Tesla Stock TSLA Officially Bullish, Eyeing $400 on EV Momentum, Price Cuts, and FSD Push

Strong Chinese sales, recent price changes, and encouraging advancements in autonomous driving technology propelled Tesla's stock to its...

Quick overview

- Tesla shares surged 6%, reaching their highest level since February, driven by strong Chinese sales and strategic price adjustments.

- A 22.6% month-over-month increase in Chinese deliveries and a 3.7% price cut on the Model 3 highlight Tesla's competitive strategy in the EV market.

- Investor optimism is bolstered by advancements in Full Self-Driving technology and the expansion of Tesla's robotaxi service.

- Despite increasing competition, Tesla's combination of sales momentum, pricing strategies, and technological innovation is restoring investor confidence.

Strong Chinese sales, recent price changes, and encouraging advancements in autonomous driving technology propelled Tesla’s stock to its highest level since February.

Tesla’s Market Rebound

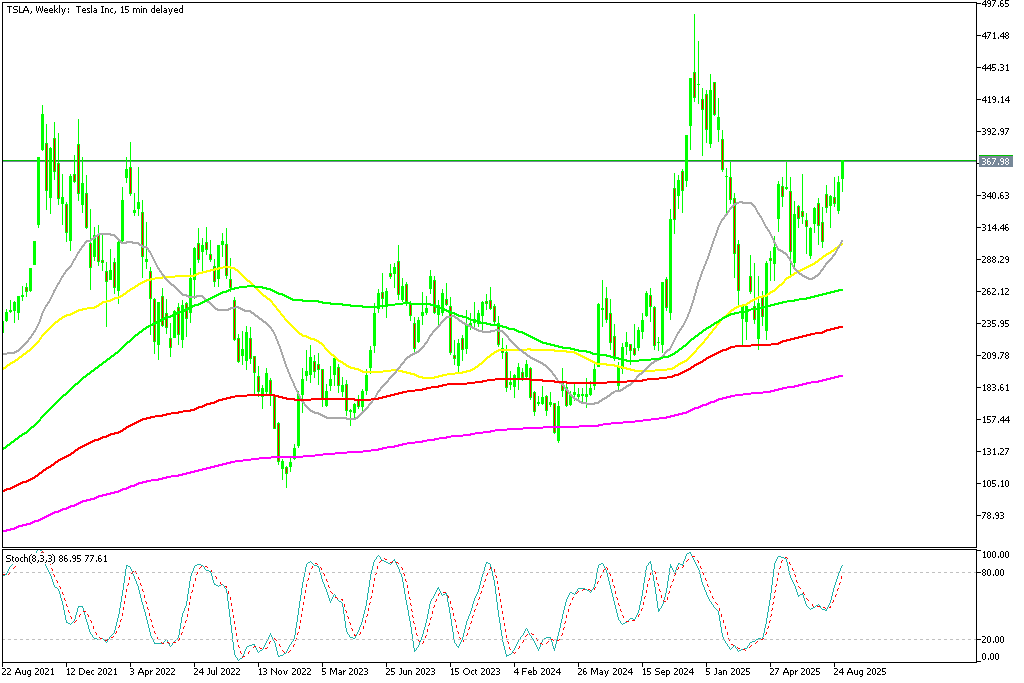

Tesla (NASDAQ: TSLA) rallied 6% today, extending a 15% recovery from August lows. The stock broke above $350 resistance and closed at $368.81, putting buyers on track to test the May peak near $368–370 and eyeing the $400 mark.

Behind the rally was a 22.6% month-over-month increase in Chinese deliveries — 83,197 vehicles in August — and a strategic 3.7% price cut on the long-range Model 3 in China. The move underscores Tesla’s commitment to compete aggressively in the world’s largest EV market.

TSLA Chart Weekly – Buyers Remain in Charge

Self-Driving Breakthroughs

Investor optimism has been amplified by progress in Full Self-Driving (FSD). CEO Elon Musk confirmed a next-generation system with 10 times more parameters than the current version. Meanwhile, Tesla expanded its Austin-based robotaxi service from 20 to 170 square miles, with full rollout expected as early as September. These milestones could mark a turning point toward fully autonomous vehicles.

China Strategy and Localization

China remains Tesla’s most critical growth driver. To better integrate with local demand and regulations, Tesla is embedding regional AI platforms like ByteDance’s Doubao and DeepSeek Chat into its vehicles. Compatibility with WeChat and Baidu Maps enhances user experience and gives Tesla an edge over domestic rivals.

Market and Macro Tailwinds

Tesla’s surge also came amid a broader equity rebound, supported by softer U.S. jobs data and dovish signals from the Fed. Even as competition intensifies, Tesla’s blend of sales momentum, price flexibility, and tech innovation has restored investor confidence.

Conclusion: Tesla is proving its resilience with a blend of strong demand, bold pricing strategies, and breakthrough autonomy updates. While challenges remain, especially in China’s competitive EV space, momentum is clearly shifting in Tesla’s favor. With the stock climbing toward key resistance levels, the next test is whether it can sustain the rally and push decisively past $400.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account