ETHZilla Unleashes $350M for Ethereum Plays — Will Bulls Take Over?

ETHZilla raises $350M to expand its Ether treasury, now valued at $428M. Will its record accumulation reshape Ethereum’s supply ahead of Q3

Quick overview

- ETHZilla Corporation has raised $350 million through convertible bonds, increasing its total debenture program to over $500 million.

- The funds will be used to acquire more Ether and support yield-generating ecosystems on Ethereum's layer-2 protocols.

- ETHZilla currently holds 102,000 ETH valued at over $428 million and plans to potentially add another 120,000 tokens with the new funds.

- The company has introduced new reporting measures to better reflect its crypto-centric treasury's performance amid a tightening Ethereum market.

ETHZilla Corporation, a Nasdaq-listed decentralized finance company, has raised $350 million through new convertible bonds, boosting its total debenture program to just over $500 million. The funds will primarily be directed toward acquiring additional Ether and supporting yield-generating ecosystems on Ethereum’s layer-2 protocols.

The new bonds carry a 2% annual interest rate, with a fixed conversion price of $3.05 per share. Earlier tranches, totaling $156.5 million, were restructured to remain interest-free until 2026 before resuming at a lower 2% rate—down from the original 4%. Management said the revised terms improve cash flow flexibility and strengthen the company’s ability to scale its balance sheet.

Ether Treasury Tops $428M With New Metrics

ETHZilla has already amassed a stockpile of 102,000 ETH, valued at more than $428 million. If the entire $350 million raise is deployed into Ether, the firm could add another 120,000 tokens to its reserves.

The company has introduced new reporting measures—ETH Net Asset Value (NAV) and Market Net Asset Value (mNAV)—to reflect the performance of its crypto-centric treasury. Management cautioned that these figures differ from conventional NAV calculations but said they provide better insight into the balance sheet’s exposure to market volatility and staking rewards.

So far, ETHZilla’s active participation in DeFi protocols has generated $11.5 million in additional tokens. The approach mirrors strategies pioneered by Bitcoin-focused corporates, which previously helped constrain liquid supply and fueled price momentum during past cycles.

Record ETH Lock-Up Sets Stage for Q3 Outlook

The fundraising coincides with a tightening Ethereum market, as roughly 30% of the network’s circulating supply is currently staked—a record high. Analysts warn that further accumulation by corporate treasuries could intensify liquidity constraints and impact pricing dynamics.

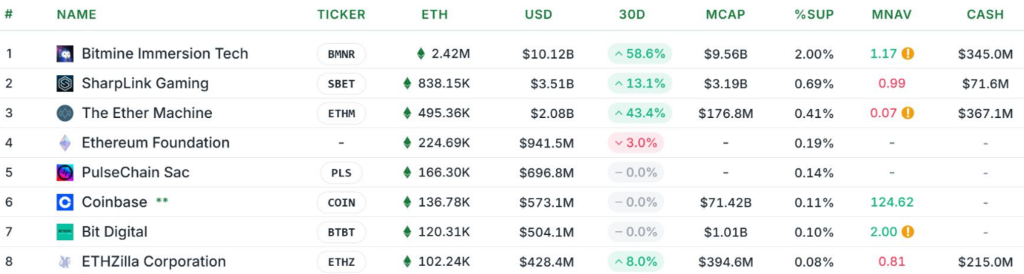

ETHZilla, which rebranded from a Nasdaq-listed biopharma company earlier this year, now ranks as the eighth-largest Ether treasury among 69 listed firms, collectively holding 5.25 million ETH valued at over $22 billion.

Management plans to outline its third-quarter earnings strategy later this year, focusing on how it will balance aggressive Ether accumulation with sustainable cash flow. With Ethereum’s supply increasingly locked away, ETHZilla’s growing role as a treasury holder is expected to draw close investor scrutiny in the months ahead.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM