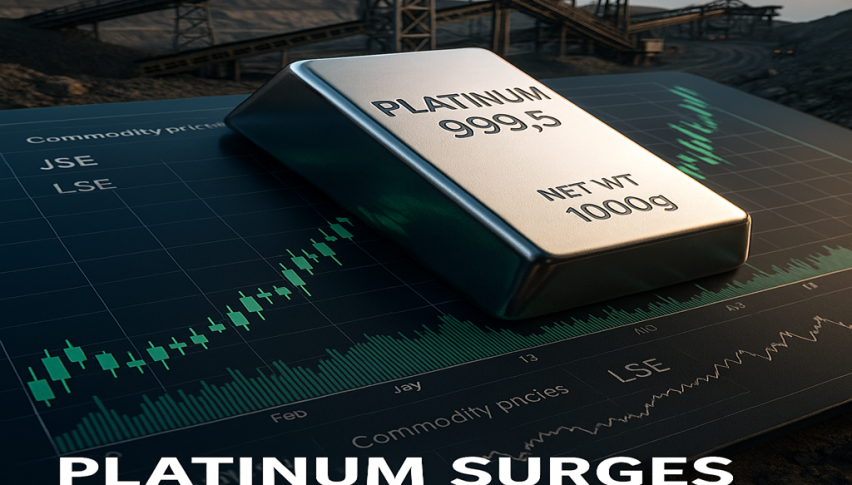

- Valterra Platinum experienced a nearly 10% increase in share price following a surge in platinum prices to an 11-year high of $1,434 per ounce.

- The company was formed through a demerger from Anglo American, which took effect on May 31, 2025, and has since seen positive trading on both the JSE and LSE.

- Valterra's leadership aims for a 40% return on headline earnings while focusing on delivering value over volume in a cyclical industry.

- The recent rally in platinum prices is attributed to tightening supply and a slowdown in electric vehicle adoption, benefiting Valterra's market position.

Valterra Platinum is riding a wave of renewed investor enthusiasm following its high-profile demerger, with platinum prices hitting levels not seen in over a decade.

Valterra’s Strongest Day Yet

Valterra Platinum delivered its best single-day performance on Thursday, climbing nearly 10% as platinum prices surged to an 11-year high of $1,434 per ounce. Investors cheered the price rally, marking a dramatic show of strength for the newly independent miner. The ASMJ share price hit 81,181 ZAC on the day, continuing a solid start to standalone trading.

A Historic Demerger from Anglo American

Valterra was formed through the formal demerger of Anglo American’s South African platinum division. Shareholders overwhelmingly approved the split in April 2025, which involved unbundling about 51% of Anglo’s stake in the newly renamed entity. The demerger took effect on May 31, 2025.

AMSJ Share Price Chart Weekly – Buyers Test Resistance

On June 2, Valterra Platinum shares began trading separately on both the Johannesburg Stock Exchange (JSE) and the London Stock Exchange (LSE). The market reacted positively from the start, with shares rising 2.5% on debut. Thursday’s spike marks the latest milestone in the company’s strong early trading record.

Market Context and Price Trends

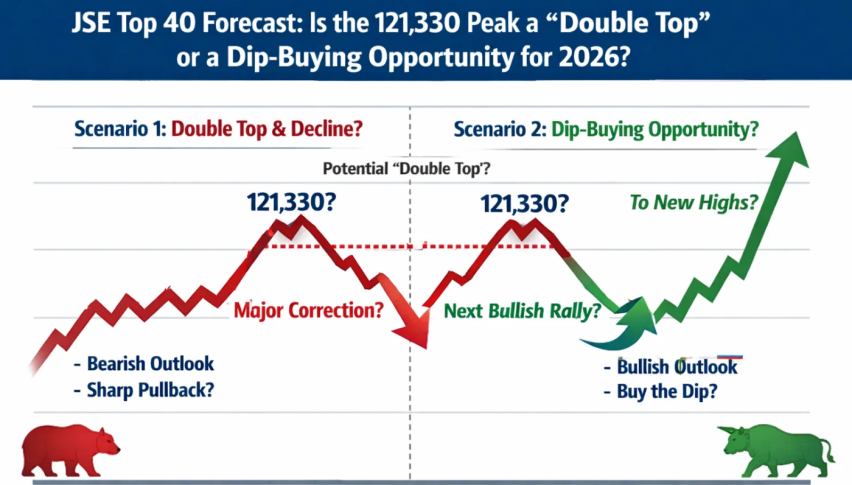

Platinum’s recent rally is a welcome tailwind after years of underperformance. Valterra shares had been in decline since 2022 but found stability in 2024, consolidating as the sector awaited a catalyst. With platinum prices rising sharply in 2025, the backdrop is shifting—though analysts note that for the uptrend to truly accelerate, technical resistance levels will need to be decisively cleared.

Meanwhile, palladium—platinum’s sister metal—also enjoyed gains, jumping 9% to $1,077/oz on the day. The broader improvement in platinum group metal (PGM) prices is seen as partly driven by slowing adoption of electric vehicles, which had threatened autocatalyst demand, and by tightening supply in South Africa.

Strategic Focus on Returns

Valterra’s leadership is working to capitalize on the favorable market while maintaining financial discipline. CEO Craig Miller outlined a strategy targeting a 40% return on headline earnings for shareholders. Miller emphasized that well-capitalized assets and disciplined reinvestment will be key to balancing growth with reliable returns.

The company is focused on delivering value over volume, ensuring that even in a cyclical industry, shareholders see steady benefits. This approach resonates well with investors seeking exposure to high-quality South African mining assets in a tightening PGM market.

Conclusion: Valterra Platinum’s strong debut and recent price surge highlight its promising start as an independent player. While challenges remain—including navigating cyclical metal markets and breaking through resistance levels—the company’s disciplined strategy and the supportive platinum price backdrop suggest it is well-positioned to deliver shareholder value in the years ahead.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM