Forex Signals Brief Aug 19: Canada Inflation and Home Depot Earnings Today

A subdued U.S. trading session reflected investors’ attention shifting from Wall Street to Washington, where high-level discussions...

Quick overview

- U.S. trading was subdued as investors focused on high-level discussions in Washington regarding Ukraine and European security.

- The dollar gained slightly due to a lack of major domestic data, while Canadian inflation data is anticipated to show rising pressures.

- Gold prices experienced volatility but found support around $3,500/oz, with ongoing uncertainty in monetary policy impacting safe-haven demand.

- In the cryptocurrency market, Bitcoin faced a sharp correction after reaching record highs, while Ethereum continued its rally towards its all-time high.

Live BTC/USD Chart

A subdued U.S. trading session reflected investors’ attention shifting from Wall Street to Washington, where high-level discussions on Ukraine and European security drew the spotlight.

Geopolitics Overshadow Market Moves

The U.S. stock market moved cautiously as traders largely stepped aside, choosing instead to monitor developments at the White House. Ukrainian President Volodymyr Zelenskyy, alongside several EU leaders, held talks in Washington to address the ongoing Ukraine–Russia crisis. The meeting followed last Friday’s high-profile Putin–Trump discussions and placed the U.S. capital firmly in the geopolitical spotlight.

European officials pressed for stronger American security guarantees, while speculation mounted over the possibility of a trilateral summit involving the U.S., EU, and Russia. For investors, the diplomatic maneuvers reinforced uncertainty, keeping equity market activity muted.

Sparse U.S. Calendar, Dollar Finds Support

With no major domestic data releases, the U.S. economic calendar offered little direction, leaving the dollar to edge higher by the session’s close. Market participants turned their focus toward upcoming releases, including Canadian inflation data on Tuesday and U.S. housing indicators such as building permits and housing starts.

Key Market Events for the Week Ahead

Canadian Inflation Data in Focus

Analysts expect Canadian CPI figures to reveal firmer underlying inflationary pressures despite headline stability. Consensus for July CPI month-on-month has shifted higher, from 0.1% to 0.4%, while annual measures are anticipated to remain close to June’s levels:

- Median CPI steady at 3.1% y/y

- Trimmed CPI unchanged at 3.0% y/y

- Common CPI nudging up slightly from 2.6% to 2.7% y/y

Headline CPI is forecast to remain at 1.9% y/y, with the removal of the carbon tax still weighing on overall numbers. However, resilient consumer demand, higher service prices, and tariffs continue to underpin core inflation. RBC analysts note that food inflation, still pressured by retaliatory tariffs, is running above 3%, while gasoline prices dropped on both a monthly and yearly basis.

Today’s Earnings Reports

The Home Depot, Inc. (HD): Q2 2025 Earnings Announcement

Medtronic plc (MDT): Q1 2026 Earnings Announcement

Alcon Inc. (ALC): Q2 2025 Earnings Announcement

Last week, markets were quite volatile once, with gold retreating and then bouncing to finish the week close to $4,000 but yesterday it retreated again. EUR/USD continued the upward move toward 1.17, while main indices closed higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

