Forex Signals Brief August 26: NVIDIA, Snowflake, CRWD, and RBC Report Q2 Earnings

Besides the Australian inflation, we have the Q2 earnings from Nvidia, Crowdstrike, Snowflake and RBC today.

Quick overview

- U.S. durable goods orders fell by 2.8% in July, but core orders excluding transportation rose by 1.1%, indicating resilience in business investment.

- Consumer confidence for August remained stable at 97.4, with mixed views on current conditions and subdued forward expectations.

- Key earnings reports from Nvidia, Crowdstrike, Snowflake, and Royal Bank of Canada are expected today, with Nvidia's results likely to dominate due to its role in the AI sector.

- The Australian July CPI is projected to rise by 0.5%, driven by higher electricity costs, with the RBA forecasting inflation to exceed 3% in the latter half of the year.

Live BTC/USD Chart

Besides the Australian inflation, we have the Q2 earnings from Nvidia, Crowdstrike, Snowflake and RBC today.

Yesterday U.S. durable goods orders fell -2.8% in July, less than the expected -4.0%, with transportation again weighing. Excluding transport, orders rose +1.1% versus +0.2% forecast, while business investment (core capital goods ex-aircraft) also advanced +1.1%, signaling resilience despite recent volatility.

Consumer confidence for August came in at 97.4, slightly above expectations but little changed from July. Views on current conditions and the labor market were mixed, while forward expectations remained subdued.

Fed’s Barkin struck a cautious tone, seeing only modest rate cuts ahead. Meanwhile, Trump hinted at legal and political battles over Fed appointments, with reports suggesting former World Bank President David Malpass could be a potential nominee. The administration is also exploring ways to expand its influence over the Fed’s regional banks.

U.S. stocks ended higher: Dow +135.6 at 45,418.7, S&P +26.6 at 6,465.9, Nasdaq +95.0 at 21,544.3.

Key Market Events Today

Today’s earnings lineup spans semiconductors, banking, cybersecurity, and cloud data infrastructure—a diverse snapshot of market sentiment across both growth and defensive sectors. NVIDIA’s results will likely dominate headlines given its central role in the AI boom, but Royal Bank of Canada offers an important macro barometer, while CrowdStrike and Snowflake provide key insights into enterprise tech demand. Market reactions could set the tone for sector leadership in the coming weeks.

Q2 Earnings Reports on Deck: Key Companies to Watch

NVIDIA (NVDA)

- Reporting: Q2 2026 results, after market close (AMC)

- EPS Expectation: $1.01

- Focus: AI-driven revenue growth, data center performance, and demand outlook for next-gen GPUs. Investors will watch closely for signs of sustained momentum in AI and cloud adoption.

Royal Bank of Canada (RY)

- Reporting: Q3 2025 results, before market open (BMO)

- EPS Expectation: $3.29

- Focus: Credit quality, net interest income, and capital ratios amid a shifting rate environment. Results will provide insight into the health of the Canadian banking sector and consumer resilience.

CrowdStrike (CRWD)

- Reporting: Q2 2026 results, after market close (AMC)

- EPS Expectation: $0.83

- Focus: Subscription revenue growth, customer additions, and margin expansion in the cybersecurity market. Cybersecurity demand remains robust, but competitive pressures are intensifying.

Snowflake (SNOW)

- Reporting: Q2 2026 results, after market close (AMC)

- EPS Expectation: $0.27

- Focus: Product revenue, customer growth, and progress in AI/ML integrations. Investors want clarity on the path to profitability and whether growth can remain strong in a slower spending environment.

Australian July CPI Preview: Electricity Costs in Focus

Expectations for July

The July Consumer Price Index is projected to rise by 0.5% on the month, lifting the annual rate to 2.3% from 1.9%. This outcome would be in line with market consensus, which ranges between 2.0% and 2.7%.

The June CPI release surprised to the downside, printing at 0.2% month-on-month and 1.9% year-on-year. A sharp 0.4% drop in electricity prices played a key role, as some retailers in major cities cut charges or boosted discounts. The impact of government rebates also unwound more slowly than anticipated, keeping inflation softer than both forecasts and market expectations.

