UnitedHealth Group Navigates Turbulent Waters as New CFO Takes Helm

As leadership changes and market pressures come together to test the strength of the Fortune 500 powerhouse, UnitedHealth Group, the largest

Quick overview

- UnitedHealth Group is undergoing significant leadership changes, hiring Wayne S. DeVeydt as CFO amid a challenging financial landscape.

- The company's market value has plummeted over 50% in the past year, exacerbated by lower-than-expected profits and the sudden resignation of CEO Andrew Witty.

- Warren Buffett's Berkshire Hathaway has invested $1.57 billion in UnitedHealth, boosting investor confidence despite ongoing industry challenges.

- Analysts believe DeVeydt's experience will be crucial in restoring trust and navigating the complexities of the healthcare sector.

As leadership changes and market pressures come together to test the strength of the Fortune 500 powerhouse, UnitedHealth Group, the largest healthcare firm in the US by revenue, is at a critical point. The company’s problems over the previous year have led to big changes at the top, including the hiring of Wayne S. DeVeydt as Chief Financial Officer, which will take effect on September 2.

UnitedHealth’s Leadership Overhaul Amid Financial Turbulence

UnitedHealth has a history of promoting people from inside, but the hiring of DeVeydt, who used to be the CEO of Surgery Partners and the managing director at Bain Capital, is a break from that. He takes over for John F. Rex, who has been CFO since 2016 and will now be a strategic advisor. This external recruitment comes at a time when the company’s market value has dropped dramatically, with shares dropping more than 50% in the past year.

In April, UnitedHealth’s first-quarter profits were much lower than Wall Street had expected, which caused the company’s market value to drop by more than $100 billion in only a few hours. The issue got worse when CEO Andrew Witty suddenly quit in May for personal reasons that were not made public. This led to the return of former CEO Stephen Hemsley to steady the ship.

Systemic Industry Challenges in Managed Care

Industry experts say that UnitedHealth’s problems are a sign of bigger problems in the managed care organization sector. Julie Utterback, a senior equities analyst at Morningstar, says that the whole industry is facing a big problem: healthcare expenses are going up faster than premiums, which makes the financial situation untenable.

Utterback says, “The medical cost ratio among the six major MCOs tracked by Morningstar is expected to be more than 450 basis points higher in 2025 than in the previous decade.” This difference between rates and medical use started to hurt Medicare Advantage programs in late 2023, extended to Medicaid by mid-2024, and is now putting pressure on individual marketplaces and employer plans.

For UnitedHealth, the Optum Health unit adds extra strain because the corporation is responsible for managing patients’ entire health while also providing medical services. This dual function makes finances more complicated when medical bills go up.

Buffett’s Vote of Confidence in UNH Stock

Even though things were tough for UnitedHealth, Warren Buffett’s Berkshire Hathaway announced a $1.57 billion investment in the company, which helped a lot. The news that Berkshire owned 5.04 million shares of UnitedHealth as of June 30 caused the stock to rise 8.5% in after-hours trading and gave the company a vote of confidence from one of the most respected investors in the market.

Buffett has called high healthcare prices a “tapeworm” that slows down economic growth. He has also tried to change the sector through the unsuccessful Haven venture with JPMorgan Chase and Amazon. His purchase in UnitedHealth shows that he thinks the company is in a good place to deal with the problems in the sector right now.

UnitedHealth Group’s Strategic Priorities and Path Forward

As DeVeydt takes on his new role, he has the difficult job of restoring investor trust while dealing with enormous challenges across the industry. Analysts think that his experience with improving operations and speeding up growth will be very important in getting the company back on track.

One of the most important things to do is to make sure that UnitedHealth gets paid more for the risks it takes in its four primary areas: UnitedHealthcare coverage, Optum Health care delivery, Optum Insight software and analytics, and Optum Rx pharmaceutical benefits. The corporation should also keep focusing on keeping costs down and using AI and digital tools to make back-office work more efficient.

The company’s recent strategic steps, including buying Amedisys to get into home healthcare services, show that it is still committed to growth even though things are tough right now. These steps, along with the company’s solid basic metrics, a 7.8% EBIT margin and a 22.81% return on equity, suggest that the business is still doing well.

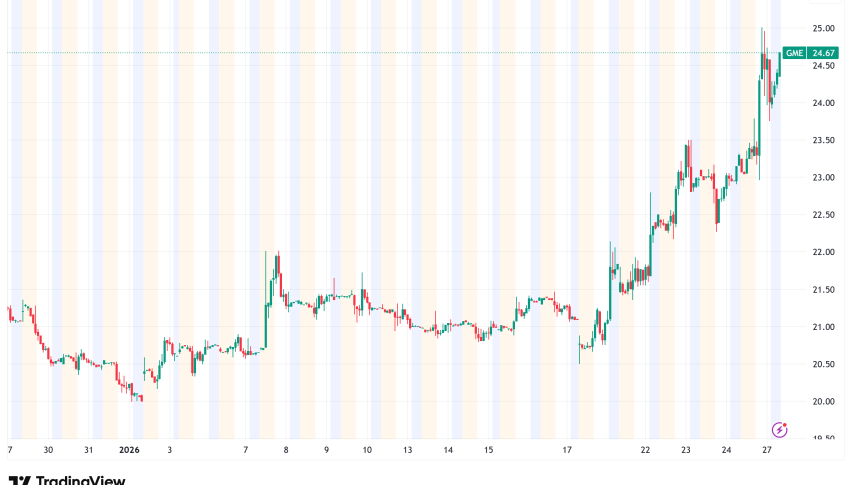

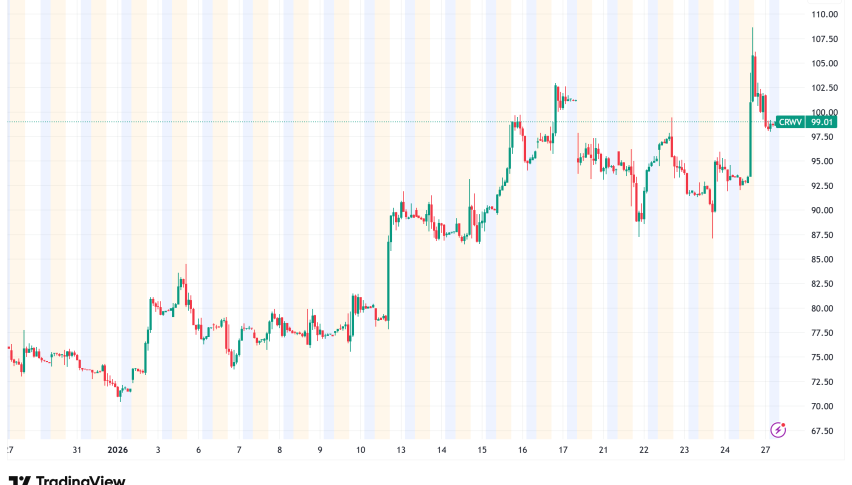

UnitedHealth (UNH) Stock: Market Response and Outlook

After Berkshire revealed its investment, UnitedHealth shares have become stronger again, with some assessments showing increases of more than 26% in recent trading sessions. However, technical indicators are sending contradictory signals, and some analysts have pointed out that the market may be overbought, which could cause volatility in the near future.

The company’s most recent quarterly statistics, which showed revenue of $111.62 billion and earnings per share of $3.76, show that it is still doing well in business even if the economy is having problems. UnitedHealth looks like it will be able to bounce back if things settle down in the business because its price-to-earnings ratio is 12.73 and its debt-to-equity ratio is 0.86.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM