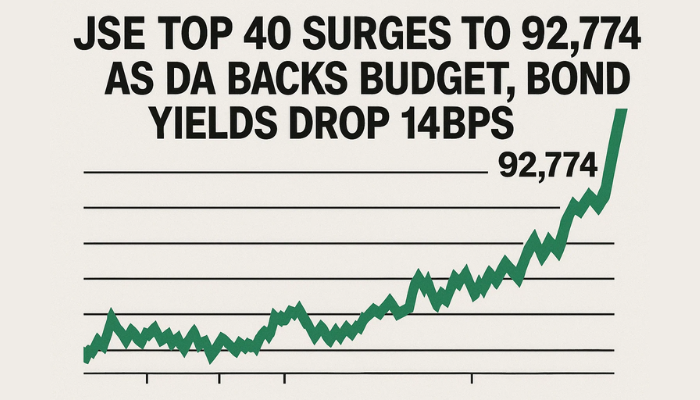

JSE Top 40 Surges to 92,774 as DA Backs Budget, Bond Yields Drop 14bps

SA’s financial markets rallied on Thursday after the Democratic Alliance (DA), the country’s second-largest party

Quick overview

- SA's financial markets rallied after the Democratic Alliance supported the Appropriation Bill following the removal of a controversial minister.

- The JSE Top 40 Index rose 1.05%, indicating restored confidence in the government's fiscal direction.

- The rand strengthened and bond yields fell, reflecting increased demand for domestic debt amid reduced political friction.

- Markets are currently focused on political clarity rather than lagging economic data, signaling a potential for stability.

SA’s financial markets rallied on Thursday after the Democratic Alliance (DA), the country’s second-largest party, publicly supported the long-overdue Appropriation Bill. This shift in political alignment came after President Cyril Ramaphosa removed a controversial minister facing misconduct allegations—a key DA condition. The move eased tensions in the ruling coalition and restored confidence in the government’s fiscal direction.

Equity investors welcomed the news, sending the JSE Top 40 Index up 1.05%, or 1,041.72 points, to a fresh multi-week high. After weeks of uncertainty caused by political infighting and legislative delays, this is a sign of fiscal cohesion—a essential ingredient for long-term investment in SA assets.

Rand Up, Bonds Rally Despite Weak Data

The rand also rose 0.1% to 17.6050 per US dollar by 15:15 GMT. Traders see the DA’s budget support as near-term policy stability, which tends to reduce risk premiums in emerging markets. Morgan Stanley also upgraded its outlook on SA government bonds, citing “reduced political friction” and potential capital inflows.

Meanwhile, bond yields reflected increased demand for domestic debt. The 2035 government bond yield fell 14 basis points to 9.845%, even as the SA Reserve Bank’s leading business cycle indicator declined 1.3% in May for the second month in a row.

Rather than reacting to lagging data, markets are looking ahead to progress.

Technical Chart: JSE Top 40 Eyes Breakout Above 92,774

From a technical perspective, the JSE Top 40 Index broke out of its rising channel this week, above previous resistance at 91,158.5. It hit an intraday high of 92,780 but is currently consolidating below immediate resistance at 92,774.8.

- Support: 91,158.5 and 50-SMA (90,337.6)

- Momentum: RSI at 65.28, overbought

- Trend: Higher highs and higher lows intactA breakout above 92,774.8 could see the next targets at 93,552.9 and 94,288.3. But failure to get above the current resistance could see a pullback to the channel or the 50-SMA.

Look out for:

- Bullish: 92,774 → 93,552.9 / 94,288.3

- Short-term reversal: Rejection at resistance → 91,158.5 / 90,337.6

This week’s move shows how SA markets are reacting more to political clarity than data. For now, stability is the buy signal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM