Transcorp Share Price Record Rally Extends on Strong H1 Earnings and Dividend Declaration

Transcorp’s share price momentum shows no sign of slowing, as the company’s strong first-half 2025 results and a fresh interim dividend...

Quick overview

- Transcorp Hotels Plc has experienced a significant share price increase, gaining over 2,500 points since July 2023, with a peak of ₦180 following strong H1 2025 results.

- The company reported a 31.2% increase in net income to ₦8.679 billion and a 60% rise in revenue to ₦47.572 billion for the first half of 2025.

- Transcorp declared an interim dividend of ₦0.10 kobo per share, further boosting investor confidence and reinforcing its commitment to shareholders.

- Overall, Transcorp's strong financial performance and market position suggest continued upward momentum in its stock price.

Transcorp’s share price momentum shows no sign of slowing, as the company’s strong first-half 2025 results and a fresh interim dividend announcement boosted investor confidence.

Sustained Share Price Momentum

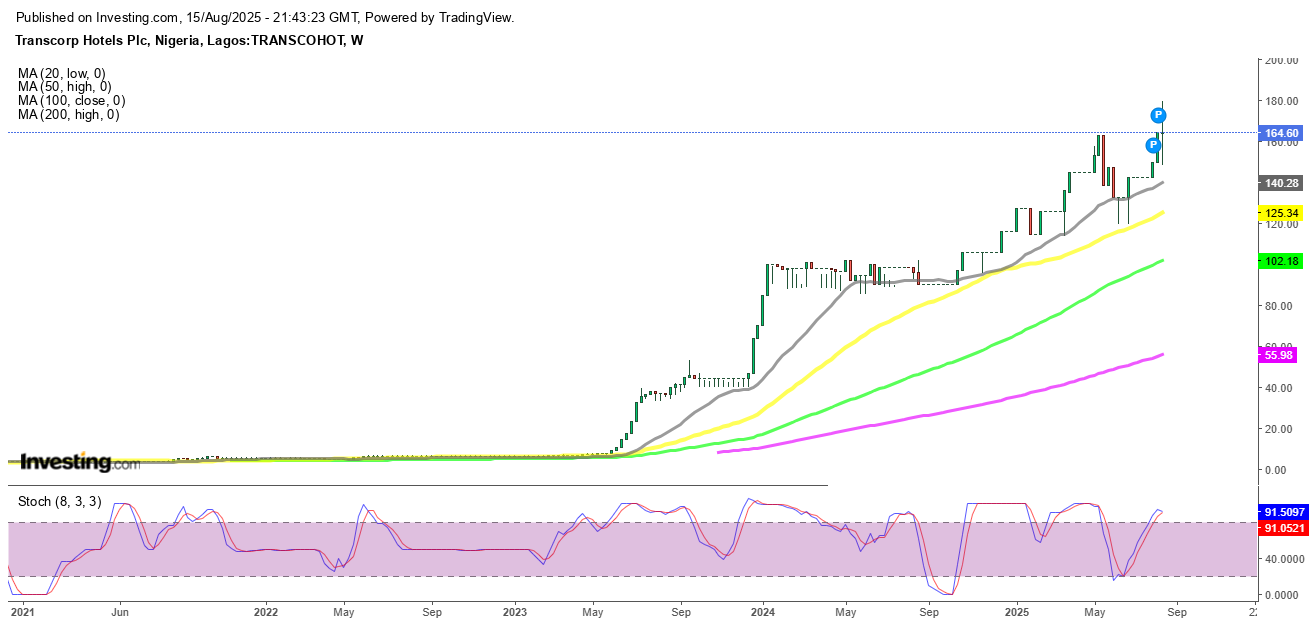

Since July 2023, Transcorp Hotels Plc has been on a steady upward climb, gaining over 2,500 points in just over a year. This rally gained fresh momentum in late July 2025 after the release of its interim results, which confirmed that the company’s fundamentals remain strong. Shares climbed to a new peak of ₦180 before ending the week at ₦164.60, rebounding sharply from a May low of ₦120.

Transcorp Chart Weekly – MAs Keeping the Price Well Supported

Earnings and Revenue Growth

For the first half of 2025, Transcorp Hotels reported net income of ₦8.679 billion, a 31.2% increase from ₦6.615 billion in H1 2024. Revenue also surged by 60% year-on-year, reaching ₦47.572 billion compared to ₦29.719 billion in the same period last year. This growth was underpinned by operational efficiency and strong demand, helping the company maintain its market leadership in the hospitality sector.

Transcorp Hotels Plc Delivered Strong H1 2025 Results

Transcorp Hotels Plc posted robust financial results for the first half of 2025, with strong growth in revenue, profit, and asset base, despite increased liabilities and higher capital investments.

Statement of Financial Position

- Total Assets: ₦153.46 billion (30 June 2025) vs ₦140.70 billion (31 Dec 2024)

- Total Liabilities: ₦70.79 billion, up from ₦60.18 billion at year-end

- Equity Attributable to Owners: ₦82.88 billion, compared to ₦80.72 billion at year-end

Statement of Comprehensive Income

- Revenue: ₦47.57 billion (H1 2025) vs ₦29.72 billion (H1 2024)

- Profit for the Period: ₦8.68 billion vs ₦6.62 billion in H1 2024

- Basic EPS: 85 kobo vs 65 kobo in prior-year period

- Operating Profit: ₦13.75 billion vs ₦12.13 billion in H1 2024

Statement of Cash Flows

- Cash from Operations: ₦10.69 billion (H1 2025)

- Investing Activities: Outflow of ₦4.43 billion (mainly PPE purchases)

- Financing Activities: Net outflow of ₦3.65 billion (loan repayments & dividends)

- Cash & Cash Equivalents (Period-End): ₦9.66 billion

Market Context and Investor Sentiment

The broader Nigerian Exchange (NGX) All-Share Index has also been in positive territory for the past four weeks, supported by increased investor positions in MTN Nigeria, Transcorp Hotels, and banking stocks. Market optimism was further fueled by expectations of strong Q2 earnings, which Transcorp Hotels ultimately delivered, reinforcing its appeal to institutional and retail investors alike.

Interim Dividend Announcement

Adding to the positive news, the company declared an interim dividend of ₦0.10 kobo per share for the first half of 2025. Eligible shareholders, as of August 8, will receive the payout, marking another milestone in the company’s commitment to rewarding its investors.

Conclusion: With record-breaking revenue growth, a significant boost in net income, and renewed dividend payments, Transcorp Hotels Plc has cemented its status as a key driver of market gains in Nigeria. As long as its strong fundamentals persist, the stock’s upward momentum could continue well into the coming quarters.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account