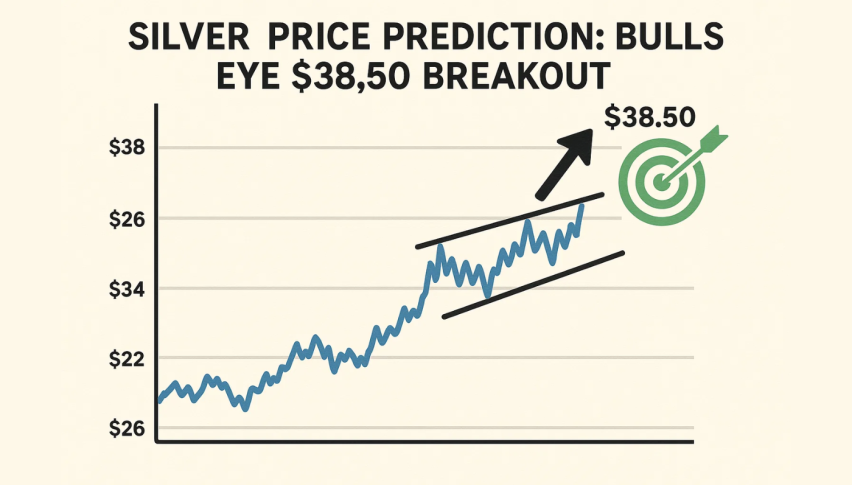

Silver Price Prediction: Bulls Eye $38.50 Breakout

Silver is trading at $38.41 after a steady climb from the August lows, approaching the $38.50 resistance...

Quick overview

- Silver is currently trading at $38.41, approaching the key resistance level of $38.50 after a steady uptrend from August lows.

- The recent price action has reclaimed the 50-period SMA at $38.05, which is now acting as support, indicating bullish momentum.

- A confirmed breakout above $38.50 could lead to targets of $39.05 and $39.53, while failure to break this level may result in a pullback to $37.50.

- Macro factors such as a weaker dollar or Fed rate cut expectations could influence silver's price movement in the near term.

Silver is trading at $38.41 after a steady climb from the August lows, approaching the $38.50 resistance. The metal has been on an uptrend from the July low, with recent price action reclaiming the 50-period SMA at $38.05 which is now acting as support. The structure shows a series of higher lows, despite periods of consolidation.

The RSI is at 66.43, not yet overbought. The MACD has turned positive, with the MACD and signal lines both rising – buyers are in control and momentum is increasing.

Breakout or Pullback?

The next test for bulls is the $38.50 horizontal resistance which has capped previous rallies. A confirmed break above this level could see $39.05 and $39.53, levels not seen since July.

Key levels to watch:

- Resistance: $38.50, $39.05, $39.53

- Support: $38.05, $37.95, $37.50

If the rally stalls the first support is the 50-SMA at $38.05 then the trendline at $37.95. A break below these levels would expose $37.50 and shift short term momentum to the sellers.

Silver (XAU/USD) Trade Setup and Market Context

From a trading perspective silver’s chart is a clean setup for breakout traders. The trendline, bullish momentum and proximity to a well defined resistance level make for a high watch scenario for a volatility expansion.

For a bullish scenario look for a daily close above $38.50, targeting $39.05 and $39.53, with stop loss below $38.05 to limit the downside.

For a bearish scenario failure to break $38.50 and a close below the trendline at $37.95 could see a pullback to $37.50 and $36.80.

Macro drivers could add fuel to either side. A weaker dollar and rate cut expectations from the Fed would typically be bullish for precious metals. A stronger than expected US data or hawkish Fed comments could see profit taking in silver after the recent rally.

In summary silver is at a crossroads – either it validates the breakout or sets up for another test of support before going higher. With bullish momentum and price action against a key resistance, get ready for a move, possibly with more volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account