BTC Touches $121K, Highest Since Mid-August Slump

The US government shutdown increased Bitcoin's allure as a haven.

Quick overview

- Bitcoin surpassed the $120K mark, driven by macroeconomic factors and increased demand as a safe haven amid a US government shutdown.

- Weak economic data, including significant job losses, led traders to anticipate a potential Fed rate cut, boosting Bitcoin's recovery.

- US spot Bitcoin ETFs experienced nearly $1 billion in inflows, with BlackRock's fund exceeding $80 billion in assets under management.

- Bitcoin reached a seven-week high of $121K, breaking through key resistance levels and setting a short-term target of $130,000.

Live BTC/USD Chart

Bitcoin jumped over $120K mark as the market was driven higher by an uncommon combination of macro, regulatory, and on-chain factors. The US government shutdown increased Bitcoin’s allure as a haven.

Weak economic data fueled Bitcoin’s recovery, according to the most recent update released by CryptoQuant. Delayed nonfarm payrolls caused traders to price in an almost certain October Fed rate cut, while the ADP report revealed 32,000 job losses, the largest in more than two years.

Reviews of Solana, XRP, and other applications are planned for this month, and the SEC took action to relax listing requirements for cryptocurrency exchange-traded funds.

US spot Bitcoin ETFs saw inflows of almost $1 billion, while BlackRock’s fund surpassed $80 billion AUM, and there were rumors that Vanguard might give it another look late in September.

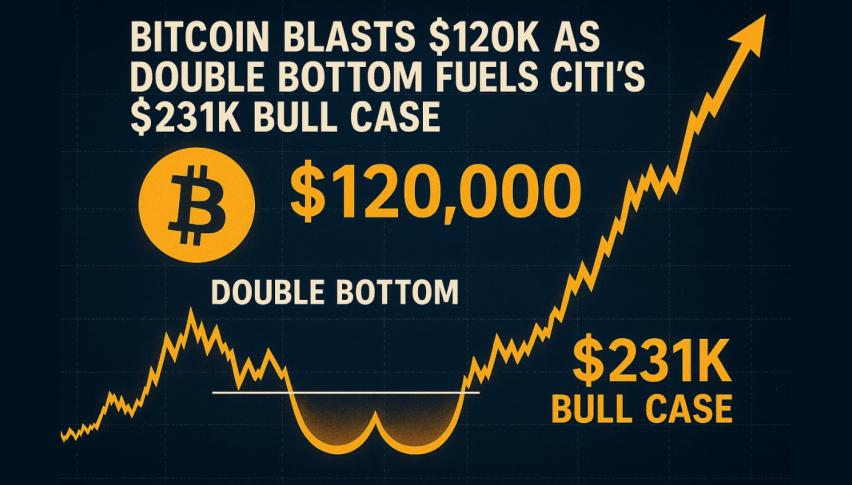

Bitcoin’s (BTC) price hit a seven-week high of $121K on October 2 as the sector’s overall value increased by $165 billion in a single day amid the broader crypto market recovery.

This upward trend, which saw Bitcoin breach significant resistance levels, is consistent with a technical analysis framework that, should current conditions hold, sets $130,000 as the asset’s realistic short-term target.

Bitcoin started a steady ascent, first regaining the $112,500 level and then breaking through a crucial resistance zone near $116,500 on October 1 after a period of consolidation below $110,000 in late September.

Analysts Watch Technical Setup as October Rally Strengthens. This breakout intensified during early Asian trading on October 2, pushing Bitcoin to its highest level since mid-August. Short positions worth roughly $475 million were sold off as a result of the move, demonstrating how swiftly market sentiment can shift.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account