Google Stock Extends Rally on Robust Earnings and Cloud Momentum

Even if increasing capital spending plans caused short-term concerns, Alphabet's Q2 earnings showed solid growth across its main businesses,

Quick overview

- Alphabet's Q2 earnings showcased strong growth, pushing Google stock to new highs with a market cap of $2.55 trillion.

- The company's core businesses exceeded Wall Street expectations, with YouTube ads and Google Cloud showing significant revenue increases.

- Analysts have upgraded forecasts for Alphabet's earnings, reflecting confidence in its long-term growth despite rising capital expenditure plans.

- Investor sentiment was tempered by concerns over increased spending, raising questions about near-term profitability amidst ongoing AI and cloud expansion.

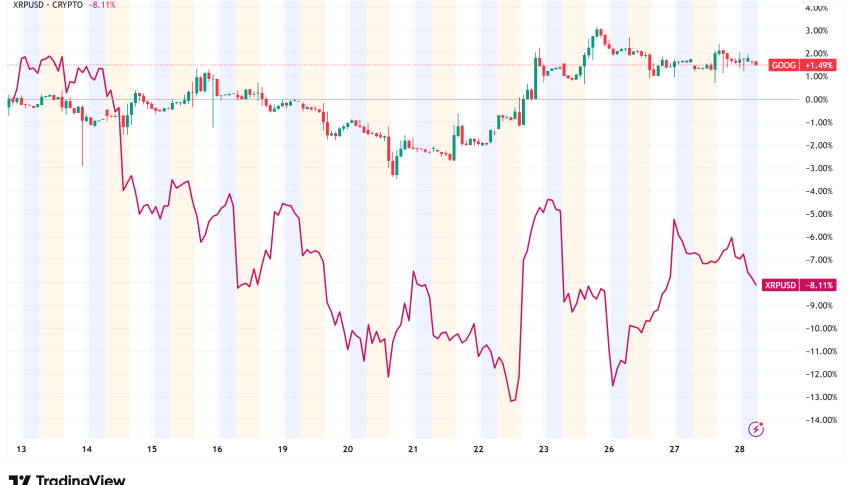

Live GOOGL Chart

[[GOOGL-graph]]Even if increasing capital spending plans caused short-term concerns, Alphabet’s Q2 earnings showed solid growth across its main businesses, propelling Google shares to new highs.

Earnings Lift Stock to New Highs

Alphabet’s latest results provided investors with both excitement and caution. Since April, buyers have firmly controlled the trend, and momentum has accelerated in recent months. Last week, GOOGL broke past its February peak of $207, and the rally extended today with shares hitting $210.50. The company’s market capitalization has now climbed to $2.55 trillion, with revenue growth of 13.1% over the past year, underlining its enduring strength.

GOOGL Chart Weekly – The Upside Is Accelerating

Core Businesses Beat Expectations

Alphabet’s second-quarter numbers exceeded Wall Street’s forecasts across the board. Adjusted EPS stood at $2.31, while revenue minus traffic acquisition costs reached $81.2 billion. YouTube ads generated $9.8 billion, up 13% year over year, and Google Cloud posted $13.6 billion, reflecting robust demand for AI-driven and infrastructure services. These results reinforced the company’s leadership in digital advertising and cloud computing.

Upgraded Forecasts Signal Confidence

Analysts remain increasingly optimistic. EPS for the current quarter is projected at $2.37, nearly 12% higher than a year ago. For FY 2025, forecasts have been revised upward to $10.12, a 25.9% annual increase, while FY 2026 is expected at $10.76. The steady upward revisions across the past month signal broad confidence in Alphabet’s long-term earnings trajectory.

Spending Plans Temper Enthusiasm

Investor sentiment cooled somewhat after Alphabet raised its 2025 capital expenditure outlook from $75 billion to $85 billion. The stock slipped in after-hours trading as concerns emerged over free cash flow and margins. While the move highlights Alphabet’s commitment to scaling its infrastructure for AI and cloud expansion, it also raises questions about near-term profitability.

Expanding Across Sectors

Beyond earnings, Alphabet continues to strengthen its AI footprint, like the Terminator more or less. The company has partnered with the U.S. government through “Gemini for Government” to deliver AI and cloud services to federal agencies. On the consumer front, Google unveiled its new Pixel 10 series, powered by the Tensor G5 chip, which integrates Gemini AI directly into devices to enhance everyday productivity.

Balancing Growth and Investment

Alphabet’s Q2 results reinforced its position as a global tech leader. Record revenues, upgraded forecasts, and a strong stock rally underscore its resilience, even as heavier spending introduces short-term risks. The company now faces the task of balancing bold AI-driven expansion with the financial discipline investors expect.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account