SA’s Top 40 Eyes 90,865 as Tariff Tensions Weigh on All Share Index

The FTSE/JSE All Share Index (JALSH) fell 0.39% on Monday, down 374.33 points to 96,808.38 ZAR as investors reacted to fresh geopolitical...

Quick overview

- The FTSE/JSE All Share Index fell 0.39% amid geopolitical tensions and trade policy uncertainty, particularly due to Trump's tariff threats on BRICS countries.

- South Africa's 2035 government bond yield increased as investors demand higher returns in the current climate of risk aversion.

- Despite record foreign exchange reserves, market sentiment remains negative due to unresolved trade talks and tariff concerns.

- The JSE Top 40 Index shows potential for a breakout if it surpasses key resistance levels, but volatility is expected as the July 9 deadline approaches.

The FTSE/JSE All Share Index (JALSH) fell 0.39% on Monday, down 374.33 points to 96,808.38 ZAR as investors reacted to fresh geopolitical jitters and trade policy uncertainty. The pressure came after former US President Donald Trump threatened a new 10% tariff on all BRICS countries. This follows the 31% import duty imposed in April which puts South African exporters in a tight spot.

With a July 9 deadline for trade talks looming, uncertainty is clouding the market. South Africa’s 2035 government bond yield jumped 9 basis points to 9.83% as investors demand more to hold local debt in this environment.

The South African rand also weakened against the US dollar as trade relations deteriorate. Trump’s comments over the weekend via social media removed any doubt that exemptions would be granted.

Trade Anxiety Saps Risk Appetite

Markets are getting cautious as tariff threats shift capital away from risk assets. Key factors spooking sentiment are:

- New 10% tariff threat: Adds to the existing 31% levy on SA imports

- Unresolved trade talks: No deal before July 9 deadline

- Investor pullback: Risk-off mood means no appetite for SA shares

South Africa’s trade team is asking for a tariff extension but markets are not convinced of a breakthrough at least in the short term.

Forex Reserves Hit Record, But Impact Is Limited

While the equity and currency markets are under pressure, South Africa’s foreign exchange reserves rose to a record $68.415 billion in June 2025 from $68.116 billion in May. This was driven by:

- Special Drawing Rights (SDRs): $6.524B

- Currency reserves: $48.652B

- Forward position: Slight gain to $0.532B

But a small decline in gold reserves – now at $13.239B – tempered the excitement. Although these numbers look good on paper, they haven’t changed market psychology as policy risk and global trade tension persists.

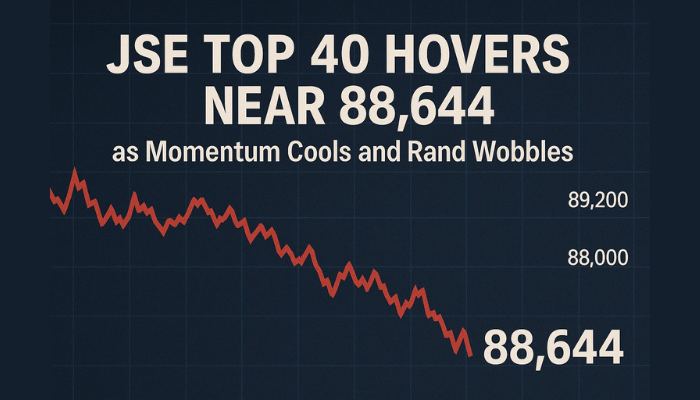

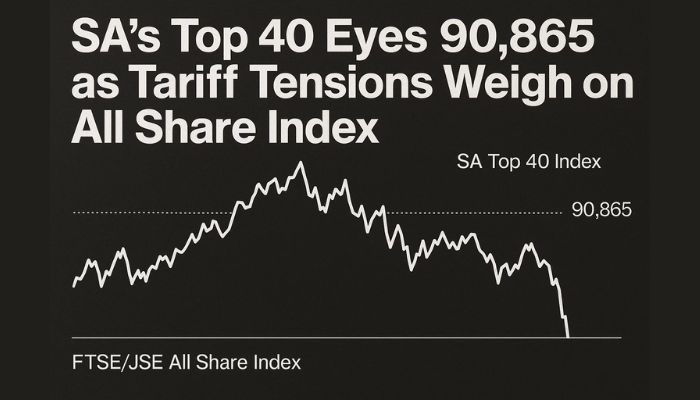

JSE Top 40 Analysis: Bulls Test ResistanceDespite the overall weakness, the JSE Top 40 Index is showing some strength. Price is still within a rising channel and approaching the key resistance at 89,573 ZAR. Technicals are bullish:

- Price above 50-SMA (88,661) confirms the trend

- RSI at 58 has room to run before overbought signals appear

- Support at 88,632 (mid-channel) and 87,941 below that

- Breakout target: 90,865 (upper channel resistance)

If the bulls can push through 89,573 with good volume, a breakout could accelerate to the 90,000-91,000 range. But if they fail to break resistance, we could see short-term pullbacks and buyers will be watching for confirmation.

Conclusion

South Africa’s markets are caught between macro and geopolitical winds. Record forex reserves provides some stability but US trade policy and tariff threats are driving the short term. With the Top 40 Index at resistance and the July 9 deadline looming, volatility will remain high in the coming days.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account