South Africa August 2025 Fuel Price: Relief on Unleaded, While Diesel Goes Up Again

The Central Energy Fund (CEF) has released its latest month‑end data, signaling a mixed outlook for fuel prices in South Africa as petrol...

Quick overview

- The Central Energy Fund reports a mixed outlook for South African fuel prices, with petrol expected to decrease while diesel prices rise.

- Geopolitical tensions, particularly between Israel and Iran, have influenced recent fluctuations in international crude oil prices.

- August is projected to bring a decrease in petrol prices, with 95 unleaded dropping by 29 cents per litre, while diesel prices are set to increase by up to 66 cents per litre.

- Despite temporary relief for petrol users, ongoing geopolitical and domestic tax pressures suggest continued volatility in fuel costs.

The Central Energy Fund (CEF) has released its latest month‑end data, signaling a mixed outlook for fuel prices in South Africa as petrol is set to drop while diesel costs continue to rise.

After 2 weeks of geopolitical tension and volatile energy markets, South African motorists are finally seeing signs of relief in fuel prices, albeit tempered by lingering policy and tax pressures.

Geopolitical Impact on Fuel Prices

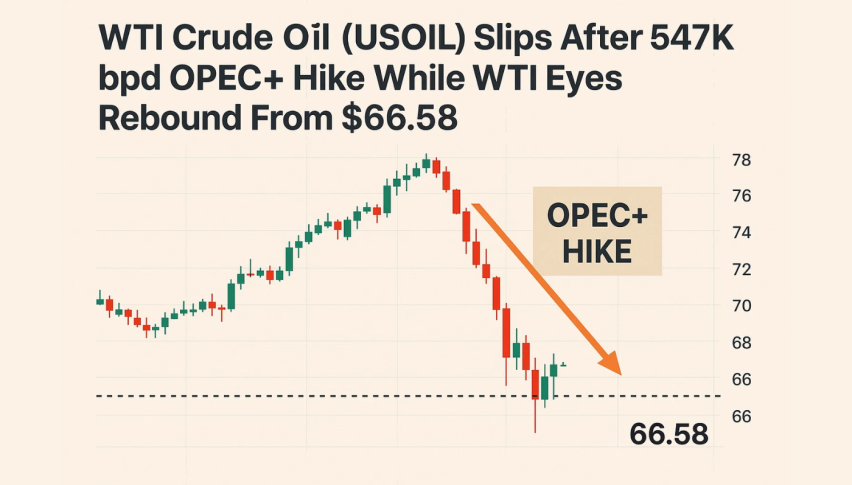

The brief but intense Israel-Iran confrontation in July 2025 prompted a spike in international crude oil prices, touching $80 in late June while in late July we saw another spike to $70 per barrel. The June spike allowed local authorities to justify raising fuel prices in July, despite public frustration over soaring food and service costs over the last three years, and they’re increasing diesel prices again in August, while lower unleaded prices.

WTI Crude Oil Chart Weekly – The Main trend Remains Bearish

Stabilization Brings Temporary Relief

With tensions easing between Iran and Israel, global fuel prices have stabilized, contributing to August’s projected price reductions for petrol in South Africa. Early estimates suggest that the period of emergency price hikes may be over for now, giving motorists a small window of relief.

South African Fuel Price Forecast for Month-End

Petrol Price Projections

Price Decrease Expected:

- 95 Unleaded: Down 29 cents per litre

- 93 Unleaded: Down 33 cents per litre

Expected Retail Prices

- 95 ULP: Around R20.79 at the coast and R21.58 in Gauteng

- 93 ULP: Expected to retail at R21.46 in Gauteng

Context:

This decline comes after July’s increases of up to 55 cents, providing some relief for motorists following a volatile month for fuel costs.

Diesel Price Projections

Price Increase Expected:

- 50ppm: Up 63 cents per litre

- 500ppm: Up 66 cents per litre

Predicted Wholesale Prices:

- 50ppm: Around R19.28 at the coast and R20.04 inland

Background:

- Diesel’s upward trend follows July’s hike of up to 84 cents, reflecting continued global market pressures and local demand for freight and industry.

Market Context and Drivers

- International Oil Prices: Recent softness in crude prices has eased petrol costs but diesel remains elevated due to higher global distillate demand.

- Currency Movements: The rand’s relative stability has prevented even sharper fuel increases.

- Seasonal Demand: The transport and agriculture sectors typically keep diesel consumption high, maintaining upward pressure on wholesale prices.

Caution on Future Pricing

The Department of Mineral Resources has cautioned that these are preliminary estimates. Additional factors, including the June 2025 fuel tax implemented by the Finance Minister, could influence the final adjustments due on Wednesday. This means that any relief at the pump could be partially offset by ongoing fiscal measures.

Conclusion

While August offers some reprieve for petrol users, the long-term outlook remains fragile, as both geopolitical shocks and domestic tax policies continue to shape South Africa’s fuel costs. Consumers should brace for ongoing volatility, even as the immediate pressure eases.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account