GBP/USD Holds on 1.3450 Gains as Fed & BoE Moves Shape Market

The pound held near three-day highs around 1.3450 against the dollar Friday, as rate expectations from the Federal Reserve and Bank...

Quick overview

- The pound is trading near three-day highs around 1.3450 against the dollar, influenced by changing rate expectations from the Fed and BoE.

- Traders are anticipating a 25-bp cut from the Fed in September, while the BoE recently cut rates by 25bp to 4% amid inflation concerns.

- Recent US economic data showed a rise in initial jobless claims and productivity growth slightly below expectations, impacting market sentiment.

- GBP/USD is testing resistance at 1.3462, with potential bullish and bearish scenarios depending on price action and volume.

The pound held near three-day highs around 1.3450 against the dollar Friday, as rate expectations from the Federal Reserve and Bank of England changed. Traders are now pricing in a 25-bp cut from the Fed in September, after news that Stephen Miran, a Trump economic adviser, may join the Fed board. Meanwhile Bloomberg reports Fed Governor Christopher Waller is being considered as Powell’s successor, despite his dovish lean.

On the other side of the Atlantic, the BoE cut rates by 25bp to 4% with a 5-4 vote. The tight margin sparked pressure but also tempered expectations for further easing, with markets only pricing in 17bp of cuts through year-end.

Economic Signals Shaping Sentiment

Recent US data added fuel to the fire:

- Initial jobless claims rose to 226K vs 221K forecast.

- Q2 productivity grew 2.4% vs 2.5% expected.

- Unit labor costs rose 1.6% vs 1.5% expected.

BoE Governor Andrew Bailey warned of inflation risks from food and energy, while boosting one-year inflation projections to 2.7% from 2.4%. UK rate guidance remains “gradual and cautious” and traders wait for Huw Pill’s comments later today.

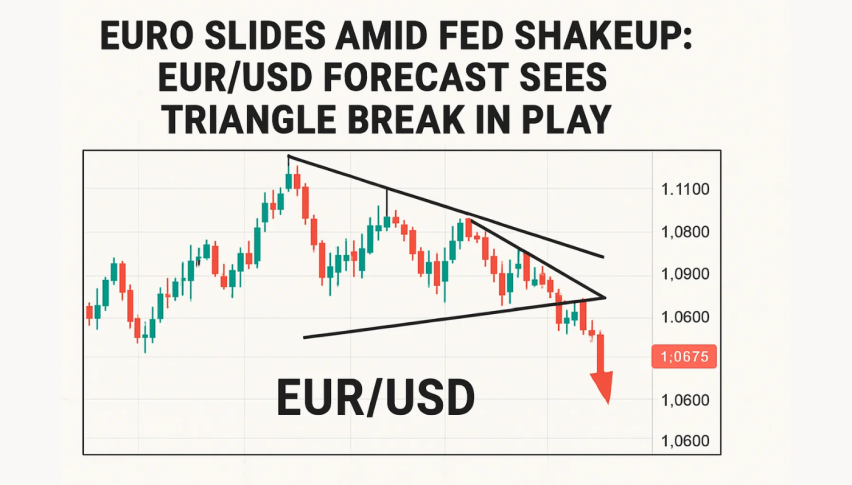

GBP/USD Technical Setup: Break or Bounce?

GBP/USD is testing resistance at 1.3462 after bouncing from 1.3218. The chart shows a steady series of higher lows, with a 50-period SMA at 1.3340. But price action has produced smaller candles recently – no reversal pattern – and RSI is near 68, overbought. MACD is slightly positive but flattening.

Here’s what to watch:

- Bullish trigger: A clean break above 1.3462 on good volume could reach 1.3514, then 1.3586. Stop-loss: below 1.3402.

- Bearish scenario: A rejection here, especially with a bearish candle, could pull back to 1.3345 or 1.3281. Stop: above 1.3480.Clean squeeze.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account