Euro Slides Amid Fed Shakeup: EUR/USD Forecast Sees Triangle Break in Play

The EUR/USD pair fell from its one week high above 1.1700 to 1.1635 in the European session on Friday as the US Dollar staged a small bounce

Quick overview

- The EUR/USD pair declined from a one-week high of 1.1700 to 1.1635 due to a rebound in the US Dollar and mixed economic data.

- Political developments, including potential changes in Fed leadership and upcoming meetings, are influencing market sentiment and expectations for monetary policy.

- US Initial Jobless Claims rose unexpectedly, while productivity data missed estimates, adding to uncertainty about a potential Fed rate cut.

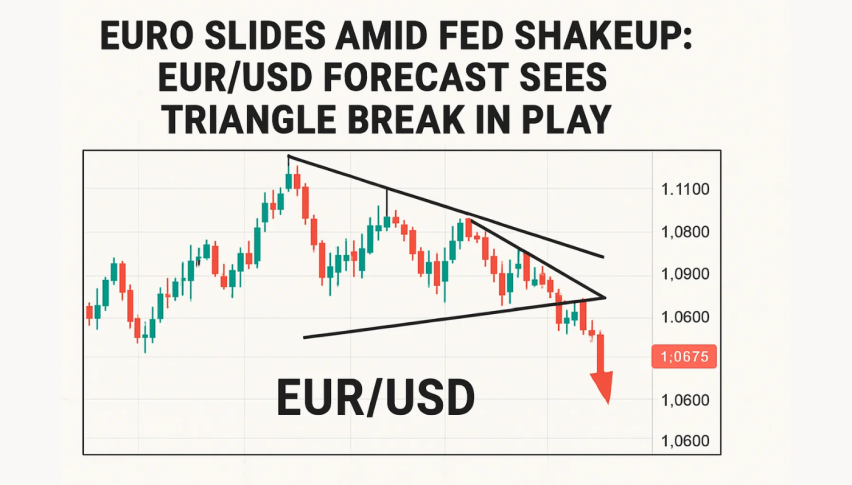

- The EUR/USD is currently consolidating in a symmetrical triangle, with key resistance at 1.1686 and support at 1.1610, indicating potential bullish or bearish scenarios.

The EUR/USD pair fell from its one week high above 1.1700 to 1.1635 in the European session on Friday as the US Dollar staged a small bounce. The move was driven by a mix of political intrigue in Washington and new economic data that had traders rethinking the chances of a Fed rate cut.

Bloomberg reported Thursday that Fed Governor Christopher Waller is the top candidate to replace Jerome Powell as Fed Chair. Waller was appointed during Donald Trump’s first term and is a rate cutter but is well respected in the financial community so his appointment wouldn’t hurt the Fed’s credibility. Also in the mix is Stephen Miran, current Chair of the Council of Economic Advisors, who will get a Fed board seat by January and will have a vote in the September, October and December meetings. Analysts see Miran’s selection as aligned with Trump’s push for a more accommodative monetary policy.

On the data front, US Initial Jobless Claims rose to 226,000 last week, above expectations of 221,000 and the prior reading of 218,000. Second quarter Nonfarm Productivity increased 2.4% missing estimates, while Unit Labor Costs rose 1.6% just above estimates but still moderate. Atlanta Fed President Raphael Bostic said the risks to the labor market are rising but it’s too early to commit to a September cut.

Geopolitical sentiment also played in. News that Trump will meet with Russian President Vladimir Putin next week has given the market hope for a Ukraine peace deal – a development that could give the Euro a small boost in the coming days.

EUR/USD Technical Outlook – Triangle Pattern at a Crossroads

EUR/USD is consolidating in a symmetrical triangle and is holding above the rising trend line from the August 1 low. The pair is above the 50-EMA (1.1609) and 100-EMA (1.1610) so short term momentum is still slightly bullish despite the recent pullbacks.Price action is showing a series of higher lows against the descending resistance at 1.1686. A break above this level could open up the move to 1.1718 and then 1.1777. A close below the trend line at 1.1610 would likely trigger a move to 1.1533 and then 1.1481.

The RSI has dropped from 60 to test the 50 line, a key area for short term direction. The MACD histogram is narrowing after a small correction.

EUR/USD Trade Setup – Clear Bullish and Bearish Scenarios

For traders:

- Bullish case: Close above 1.1686 on strong volume and it’s a breakout, targets 1.1718 and 1.1777. Stop below 1.1608 to limit downside risk.

- Bearish case: Break below 1.1610 and it’s lower, 1.1533 and 1.1481 are the supports. Stops above 1.1650.

This is an asymmetric setup: a tight risk range with a big move, purely technical, EMA aligned and momentum based.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account