Bitcoin Price Prediction: BTC Eyes $150K on ETF, 401(k) Reform, Treasury Demand

Despite persistent macroeconomic uncertainty and recent corrections, Bitcoin continues to defy expectations, reclaiming ground above $120K..

Quick overview

- Bitcoin has reclaimed ground above $120,000, with over 93% of holders currently 'in the money', indicating strong long-term positioning.

- After a significant retracement earlier in 2025, Bitcoin bounced off the 50-week SMA near $75,000 and reached a new peak of $123,000 in July.

- Institutional demand remains robust, with record inflows into Bitcoin-backed funds and forecasts of over $15 billion in corporate BTC purchases.

- President Trump's upcoming executive order could expand retirement fund access to Bitcoin, potentially reshaping long-term demand and capital allocation.

Live BTC/USD Chart

Despite persistent macroeconomic uncertainty and recent corrections, Bitcoin continues to defy expectations, reclaiming ground above $120,000 and reaffirming its dominance in the digital asset market.

Price Action: Bitcoin Holds Strong Near $120K

Bitcoin (BTC) continues to attract demand even after facing volatile pullbacks earlier in the year. It surged past $120,000 last week and remains well-supported just under that level. IntoTheBlock data indicates that over 93% of BTC holders are currently “in the money,” a testament to the market’s robust long-term positioning.

Bitcoin Chart Weekly – MAs Have Turned Into Support

After a steep retracement earlier in 2025—briefly breaking below $100,000—Bitcoin regained upward momentum, bouncing off the 50-week simple moving average (SMA) near $75,000. This technical rebound, paired with renewed market optimism, triggered a price rally that sent Bitcoin to a new peak of $123,000 in July.

Market Cap & Technicals Signal Strength

In May, Bitcoin’s market capitalization exceeded $2.3 trillion, contributing to a total crypto market cap of nearly $4 trillion. While geopolitical risks and regulatory pressures caused a temporary dip in June, buyers stepped back in near the 20-week SMA, reigniting upward momentum. Since then, the technical structure has remained bullish, with accumulation patterns suggesting potential for another leg higher.

Bitcoin is currently consolidating just below overhead resistance at $123K. A sustained break above this zone could pave the way for a move toward $150,000 in the coming weeks, especially as macro catalysts and institutional flows remain supportive.

Institutional Demand Fuels Optimism

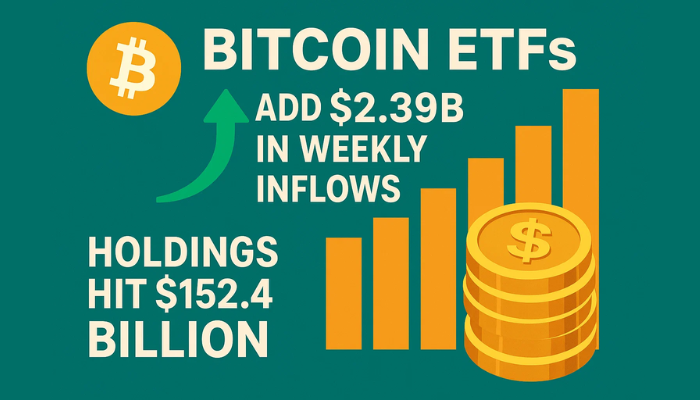

On July 18, U.S. spot Bitcoin ETFs recorded a net daily inflow of $363.45 million, marking the 12th consecutive session of inflows. Crypto investment products saw a $3.7 billion weekly inflow recently—the second-largest on record—pushing global assets under management (AUM) to a record $211 billion. Of this, Bitcoin-backed funds account for 85%, underscoring BTC’s dominance as the preferred institutional crypto asset.

Furthermore, businesses are increasingly adding Bitcoin to their treasuries. Forecasts suggest over $15 billion in corporate BTC purchases are in the pipeline, far outpacing first-half ETF inflows and pointing to a broader adoption wave.

President Trump’s Executive Order Could Unlock New Demand

Adding to the bullish narrative, US President Trump is expected to sign a sweeping executive order this week. The directive aims to expand retirement fund access to alternative investments, including Bitcoin, gold, private equity, and infrastructure assets. Specifically, the order will instruct regulators to examine restrictions that 401(k) managers face when offering such options to participants.

This initiative could mark a pivotal shift in long-term demand, opening the door for mainstream retirement portfolios to gain exposure to Bitcoin—a move that could dramatically reshape capital allocation over the coming years.

Bitcoin Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account