Will Amazon Stock AMZN Break the Support After 2% Fall Despite Expansion?

As investors balance cautious advice and wider tech weakness against recent profits, technical movements, and strategic alliances, Amazon...

Quick overview

- Amazon shares are under pressure, falling nearly 2% amid broader tech sector weakness and cautious guidance.

- The company is investing over NZD 7.5 billion to launch a new AWS region in New Zealand, expected to boost the local economy and create jobs.

- Amazon expanded its streaming services through a partnership with Comcast, enhancing its Prime Video offerings and strengthening its position in the competitive market.

- Despite beating Q2 earnings expectations, investor skepticism remains due to management's cautious outlook and recent stock volatility.

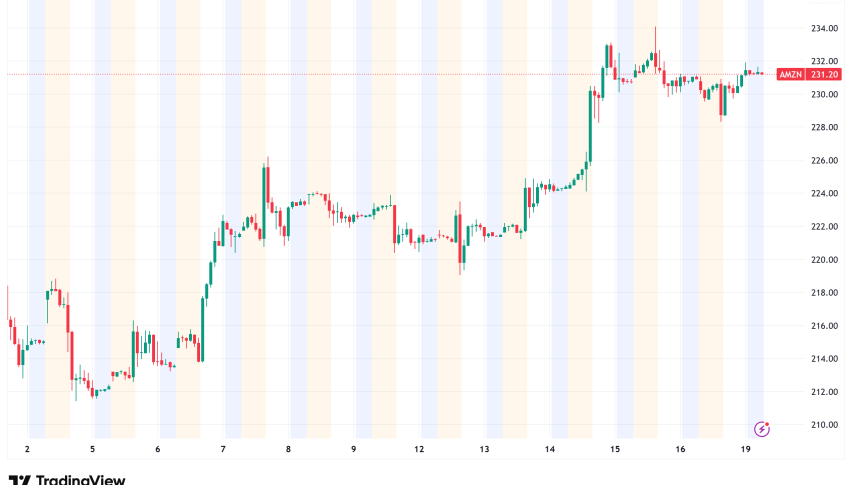

Live AMZN Chart

[[AMZN-graph]]As investors balance cautious advice and wider tech weakness against recent profits, technical movements, and strategic alliances, Amazon shares continue to be under pressure.

Amazon Shares Show Weakness Again

Amazon.com Inc. (NASDAQ: AMZN) started the week on a soft note, falling nearly 2% in early trading after the broader tech sector slid on Alibaba’s chip news. The move tested support levels and erased some of the momentum built during the prior week’s rebound.

The stock had been regaining ground after comments from Federal Reserve Chair Jerome Powell sparked a recovery from earlier August selling pressure. Amazon shares briefly bounced off the 50-day SMA and moved above the 20-day SMA, signaling a potential technical turnaround. However, the reversal on Friday reminded traders that volatility remains, with $210 emerging as the next upside target if key averages can hold.

Global Expansion: AWS Investment in New Zealand

Despite market jitters, Amazon continues to push forward with its long-term growth strategy. The company announced the launch of a new Asia-Pacific AWS region in New Zealand, backed by an investment of over NZD 7.5 billion. The project is expected to add NZD 10.8 billion to New Zealand’s GDP and generate more than 1,000 jobs annually.

AMZN Chart Daily – The 50 SMA Held as Support

Significantly, the new AWS infrastructure will be powered entirely by renewable energy, reinforcing Amazon’s commitment to sustainability while also enhancing digital transformation and cloud reliability across the region.

Strategic Partnerships: Comcast Agreement Adds Streaming Depth

In the U.S., Amazon also expanded its streaming footprint through a distribution agreement with Comcast’s NBCUniversal. The deal grants Prime Video subscribers access to Peacock Premium Plus, the ad-free tier priced at $16.99 per month or $169.99 annually.

Additionally, Universal Pictures films will be available for rental or purchase on Prime Video, while Peacock joins Amazon’s Fire TV platform. At the same time, Comcast’s Xfinity X1 devices will maintain access to Prime Video. The two-way partnership strengthens both companies’ ecosystems, giving Amazon another foothold in the competitive streaming market.

Earnings Recovery Overshadowed by Skepticism

While Amazon’s Q2 earnings topped Wall Street expectations, management’s cautious outlook tempered enthusiasm. Shares remain volatile after losing nearly $25 in late July, fueling a choppy trading stretch through August.

Analysts note that Amazon’s logistics enhancements, AWS expansion, and media partnerships demonstrate its determination to reinforce leadership across multiple sectors. Still, many investors appear unconvinced, waiting for clearer signs of consistent earnings growth before re-rating the stock higher. For now, AMZN remains in a fragile balance between potential recovery and lingering investor doubt.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account