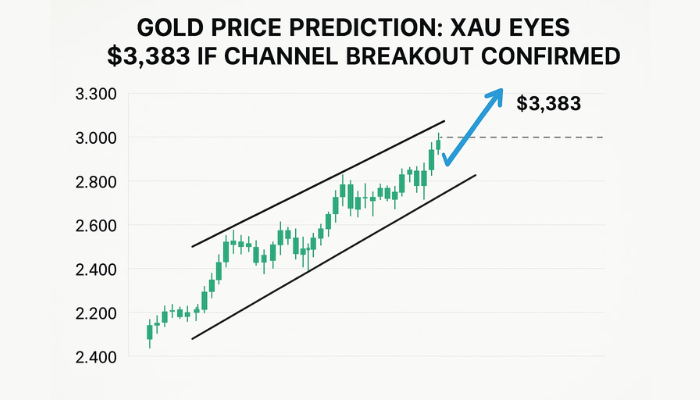

Gold Price Prediction: XAU Eyes $3,383 if Channel Breakout Confirmed

Gold steady at $3,321 as traders weigh softer dollar and falling yields against tariff concerns. President Trump upped...

Quick overview

- Gold remains steady at $3,321 as traders assess the impact of a softer dollar and falling yields amid tariff concerns.

- President Trump has announced significant tariffs on US copper imports and several other countries, effective August 1, raising trade disruption fears.

- The current price action of gold shows indecision, with resistance at $3,345 and potential for a breakout if momentum continues.

- Investors are weighing short-term rate paths against market reactions to tariffs, making gold a defensive investment in this uncertain environment.

Gold steady at $3,321 as traders weigh softer dollar and falling yields against tariff concerns. President Trump upped the ante this week with 50% tariff on US copper imports and 25-50% duties on Brazil, Japan, South Korea and 18 other countries. These tariffs take effect August 1 and are causing new trade disruption concerns.

Gold’s strength comes as the dollar index is down 0.2% and 10 year Treasury yields are easing from recent highs. With yields falling the opportunity cost of holding gold goes down and demand for the non-yielding asset increases. The latest Fed minutes add to the uncertainty—only “a couple” of officials saw rate cuts in July and most leaned towards later action due to inflation risk from tariffs.

Investors are now split between short term rate path and market fallout from the tariff announcements. In this environment gold is a defensive play.

Gold Technical Outlook: $3,345 in Sight

On the chart gold (XAU/USD) is stuck in a descending channel with price testing the upper boundary at $3,321. The 50 period SMA at $3,318 is acting as dynamic resistance—a level that has rejected multiple bullish attempts.

The current price action of gold is weak with small bodied candles and upper wicks forming at key resistance. This is indecision but the RSI at 56 shows bulls still have momentum.

A breakout above $3,345 would be a clean break of the channel and could see $3,365 or higher. Until then the channel is in play.

Key Levels:

- Resistance: $3,345.84, $3,365.92

- Target: $3,383.17

- Support: $3,318 (SMA), $3,306.94

- Deeper Support: $3,284.36, $3,259.58

Trade Setup: Breakout or Rejection?

Gold is at a decision point—and wait for confirmation. The channel’s upper boundary has capped price multiple times. But with RSI rising and the dollar falling this resistance may not hold for long.

Scenario 1: Breakout

- Entry: Above $3,346 with volume

- Stop: $3,318

- Target: $3,365.92, $3,383.17

Scenario 2: Fade the Rejection

- Entry: Bearish candle at $3,345

- Stop: $3,346

- Target: $3,306.94, $3,284.36

In my experience descending channels often break to the upside especially when price makes higher lows at resistance. But don’t get in early. Without a close above $3,346 it’s still 50/50.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account