Google Stock Starts Week at New Records – Can Alphabet Break $250 This Week?

Alphabet shares soared to fresh all-time highs this week, powered by strong earnings, a favorable antitrust ruling, and Apple’s missteps....

Quick overview

- Alphabet shares reached all-time highs this week, driven by strong earnings and a favorable antitrust ruling.

- The stock has surged from $206 to $242.25, raising questions about its ability to surpass the critical $250 mark.

- A mixed ruling in the antitrust case allowed Google to maintain its search dominance while easing regulatory concerns.

- Apple's struggles with the iPhone 17 launch have provided Alphabet an opportunity to grow its Pixel smartphone sales.

Alphabet shares soared to fresh all-time highs this week, powered by strong earnings, a favorable antitrust ruling, and Apple’s missteps in the smartphone market.

Stock Momentum and Market Position

After climbing steadily for two months, Alphabet’s stock now sits near a critical $250 mark. The rally has been nothing short of remarkable: from lows of $206 earlier this summer, shares pushed to $242.25 in September, delivering substantial gains to investors. The central question now is whether Google can push beyond this ceiling or if the rally is due for a pause.

Court Ruling Provides Tailwind

The U.S. government’s high-profile antitrust case against Google reached an important turning point when Judge Amit Mehta handed down a mixed ruling. While the court imposed restrictions such as requiring Google to share some search data and ending its ability to form exclusive search engine deals, Alphabet avoided the harshest penalties feared by markets. The verdict was widely seen as a victory, allowing Google to maintain its dominance in search through Chrome while easing regulatory uncertainty.

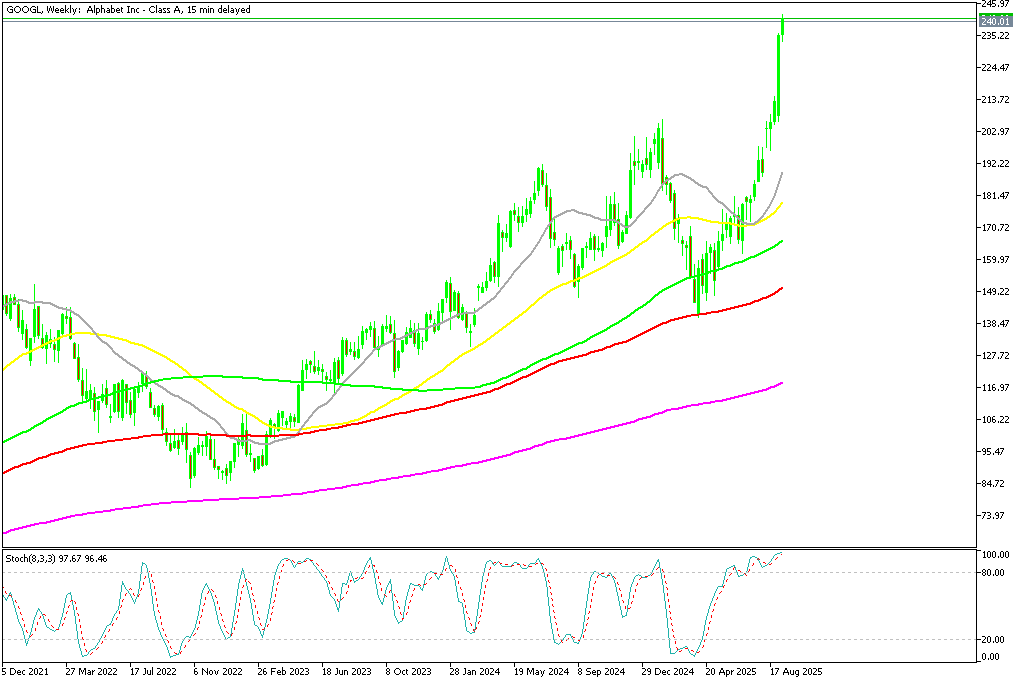

GOOGL Chart Daily – The Uptrend Is Picking Up Pace

Apple’s Weakness, Google’s Opportunity

Apple’s disappointing iPhone 17 launch also played into Alphabet’s hands. As Apple stumbled, Alphabet capitalized through its Pixel smartphone line, which has been steadily gaining traction. Between the first halves of 2024 and 2025, global Pixel sales doubled, fueled by strong demand for the Pixel 9 series. In the U.S., Pixel has been chipping away at Apple’s market share, and analysts note that Chinese rivals like Xiaomi and Huawei—as well as Samsung—are also poised to benefit from Apple’s slowdown, particularly in price-sensitive markets.

Alphabet Earnings Beat Expectations

Alphabet’s second-quarter financials further bolstered sentiment. Adjusted EPS reached $2.31, beating estimates, while revenue (excluding traffic acquisition costs) came in at $81.2 billion. Google Cloud continued its strong growth trajectory, delivering $13.6 billion in sales, reflecting robust demand for AI-driven infrastructure. Meanwhile, YouTube reinforced Alphabet’s advertising dominance with ad revenues rising 13% year-over-year to $9.8 billion.

Conclusion: Can $250 Be Breached?

With multiple tailwinds—legal clarity, strong financial performance, and favorable competitive dynamics—Alphabet looks well-positioned heading into year-end. Investors are now watching closely to see whether momentum can push the stock past $250, a level that could open the door to even higher valuations.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account