Kumba Iron Ore Falls to ZAC 29,674 Amid Rate Pressure and Trade Uncertainty

Kumba Iron Ore Ltd (JSE: KIO) fell 2.19% to ZAC 29,674 on Thursday after hitting resistance at ZAC 30,838, highlighting the fragile state...

Quick overview

- Kumba Iron Ore Ltd (JSE: KIO) experienced a 2.19% decline to ZAC 29,674 after facing resistance at ZAC 30,838, indicating a fragile state in South African equities.

- Despite the drop, KIO remains above its 50-period EMA and has support levels at ZAC 29,248, but a shooting star candlestick raises short-term concerns.

- Macro pressures, including rising bond yields and currency stability, are affecting Kumba's near-term outlook, while investor caution is increasing ahead of key economic reports.

- Kumba's strong balance sheet, with R14.9 billion in net cash and low debt, provides some cushion against rising financing costs despite a 43% year-on-year drop in EBIT.

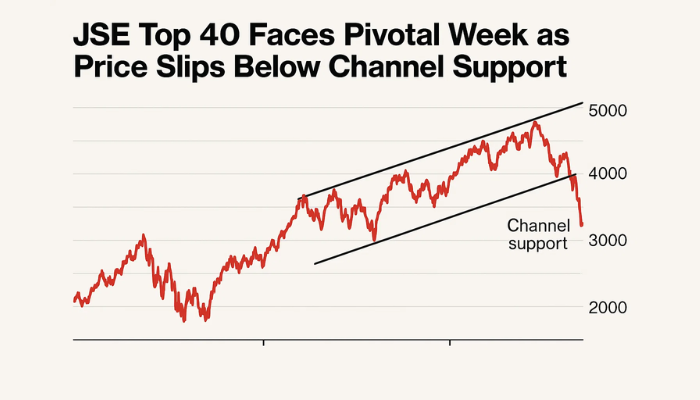

Kumba Iron Ore Ltd (JSE: KIO) fell 2.19% to ZAC 29,674 on Thursday after hitting resistance at ZAC 30,838, highlighting the fragile state of South African equities. The decline came despite an earlier rally that formed a textbook ascending channel with higher highs and higher lows, backed by strong institutional flows.

The technicals are cautiously optimistic. KIO is still above its 50-period EMA at ZAC 28,864 and has support at ZAC 29,248. But the shooting star candlestick at the upper channel boundary is a short-term worry. This candlestick is often a sign of exhaustion and could be a brief pullback before any new upside.

Momentum is slowing down with the MACD flattening out after the previous bullish crossover. For traders, it’s still a “buy-the-dip” opportunity. A pullback to ZAC 29,000-28,800 could be a good entry, as long as there’s bullish candlestick confirmation like a hammer or engulfing pattern.

Macro Headwinds Weigh on Stock

Beyond the technicals, macro pressures are starting to impact Kumba’s near-term outlook. Investor caution is rising on several fronts:

- US Jobs: Markets are waiting for the June NFP report which is expected to show 110,000 new jobs. A surprise here could impact Fed rate expectations and global flows.

- Bond Yields: South Africa’s 2035 government bond yield rose 1.5bps to 9.85%, indicating tighter domestic conditions. Higher yields could impact Kumba’s future borrowing costs, despite its strong balance sheet.

- Currency: The South African rand traded flat at 17.57/USD. A strong rand is good for stability but reduces export competitiveness, limiting upside for Kumba’s global sales.

Meanwhile, eyes are on the S&P Global whole-economy PMI release. While manufacturing is still weak, a broader rebound in business activity could support local equities.

Balance Sheet Still a Cushion

Despite the near-term pressure, Kumba is still financially strong. The company ended 2024 with R14.9 billion in net cash and just R2 billion in debt. Its free cash flow conversion is 66% of EBIT over the past three years, plenty of liquidity.But KIO’s earnings are still under pressure.

EBIT is down 43% year-on-year as of December 2024 and current liabilities are slightly above near-term assets. Still, the cash reserves give management some breathing room even if financing costs rise.

Quick Facts:

- KIO Price: ZAC 29,674, -2.19%

- Resistance: ZAC 30,838

- Support: ZAC 29,248 and 28,800

- SA Bond Yield (2035): 9.85% (+1.5bps)

- Rand/USD: 17.57

- NFP: 110,000 (June)

KIO may be cooling off in the short-term but the bigger picture is still intact. For traders and long-term investors, the next move will be determined in the coming days.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account