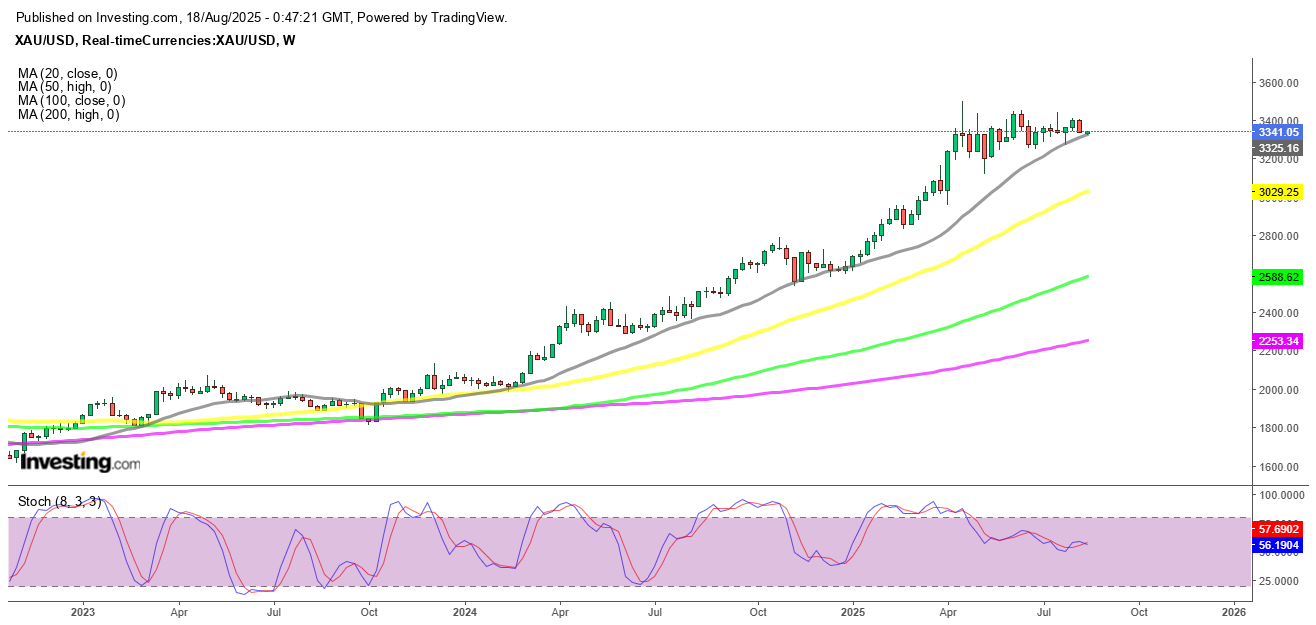

Gold Holds Key Support

Gold prices briefly dipped below $3,268/oz following the Federal Reserve’s decision last week to keep rates unchanged. After recovering, the metal settled at $3,500/oz, still down $21.52 (-0.63%) on the day. Despite the pullback, technical momentum remains tilted to the upside, supported by the 20-week simple moving average and steady U.S. labor market conditions. The $3,450–$3,500/oz zone remains a crucial breakout region for bulls, as investors weigh monetary policy stability against safe-haven demand.

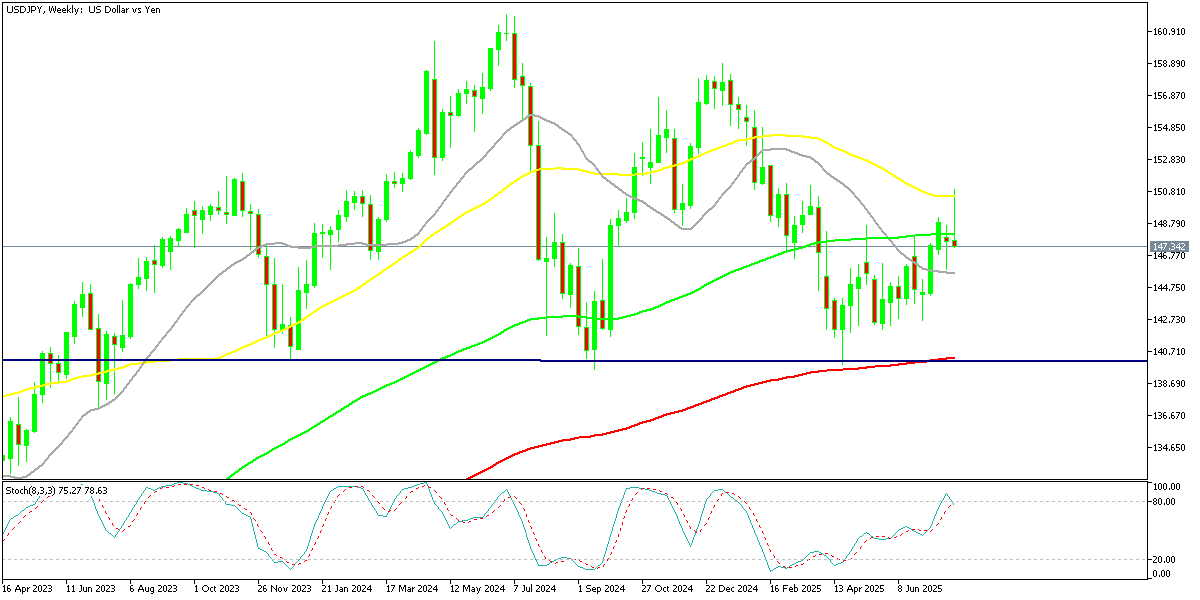

Yen Recovery from ¥150 Shock

In FX trading, the dollar briefly climbed above ¥150 earlier in the week, driven by yield differentials and Japanese capital outflows. However, profit-taking combined with weak U.S. jobs data strengthened the yen, pulling USD/JPY four yen off its highs. The move highlighted ongoing volatility in currency markets, with traders balancing Fed policy expectations against Japan’s efforts to curb yen weakness.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin and Ethereum: Diverging Momentum

The cryptocurrency market has remained active through the summer. Bitcoin (BTC) surged to record highs above $123,000 in July and $124,000 in August, fueled by institutional demand and technical momentum. Optimism suggested BTC could be approaching the $150,000 mark.

However, enthusiasm faltered after Treasury Secretary Scott Bessent confirmed the U.S. would not expand Bitcoin reserves and inflation data came in hotter than expected. This triggered a sharp correction, dragging BTC down to $117,000 over the weekend. Chart signals: Two consecutive doji candlesticks hinted at exhaustion, and the pullback found solid support at the 50-week SMA, reinforcing the long-term bullish trend.

BTC/USD – Weekly chart

Ethereum Extends 2024 Rally

Meanwhile, Ethereum (ETH) has surged past $4,300, its highest since 2021, and appears poised to challenge its all-time high of $4,860. The rally has been driven partly by retail enthusiasm, but fresh institutional flows and bullish chart setups provide additional support.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account