Risks for July

Westpac sees upward pressure building in the July data. Higher Default Market Offer (DMO) electricity bills, along with the ongoing phase-out of rebates, are expected to push prices higher. These dynamics form the core of the inflation rebound narrative, highlighting the energy sector as the main swing factor.

RBA Outlook

The Reserve Bank of Australia’s August Statement on Monetary Policy projected headline inflation to rise above 3% in the second half of the year before easing back, largely due to electricity costs. Trimmed mean inflation remains at 2.7% year-on-year, the top end of the RBA’s target band, reinforcing the pressure to keep policy settings cautious.

Last week, markets were quite volatile once, with gold retreating and then bouncing to finish the week close to $4,000 but yesterday it retreated again. EUR/USD continued the upward move toward 1.17, while main indices closed higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Approaches $3,400

Gold also joined the rally: after briefly dipping below $3,268/oz following the Fed’s steady-rate decision, the metal climbed nearly $50 higher by week’s end. Strong safe-haven demand and stable labor data lifted prices above the 100-day SMA, reinforcing bullish momentum. Technicals continue to highlight the $3,450–$3,500/oz zone as the next key breakout area.

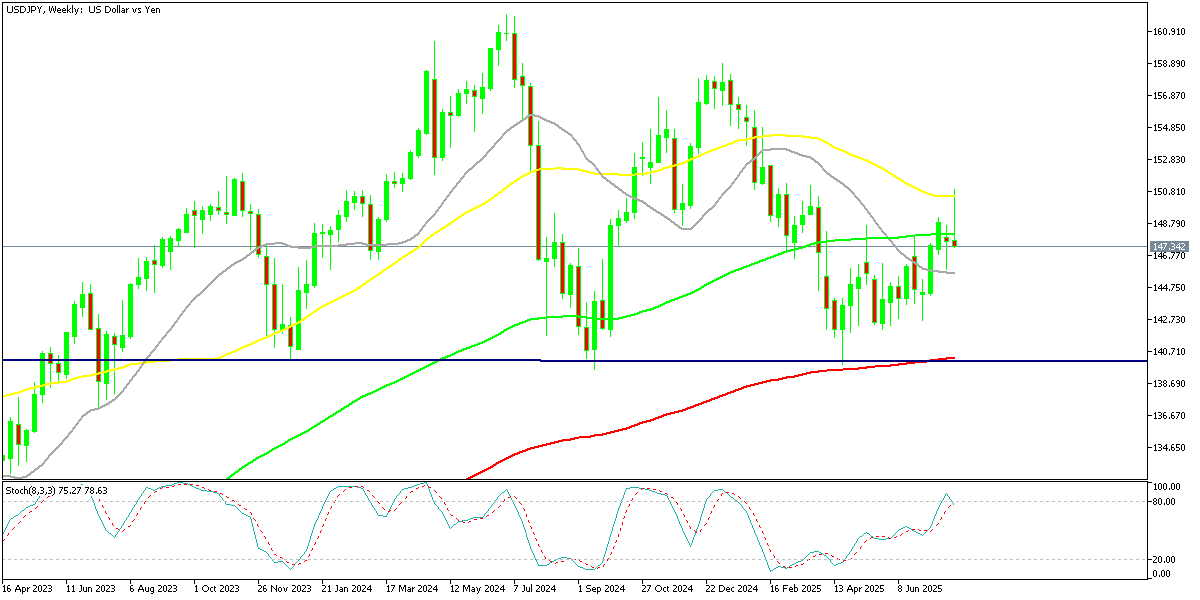

Yen Recovery from ¥150 Shock

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. The move underscored persistent volatility as traders weighed Japan’s intervention risks against evolving Fed expectations.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Returns Above $110K after Finding Support

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $113,000 before recovering above $116,000 last week, however sellers returned and sent BTC below $110,000, however we saw a rebound off the 20 weekly SMA (gray) yesterday.

BTC/USD – Weekly chart

Ethereum Reclaims the $4,500 Level

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. However buying resumed and on Sunday ETH/USD printed another record at $4,941. However we saw a retreat to $,000 lows over the weekend, but yesterday buyers returned.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account