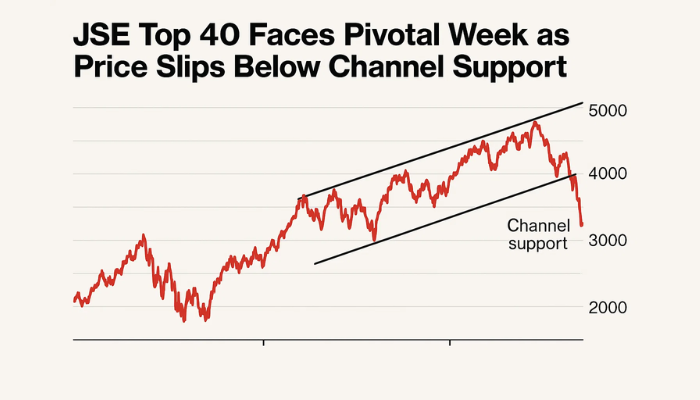

JSE Top 40 Faces Pivotal Week as Price Slips Below Channel Support

The South Africa JSE Top 40 Index ended the week at 89,194.5, down 0.19% by Friday’s close. After weeks of steady gains the index...

Quick overview

- The South Africa JSE Top 40 Index closed the week at 89,194.5, down 0.19%, breaking below its ascending channel.

- The index's pullback is attributed to waning momentum amid lackluster economic growth and rand resilience.

- Key support levels to watch are 88,713 and 88,526, with a potential bearish phase if the index falls below 87,347.

- The outlook for the upcoming week is neutral to bearish, dependent on local data and global risk sentiment.

The South Africa JSE Top 40 Index ended the week at 89,194.5, down 0.19% by Friday’s close. After weeks of steady gains the index broke below its ascending channel—a structure that had supported the rally since late June. This break suggests uncertainty ahead of the July 15–19 trading week.

The pullback is due to waning momentum as traders weigh lacklustre economic growth against rand resilience. Thursday’s brief break of 90,246 was not sustainable and the index fell towards its 50-period SMA—a level to watch.

JSE Key Support Zones

Technically the 88,713 support level defined by the 50-period SMA is now the last line of defence before deeper losses. A break below this could see 88,526 and 87,941—two previous swing areas. The RSI is at 49.09 just below the middle and is neutral with a bearish bias.

If the bulls can’t hold 88,713–88,526 the next level of support is 87,347. A fall to that level would confirm a short-term bearish phase.

What to watch:

- Close above 89,470 → Re-enters prior uptrend

- Break below 88,526 → Opens 87,347

- RSI below 45 → Bearish

JSE Weekly Outlook: Neutral to Bearish

The JSE’s technicals are neutral to bearish for the July 15–19 week. We expect consolidation or a mild correction unless the bulls can get back above 89,470. A close above that level could see 90,246 and 90,865.

But with economic growth slow and business confidence low the broader market direction will depend on fresh local data and global risk sentiment. For now it’s up to the buyers to prove the rally is over.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account