Natural Gas Is up to $3.35 after EIA Data Shows Storage Decline

Natural gas prices are higher now that the latest EIA report has come in and shown that storage increases are not as high as anticipated.

Quick overview

- Natural gas prices rose to $3.36/MMBtu due to lower-than-expected gas storage reported by the Energy Information Administration.

- The recent increase in natural gas prices is seen as positive news for investors ahead of the winter season.

- Crude oil prices also increased by 1.6% amid geopolitical tensions that threaten oil supplies.

- Analysts suggest that natural gas prices could potentially climb as high as $3.60 based on current market indicators.

Ending two days of decreasing prices, natural gas climbed today to $3.36/MMBtu. The increase is attributed to a new Energy Information Administration report that showed lower gas storage.

The week of September 26th ended with a lower than expected amount of gas in storage, and that has caused the price of natural gas to increase slightly this week, up to $3.35. The report indicates that gas storage is far below the historical average for the same week.

That is good news for investors who were hoping to see prices tick up ahead of the winter season. With an unusually warm fall and excess storage injections throughout the year, gas prices have remained low, making the commodity less desirable for investors throughout the year.

Prices Up across the Board

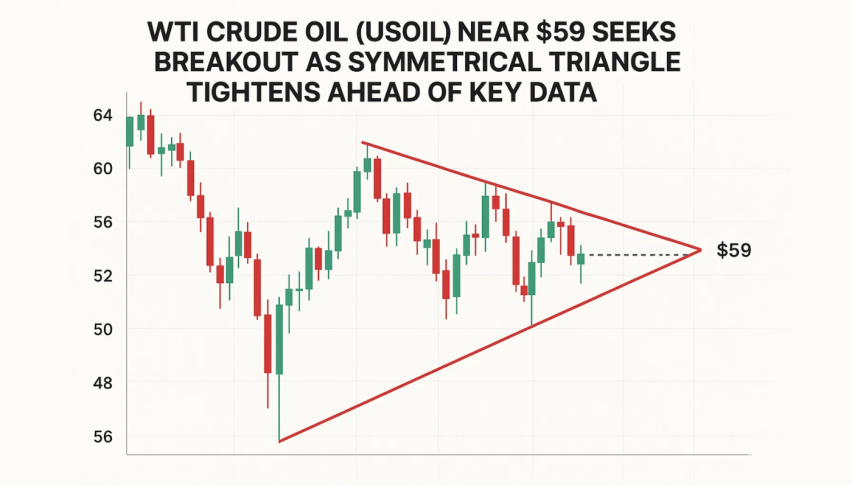

Crude oil prices are up as well, climbing 1.6% on Monday as there is a rising threat of political action that could jeopardize oil supplies. This includes conflict in the Middle East between Israel and Hamas, continued hostilities between Ukraine and Russia, and fighting between the United States and Venezuela. In all of these areas, oil is a precious commodity, and if supplies are threatened in any of these regions that can affect the price of oil around the world.

Crude oil is now at $6.17, and natural gas is now above its 200-day EMA. That means the price could break out even further and climb as high as $3.60 according to some expectations.

Storage was expected to grow in the natural gas market, but the increase was less than expected. The EIA report showed an increase of just 53 bcf, which is well below what is expected for this time of year.

WTI looks like it is trying to break above its 50-day average. Indicators point toward that being quite likely at this point, with oil prices ticking higher across the board. Investors should consider buying in before the prices go up even further as analysts are mildly optimistic about the natural gas market right now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account