Ethereum Shows Resilience Above $3,800 as Corporate Treasuries Drive Long-Term Demand

Ethereum (ETH) is still strong above the important $3,800 barrier. It has stayed stable in recent trading sessions, even if the rest of the

Quick overview

- Ethereum remains strong above the $3,800 level, showing stability amidst market volatility.

- Institutional interest in Ethereum is growing, with companies like BitMine and Sharplink Gaming making significant investments.

- The tokenization of real-world assets on Ethereum is expanding, with platforms like eToro integrating popular US equities as ERC-20 tokens.

- On-chain metrics indicate genuine demand growth for Ethereum, supported by decreasing supply and increasing DeFi activity.

Ethereum ETH/USD is still strong above the important $3,800 barrier. It has stayed stable in recent trading sessions, even if the rest of the market has been volatile. After a huge 60% rise in July, the world’s second-largest cryptocurrency has gotten a lot of attention. It went from about $2,400 to highs near $3,940 by the end of July.

ETH Corporate Treasury Strategies Signal Long-Term Confidence

The institutional landscape for Ethereum is changing quickly, with big public firms starting to build up their ETH holdings in strategic ways. BitMine Immersion, which is currently Ether’s largest publicly traded holding, has announced a $1 billion stock repurchase scheme instead of continuing to buy ETH right away. BitMine’s strategic halt makes sense given the current state of the market, since its shares are trading below the company’s net asset value of $22.76 and it has 625,000 ETH and 192 Bitcoin.

Chairman Tom Lee said that the company is dedicated to eventually getting 5% of Ethereum’s entire supply. He called Ether “the most important macro trade for the next decade.” The company’s choice to focus on share buybacks instead of quickly getting more ETH shows that they are carefully trying to maximize value at these pricing levels.

Sharplink Gaming, on the other hand, has been rapidly expanding its investment. It just bought an extra 77,209.58 ETH, bringing its total holdings to 438,190 ETH, which is worth over $1.6 billion. This battle amongst companies shows that more and more institutions are starting to see the long-term worth of Ethereum.

Standard Chartered Bank says that since June, public firms have bought 1% of all ETH in circulation. Analyst Geoffrey Kendrick says these treasury companies are “just getting started” and might grow tenfold from where they are now.

Real-World Asset Tokenization Drives Ecosystem Growth

Ethereum’s usefulness as a tokenization platform keeps growing, and big financial platforms are adopting the network to connect real-world assets. eToro said it would issue the 100 most popular US equities as ERC-20 tokens on Ethereum. This would allow trading 24/5 and integration with DeFi. This change comes after Robinhood and Backed Finance did something similar, which brought hundreds of tokenized equities to blockchain rails.

The current market size for tokenized stocks is $418 million, which is part of the larger $21.3 billion RWA market. This suggests that there is a lot of room for growth as traditional finance continues to integrate blockchain technology.

Ethereum’s On-Chain Metrics Confirm Genuine Demand Growth

People thought that Bitcoin-to-Ethereum rotation was going to happen, but on-chain analysis shows that ETH’s rise is due to new money coming in, not reallocation. On July 25, Bitcoin’s Realized Cap hit a new all-time high of $1.018 trillion. This shows that BTC is still being bought and that ETH is still growing.

Ethereum’s fundamentals reveal that demand is growing across a number of indicators. The total value locked in DeFi protocols went from $49 billion in late April to $84.6 billion by July 29. On July 27, daily transactions were close to 1.48 million. Also, liquid staking is at an all-time high, with 35.5 million ETH now locked in staking protocols. This is making it harder to get supplies.

The amount of ETH in exchange reserves has gone down by one million over the previous month. This supports the growing “supply crunch” story, which says that institutional demand is going up while the amount of ETH in circulation is going down.

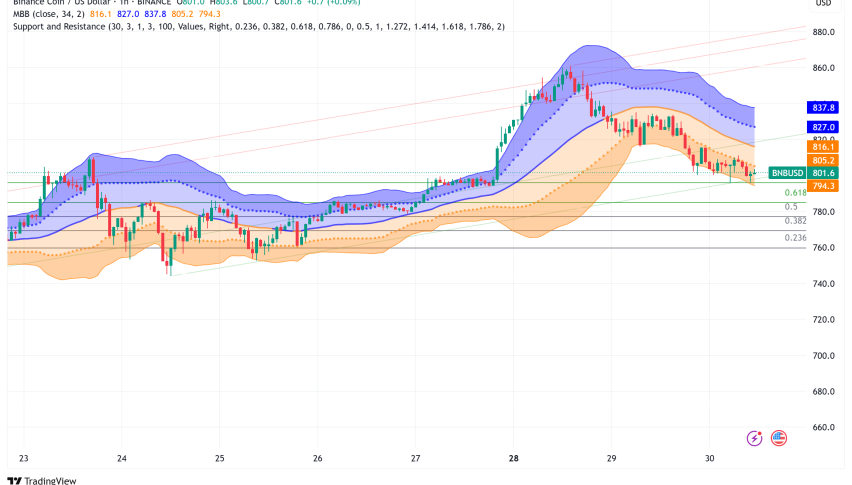

ETH/USD Technical Analysis Points to Consolidation Above Key Support

From a technical point of view, Ethereum is having trouble at $3,840, although it is getting support around $3,720 from the 50% Fibonacci retracement level. The price movement implies that the market is consolidating above the $3,800 barrier, which is essential for the mind. The 100-hourly moving average also provides more technical support.

$3,880 and the latest high near $3,940 are two important resistance levels. A strong break above $3,940 could aim for the $4,000 psychological barrier and maybe even $4,120 in the near future. On the other hand, if support doesn’t stay above $3,720, it might lead to a retest of $3,680 and lower support zones.

Ethereum Price Prediction: Bullish Outlook Supported by Fundamentals

Ethereum looks like it will keep going higher because of the confluence of institutional accumulation, more real-world use cases, and stronger on-chain measures. The combination of corporate treasury acceptance, tokenization growth, and supply limits makes it a good time for prices to go higher.

If institutional demand picks up, ETH might test $4,200 to $4,400 in the next few weeks. If not, it could challenge $4,000. But the price of Bitcoin in the short run will probably depend on how the rest of the market is doing.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account