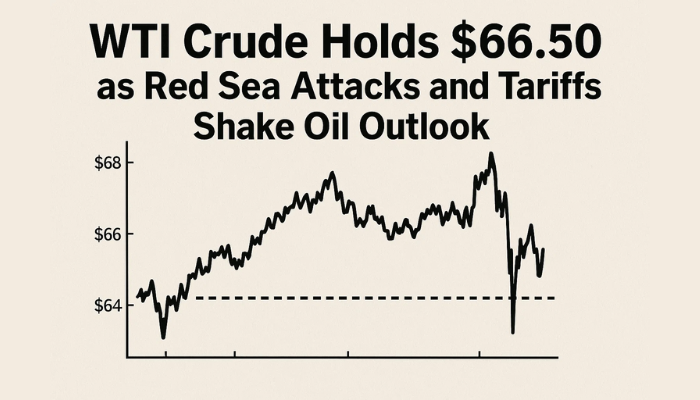

WTI Crude Holds $66.50 as Red Sea Attacks and Tariffs Shake Oil Outlook

WTI crude oil futures climbed back above $67 on Friday, paring earlier losses as a wave of geopolitical and macroeconomic events reshaped...

Quick overview

- WTI crude oil futures rose above $67 after earlier losses, driven by geopolitical tensions and macroeconomic factors.

- Escalating conflicts in the Red Sea and U.S. tariff threats have raised concerns about global oil demand and supply disruptions.

- OPEC has revised its medium-term demand forecast downwards, anticipating slower consumption from China.

- Traders are advised to watch for a breakout above $67.68 for potential bullish momentum, while a failure to do so could lead to further declines.

WTI crude oil futures climbed back above $67 on Friday, paring earlier losses as a wave of geopolitical and macroeconomic events reshaped trader sentiment. The rebound follows escalating tensions in the Red Sea, where Houthi strikes reportedly sank two commercial vessels this week—fueling renewed supply disruption fears across global shipping lanes.

Meanwhile, the broader market is digesting another round of U.S. tariff threats. President Trump announced a 35% duty on Canadian imports effective August 1, with a wider 15–20% blanket tariff looming over other trade partners. These measures, though aimed at political leverage, have raised concerns about slower global growth—likely weighing on oil demand into Q3 and beyond.

Adding to the mix, OPEC trimmed its medium-term demand forecast. The group now projects 2026 global oil demand at 106.3 million barrels per day, down from the prior 108 million bpd outlook, mainly due to slower Chinese consumption. Traders are also speculating OPEC may halt its planned output hikes beyond October—suggesting the cartel sees limited headroom for more supply under current macro conditions.

WTI Attempts Rebound After Channel Breakdown

Technically, WTI crude (USOIL) is in a recovery phase after sliding out of its rising price channel. After peaking above $70 earlier this month, price action has pulled back to the $66.80 level—right around a key demand zone dating back to late June.

The 50-period SMA on the 2-hour chart, now sitting at $67.68, has become a dynamic resistance area. Reclaiming this level could mark a turning point. With volume thinning and sellers losing steam near $66.50, momentum is starting to stabilize.

RSI is 38 which is oversold zone often a short term bounce. Close above $67.68 can validate the breakdown and setup a move to $68.89 and $70.02.

Key Technical Highlights:

- RSI sits near 38.06, close to oversold

- $66.54 acting as immediate support zone

- 50-SMA resistance capped past rebound attempts

- Watch for volume confirmation on any breakout

WTI Crude Oil (USOIL) Trade Setup: Watch for a Break Back Above $67.68

At current levels crude is at a crossroads. For traders the most actionable trade is a structure confirming breakout above $67.68. That would be a bounce off oversold RSI and a move back to the mid-$68s.

But if price fails to clear that level convincely the risk of deeper correction remains. Below $66.54 would likely mean $65.54 or $64.43 in the next few days.

Trade Setup (Breakout Recovery Play):

- Entry: Bullish candle close above $67.68

- Stop-loss: Below $66.50 support

- Targets: $68.89 and $70.02

In my experience these channel breakdown retests can go either way—but when paired with macro events like tariffs or shipping shocks the setup becomes more directional. I’ll be watching EIA inventory and fresh headlines from the Middle East to guide the next move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account